Top Story | Capital Markets | Credit Facility Change

E&P Gets $500 in Liquidity; Plans to Continue Executing Dev. Program

QEP Resources, Inc. has entered into an amendment to its existing credit agreement with Wells Fargo Bank, National Association, and other lenders.

The amendments increase the company's liquidity by over $500 million.

CEO Tim Cutt said: "The amended credit facility increases our liquidity by more than $500 million and is expected to provide us with the necessary financial flexibility to execute our ongoing business plan."

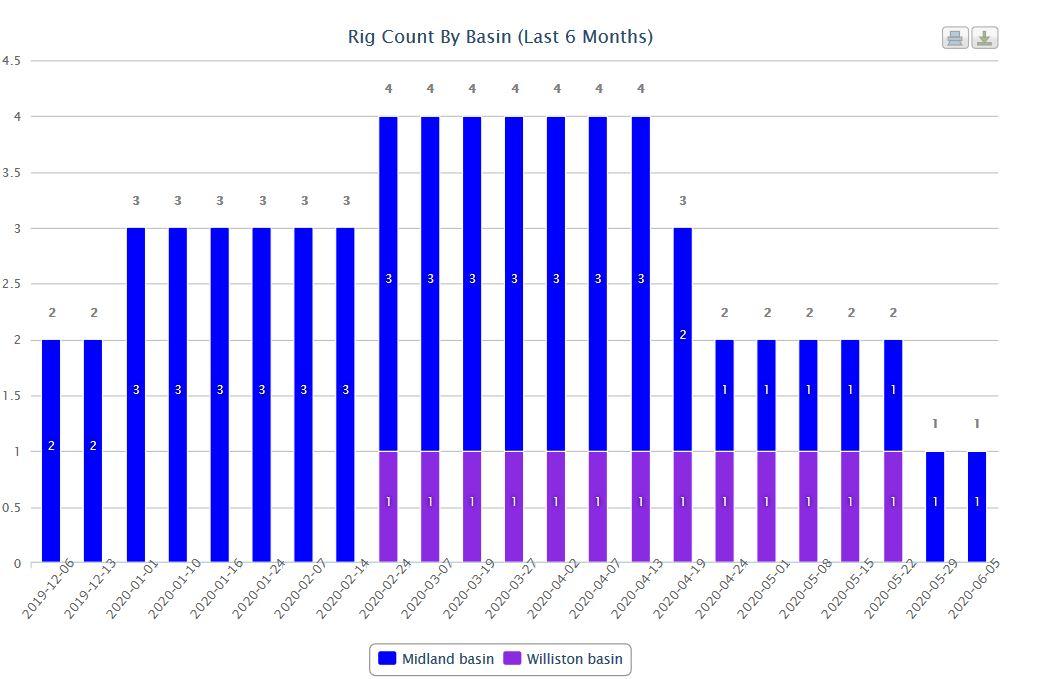

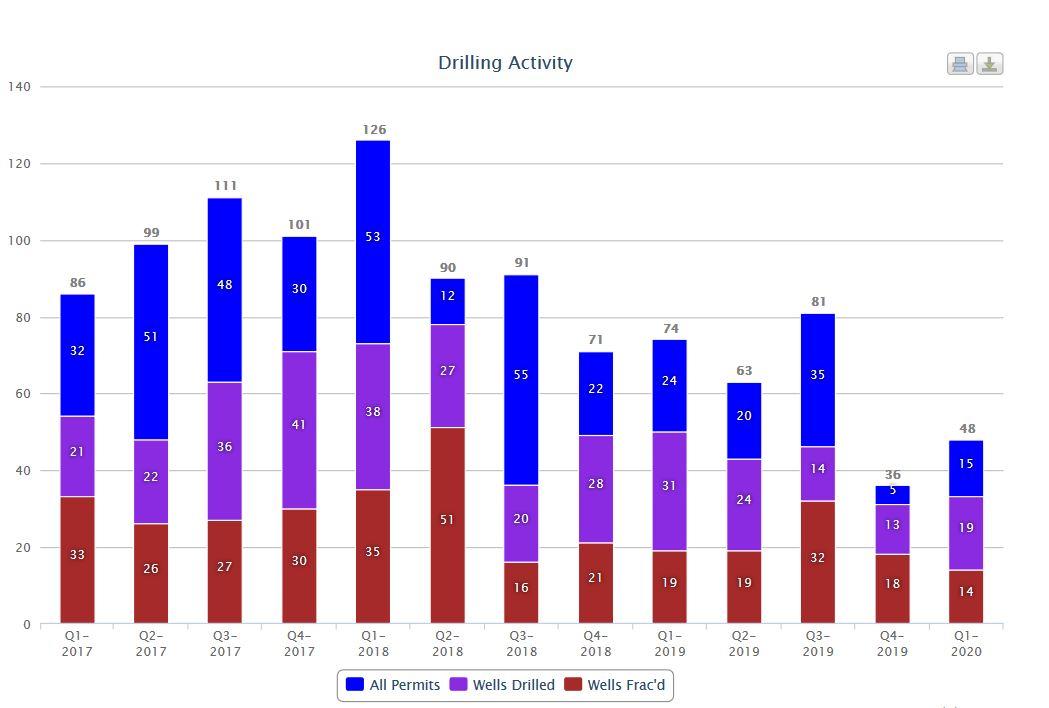

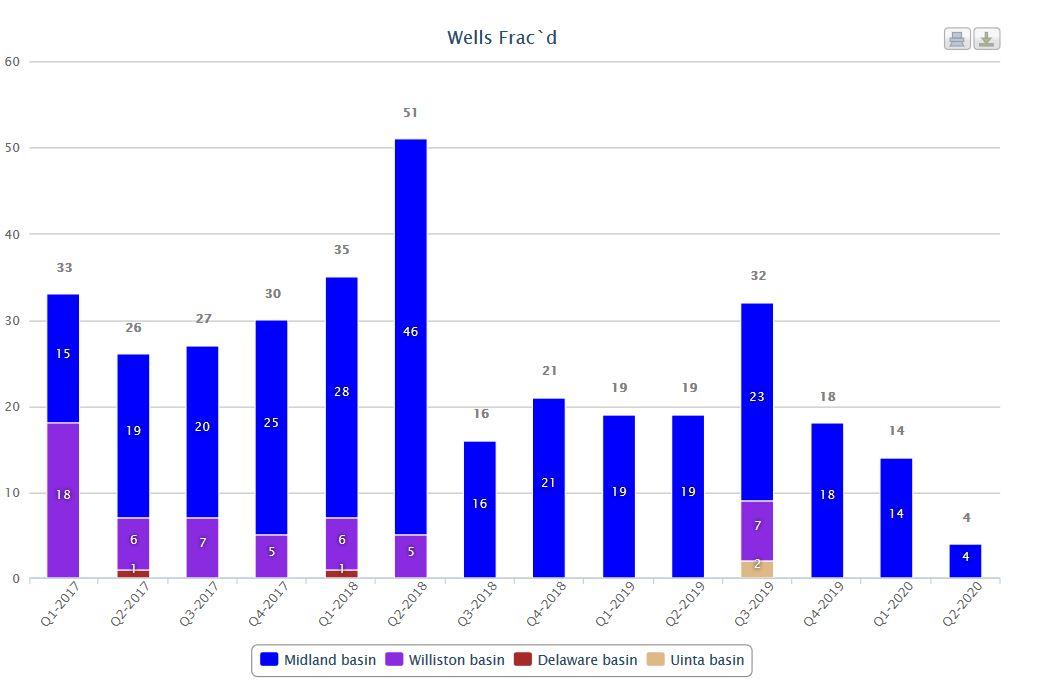

QEP Drilling / Rigs

The company plans to spend around $570 million in 2020 and this liquidity will likely spur the company to increase D&C operations again.

Full details of the amendment include:

- a change to the leverage ratio covenant to permit a maximum ratio of net priority guaranteed debt to consolidated EBITDAX of 2.50 to 1.00 as of the last day of each fiscal quarter of the Company

- a change of the present value debt ratio covenant to require a minimum present value to net priority guaranteed debt ratio of at least 1.50 to 1.00 at all times

- the ability to repurchase outstanding senior notes with up to $500 million of loan proceeds and certain other amounts

- the ability to issue subsidiary guarantees of up to $500 million of unsecured debt, with such guarantees being subordinated to the obligations under the Credit Agreement

- a reduction in aggregate commitments from $1.25 billion to $850 million

- the requirement that the Company’s material subsidiaries guarantee the obligations under the Credit Agreement and certain swap obligations and bank product obligations

- the revision of the applicable rate for all borrowings under the Credit Agreement to be based on the utilization under the Credit Agreement rather than the Company’s leverage ratio

- amendments of certain of the negative covenants and other provisions of the Credit Agreement, as more specifically set forth in the amendment.

Related Categories :

Credit Facility Change

More Credit Facility Change News

-

Earthstone Energy's Credit Line Increased 21% to $1.7B

-

Silverbow's Borrowing Base Increased 48% to $775 Million

-

Northern Oil's Borrowing Base Raised Over 50% to $1.3 Billion

-

Earthstone's Credit Line Increased 6% to $1.4 Billion

-

Ranger Oil's Credit Line Increased 20% to $875 Million

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian - Midland Basin News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -