Production Rates | Hedging | Capital Markets

Apache Reports Prelim 1Q'21 Data; Production Down Signifcantly

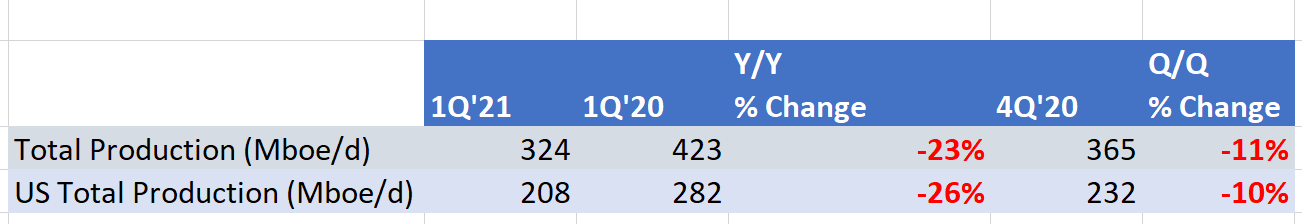

Apache reported first quarter production for US and its global operations and as we can see production is down +20% Year / Year and 10%+ sequentially.

"Total Adjusted Production guidance remains 324 Mboe/d. US production was reported to be 208 Mboe/d in 1Q'21"

The company also reported that it entered into some new hedges during the February month where we say high demand for gas, those hedges resulted in gains of $147 million.

Supplemental quarterly information

To further assist analysts with their first-quarter earnings models, the company is providing the following estimates:

| Estimated Average Realized Prices – 1Q21 | ||||||

| Oil (bbl) | NGL (bbl) | Natural Gas (Mcf) | ||||

| United States | $57.00 | $23.00 | $4.40 | |||

| International | $61.00 | $47.50 | $3.40 | |||

Hedging..

In late January 2021, Apache entered into financial contracts that increased its exposure to “gas daily pricing” and reduced its exposure to “first of month” pricing for the month of February. Given the subsequent and unprecedented daily gas price volatility across Texas during February, these contracts resulted in a 1Q21 realized gain of $147 million.

Apache also incurred a net loss on oil and gas purchased and sold during the quarter of approximately $54 million. This was primarily attributable to transport, fuel, and physical gas purchases and sales made by Apache to fulfill natural gas takeaway obligations, the extent of which was also exacerbated by the extreme price volatility during the month of February.

Related Categories :

Production Rates

More Production Rates News

-

Ranger/Penn Virginia Provides Production Update -

-

Ring Energy Progresses Drilling Ops at Permian NWS Project

-

Devon Sells Wind River/CO2 Oil Asset; Production Update

-

Ovintiv IDs 2021 Budget; Talks Preliminary Q4, Full Year 2020 Results

-

W&T Offshore Ups Production Outlook for 4Q20

Permian News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

New Comapny : New Permian E&P Secures Funds From Large PE-Firm

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -