Capital Markets | Capital Expenditure | Drilling Program - Wells | Capital Expenditure - 2021

Bonanza Creek Refreshes 2021 Guidance Post-HighPoint Deal

Bonanza Creek Energy, Inc. has refreshed its 2021 capital plan following its acquisition of HighPoint Resources.

Highlights Include:

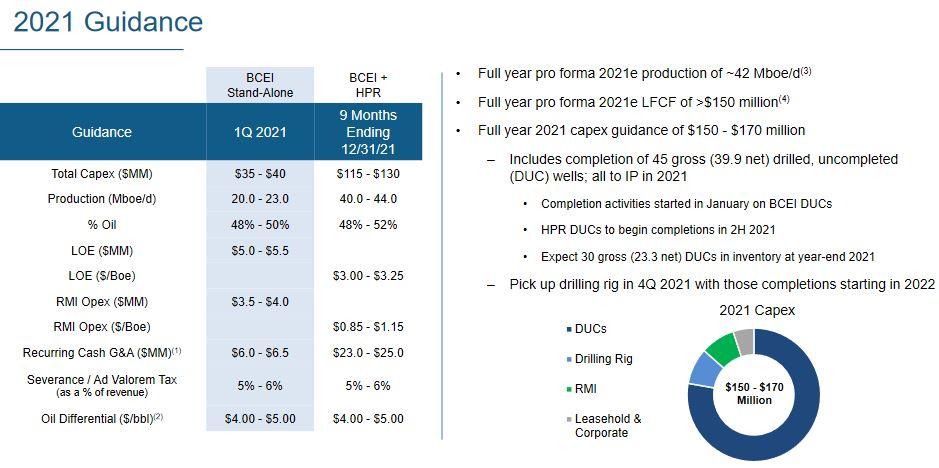

- Total 2021 annual capital expenditures are expected to be between $150 and $170 million

- 2Q - 4Q 2021 production guidance of 40.0 to 44.0 thousand barrels of oil equivalent per day ("MBoe/d")

- Full year pro forma 2021 estimated production of approximately 42.0 MBoe/d(1)

- 2Q - 4Q 2021 oil production guidance of 48% to 52% of BOE volumes

- Leverage ratio at closing of approximately 0.5x (pro forma net debt / pro forma LTM EBITDAX)

- Expect to generate over $150 million of full year 2021 estimated levered free cash flow at current strip pricing

2021 capital plan includes completing 45 gross (39.9 net) drilled, uncompleted ("DUC") wells, and picking up a drilling rig in 4Q 2021, with completions of those newly drilled wells to begin in 2022. The Company started completion activities in early January on Bonanza Creek DUCs, and we expect to begin completing DUCs from HighPoint's inventory during the third quarter of 2021. The Company expects to exit the year with 30 gross DUCs from the current inventory.

HighPoint Closing

The Company announced the closing of its merger with HighPoint Resources on April 1, 2021.

At closing, Bonanza Creek assumed approximately $154 million of RBL debt from HighPoint, issued $100 million of new 7.50% senior unsecured notes due 2026, and had a combined cash balance of approximately $85 million. Bonanza Creek had no debt prior to the closing. The Company estimates its leverage ratio at the time of closing, based on pro forma net debt and estimated pro forma EBITDAX over the last 12 months, to be approximately 0.5x. The table below outlines the pro forma capitalization of the Company at closing.

| Pro Forma Capitalization | |

| Pro Forma Shares Outstanding (Million) | 30.6 |

| BCEI Share Price as of 4/1/2021 | $38.25 |

| $ in millions | |

| Market Capitalization | $1,170 |

| RBL Debt | 154 |

| 7.50% Senior Unsecured Notes (due 2026) | 100 |

| Total Debt | $254 |

| Estimated Cash | 85 |

| Estimated Enterprise Value | $1,339 |

Eric Greager, President and Chief Executive Officer of Bonanza Creek, commented, "It's been nearly five months since we announced our merger with HighPoint on November 9, 2020, and I'm pleased to speak with greater clarity regarding our 2021 guidance for the combined company. In the time since the merger announcement, we have benefited from exposure to higher commodity prices that have lifted our 2021 cash flow expectations, but also made adjustments to the development schedule. This added approximately $35 million in cash at closing, and sets up greater operational flexibility going forward. Certain HighPoint completions were rescheduled from 4Q 2020 and 1Q 2021 to later in 2021 to allow our combined teams the opportunity to design the completions and optimize facility and gathering capital. Those changes to the schedule resulted in lower full year 2021 pro forma production than we estimated in November, but the decision to complete these wells as a combined team creates real value. The guidance we released today also incorporates weather that impacted both Bonanza Creek and HighPoint in the first quarter."

Greager, added, "We've included approximately $30 million of non-recurring merger-related costs into our pro forma estimated 2021 cash flow forecast and, inclusive of these expenses and changes to the development schedule, expect greater 2021 levered free cash flow than previously estimated. We have taken immediate steps to allow us to deliver the estimated $31 million of first-year synergies that we identified in November, and we expect to deliver those synergies in the first 12 months from closing. All things considered, we estimate our 2021 pro forma levered free cash flow at over $150 million at current commodity prices. As a result of the stronger balance sheet at closing we're already at our target leverage ratio of approximately 0.5x. We're quickly integrating two new directors into capital allocation discussions, and plan to announce formal plans with our 1Q earnings."

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Rockies News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

-

Contrary to the Noise from Top Service Companies; Activity to Slow For Remainder 2024 -

Rockies - DJ Basin News >>>

-

Shale Experts Frac Maket Forecast 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans