Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets

Earthstone Energy Second Quarter 2021 Results

Earthstone Energy, Inc. reported its Q2 2021 results.

Second Quarter 2021 Highlights:

- Announced the Tracker Acquisition(1) which closed subsequent to quarter end on July 20, 2021

- Closed Eagle Ford working interest acquisitions in May and June 2021 for $48.0 million

- Net loss of $15.8 million

- Adjusted net income(2) of $20.3 million

- Adjusted EBITDAX(2) of $53.7 million ($25.96 per Boe)

- Net cash provided by operating activities(4) of $55.1 million

- Free Cash Flow(2) of $28.4 million

- Average daily production of 22,716 Boepd(3)

- All-in cash costs(2) of $11.65 per Boe

- Operating Margin(2) of $35.19 per Boe ($28.19 including realized hedge settlements)

Year-to-Date 2021 Highlights:

- Closed the IRM Acquisition(5) on January 7, 2021

- Net loss of $26.4 million

- Adjusted net income of $33.7 million(2)

- Adjusted EBITDAX(2) of $97.5 million ($25.03 per Boe)

- Net cash provided by operating activities(4) of $93.4 million

- Free Cash Flow(2) of $60.3 million

- Average daily production of 21,525 Boepd(3)

- All-in cash costs(2) of $12.12 per Boe

- Operating Margin(2) of $33.99 per Boe ($27.49 including realized hedge settlements)

Robert J. Anderson, President and CEO of Earthstone, commented, "We achieved strong second quarter results and continue building towards what we believe will be an exceptional year for Earthstone. Our team executed and delivered these strong results while successfully integrating the assets from our IRM Acquisition into our operations and actively pursuing additional acquisitions such as the recently closed Eagle Ford and Tracker acquisitions. Our growing cash flow combined with our solid balance sheet has positioned us to be able to execute an active acquisition strategy this year that is significantly increasing our scale while expanding our opportunities for greater efficiency and profitable growth. The series of accretive acquisitions that we have announced so far this year substantially increase our production and add about 120 high-graded drilling locations while only minimally impacting our leverage levels and total G&A costs. As we fully integrate the assets acquired in the Tracker Acquisition and execute on our two-rig drilling program, we expect that our results in 2022 will further demonstrate the meaningful benefits of our consolidation strategy."

Liquidity

As of June 30, 2021, we had $0.5 million in cash and $241.4 million of long-term debt outstanding under our senior secured revolving credit facility (our "Credit Facility") with a borrowing base of $475 million. With the $233.6 million of undrawn borrowing base capacity and $0.5 million in cash, we had total liquidity of approximately $234.1 million. Adjusted for the closing of the Tracker Acquisition on July 20, 2021, we had an estimated $0.5 million in cash and $301.0 million of long-term debt outstanding under our Credit Facility with a borrowing base of $550 million. With the $249.0 million of undrawn borrowing base capacity and $0.5 million in cash, we had total liquidity of approximately $249.5 million on a combined basis. Through June 30, 2021, we had incurred $32.6 million of our estimated $130-$140 million in capital expenditures for 2021. We expect to fund our remaining 2021 capital expenditures with cash flow from operations while any excess will be used to pay down debt.

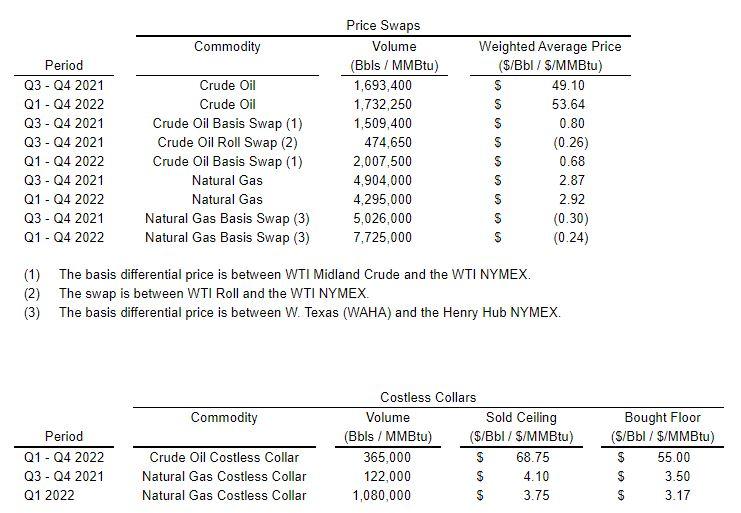

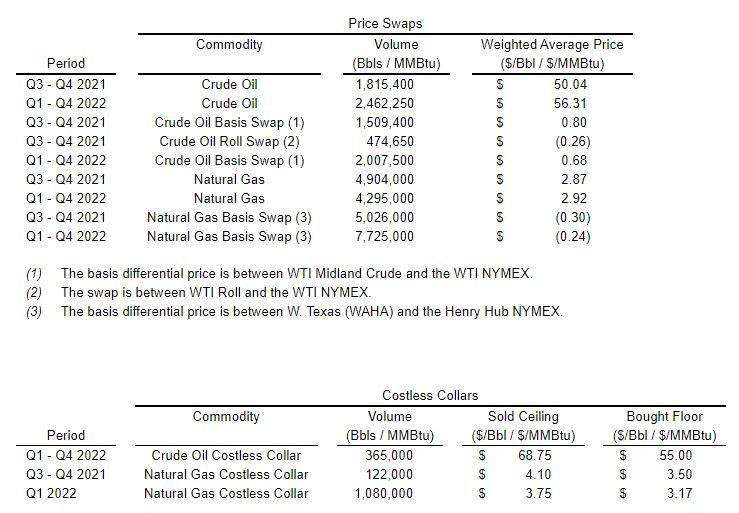

Hedging

The following table sets forth our outstanding derivative contracts at July 20, 2021. When aggregating multiple contracts, the weighted average contract price is disclosed.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -