Noble Energy, Inc. → Clayton Williams Energy Inc.- One-Page Deal Sheet

Calculated Metrics( EV/Category)

Transaction Details:

Closing Announcement - April 25, 2017

Noble Energy has closed the acquisition of Clayton Williams Energy. In conjunction with the closing, Clayton Williams Energy became a wholly owned subsidiary of Noble Energy under the name NBL Permian LLC.

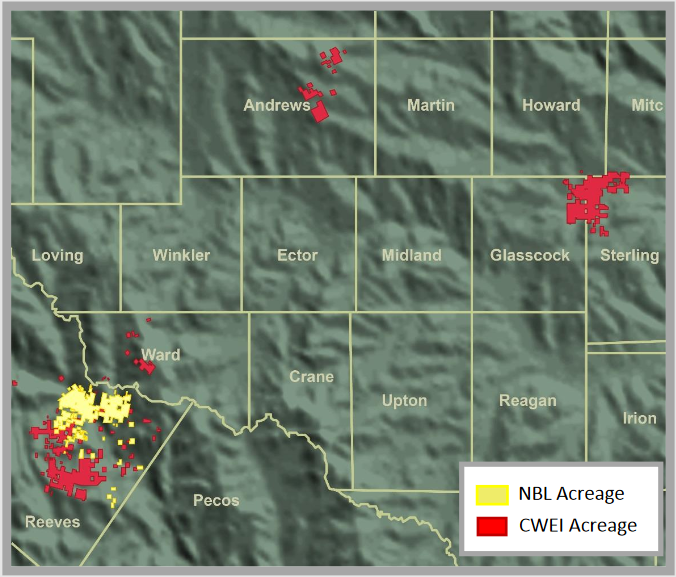

Acquired assets include 71,000 highly contiguous net acres in the core of the Southern Delaware Basin adjacent to Noble Energy's original Reeves county holdings in Texas, an additional 100,000 net acres in other areas of the Permian Basin, and more than 300 miles of oil, natural gas, and produced water gathering pipelines. Production on the assets totals approximately 10 thousand barrels of oil equivalent per day (MBoe/d).

Initial Announcement - January 16, 2017

Noble Energy, Inc. and Clayton Williams Energy, Inc.'s Boards of Directors of both companies have unanimously approved and the companies have executed a definitive agreement under which Noble Energy will acquire all of the outstanding common stock of Clayton Williams Energy for $2.7 billion in Noble Energy stock and cash, plus the assumption of $500 million in debt.

Highlights

- 71,000 highly contiguous net acres in the core of the Southern Delaware Basin in Reeves and Ward counties in Texas (directly adjacent to Noble Energy's existing 47,200 net acres). In addition, there are an additional 100,000 net acres in other areas of the Permian Basin.

- 80% average working interest in the Southern Delaware position, with more than 95% of the acreage operated.

- 2,400 Delaware Basin gross drilling locations identified, targeting the Upper and Lower Wolfcamp A zones, along with the Wolfcamp B and C. The average lateral length of the future locations is 8,000 feet.

- Total estimated net unrisked resource potential on the acreage of over 1 billion barrels of oil equivalent in the Wolfcamp zones, with significant upside potential in other zones.

- Wolfcamp A wells (EUR 1.0 mm Boe for a 7,500 foot lateral) generating approximately 60% to 90% before-tax rate of return at base and upside plan pricing, respectively.

- The acquired Delaware Basin acreage is largely undedicated to third-party oil and gas gathering and water systems, and approximately 12,500 acres are dedicated from a third-party operator.

- Existing midstream Delaware Basin assets include over 300 miles of oil, natural gas, and produced water gathering pipelines (over 100 miles for each product).

| Date | Deal Headline | Price | $/acre |

|---|---|---|---|

| Feb-12-2024 | Diamondback To Acquire Endeavor Energy In $26 Billion Transaction | -  |

-  |

| Jan-04-2024 | APA Corp to Acquire Permian Pure Player- Callon In All Stock Deal | -  |

-  |

| Dec-15-2023 | Fury Resources Takes Battalion Private In Transaction Worth $450 Million : Map | -  |

-  |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jan-01-2017 |

-  |

-  |

Click here | Texas | E&P |

| Oct-24-2016 |

-  |

-  |

Click here | Texas | E&P |

| Jan-19-2016 |

-  |

-  |

Click here | Texas | E&P |

| Jun-18-2015 |

-  |

-  |

Click here | Texas | E&P |

| Nov-12-2014 |

-  |

-  |

Click here | Texas | E&P |

| Announced Date | Buyer | Seller | Deal Value($mm) | Location | Category |

|---|---|---|---|---|---|

| Jul-20-2020 |

-  |

-  |

Click here | Colorado | E&P |

| Mar-14-2019 |

-  |

-  |

Click here | Texas | E&P |

| Feb-16-2018 |

-  |

-  |

Click here | E&P | |

| Jan-29-2018 |

-  |

-  |

Click here | E&P | |

| Nov-27-2017 |

-  |

-  |

Click here | Texas | E&P |