Top Story | Bankruptcy / Restructure Update | Financial Trouble | Capital Markets | Drilling Activity

Chesapeake Energy Files Chapter 11 Bankruptcy

Chesapeake Energy Corp. has voluntarily filed for Chapter 11 protection in the U.S. The plan will call for the elimination of $7 billion in debt.

As part the RSA, the company has secured $925 million in debtor-in-possession (DIP) financing from certain lenders under Chespaeakes credit facility.

Liquidity

The Company and certain lenders under Chesapeake's revolving credit facility have also agreed to the principal terms of a $2.5 billion exit financing, consisting of a new $1.75 billion revolving credit facility and a new $750 million term loan.

Additionally, the Company has the support of its term loan lenders and secured note holders to backstop a $600 million rights offering upon exit.

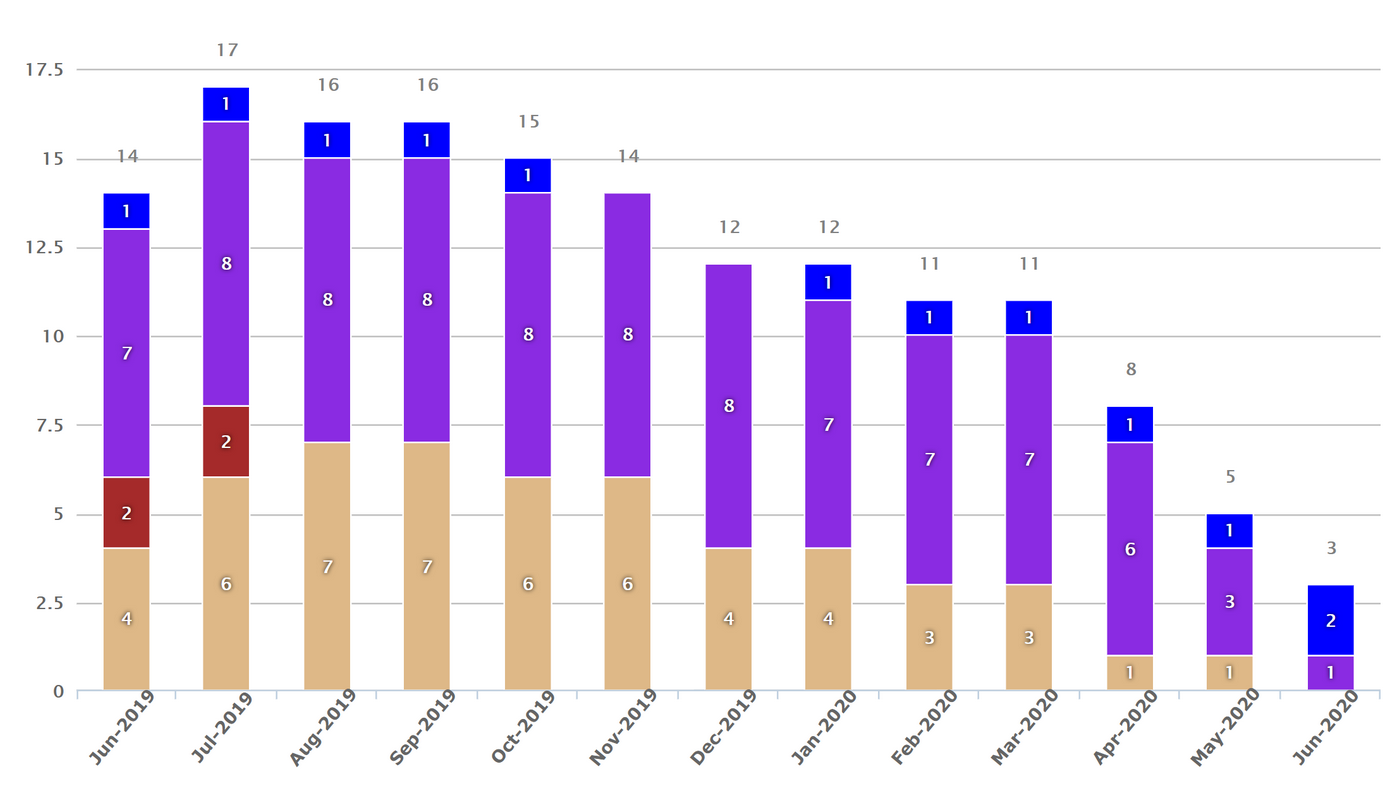

Chesapeake Energy - Drilling Activity (Rig Count)- Last 12 Months.

Doug Lawler, Chesapeake's President and Chief Executive Officer, stated, "We are fundamentally resetting Chesapeake's capital structure and business to address our legacy financial weaknesses and capitalize on our substantial operational strengths. By eliminating approximately $7 billion of debt and addressing the legacy contractual obligations that have hindered our performance, we are positioning Chesapeake to capitalize on our diverse operating platform and proven track record of improving capital and operating efficiencies and technical excellence. With these demonstrated strengths, and the benefit of an appropriately sized capital structure, Chesapeake will be uniquely positioned to emerge from the Chapter 11 process as a stronger and more competitive enterprise.

"In addition to securing financing to fund our ongoing operations and facilitate our exit from this process, we are pleased to have the support of our term loan lenders and secured note holders to backstop a $600 million rights offering, demonstrating their confidence in Chesapeake's operating platform and future. We deeply appreciate the hard work and commitment of our employees, who remain focused on safely and efficiently executing our business. We look forward to working productively with our suppliers, business partners and all stakeholders throughout this process.

"Over the last several years, our dedicated employees have transformed Chesapeake's business — improving capital efficiency and operational performance, eliminating costs, reducing debt and diversifying our portfolio. Despite having removed over $20 billion of leverage and financial commitments, we believe this restructuring is necessary for the long-term success and value creation of the business."

Related Categories :

Bankruptcy - Filing

More Bankruptcy - Filing News

-

ION Geophysical Files for Bankruptcy

-

Basic Energy Services Files for Bankruptcy; Inks Stalking Horse Deals

-

HighPoint Files Chapter 11 Ahead of Merger with Bonanza Creek

-

SCOOP / STACK Operator Files for Bankruptcy

-

Superior Energy Services Files for Bankruptcy

Ark-La-Tex News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New Haynesville Focused E&P Scores Cash From Large PE Firm.

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

Gulf Coast News >>>

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs

-

Comstock Resources To Increase Haynesville Drilling Activity in 2025

-

Top E&P Outline Drilling & Frac Program For 2025; 18 Rigs & 5 Frac Crews

-

Liberty Energy Reducing Frac Fleets As Market Activity Slows; Talks 2025 -