Quarterly / Earnings Reports | Debt | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets | Drilling Activity | 2020 Guidance

Enerplus Corp. Second Quarter 2020 Results

Enerplus Corp. reported its Q2 2020 results.

Highlights:

- Second quarter production was 87,360 BOE per day, including liquids of 48,097 barrels per day

- Adjusted funds flow of $70 million exceeded capital spending in the second quarter, generating free cash flow of $30 million, with additional free cash flow forecast during the second half of 2020

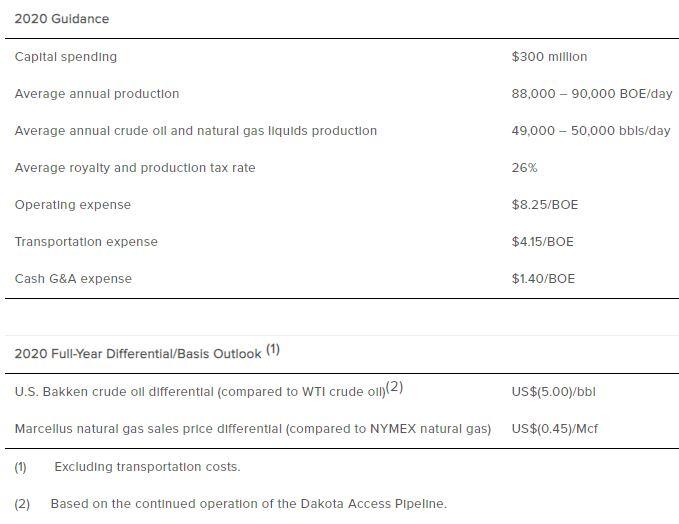

- Reinstated 2020 production guidance: 88,000 to 90,000 BOE per day, including 49,000 to 50,000 barrels per day of liquids

- 2020 capital spending unchanged at $300 million

- Maintained low financial leverage; net debt to adjusted funds flow ratio was 1.0 times at quarter-end

- Advantaged position for rapid future capital deployment with drilled uncompleted well inventory

CEO Ian Dundas commented: "We have seen extraordinary volatility in the first 6-months of 2020 as the COVID-19 pandemic and OPEC supply issues meaningfully impacted the industry. Enerplus took decisive action to respond to this instability, enabling the company to navigate this period and maintain financial resilience. Despite the challenging conditions, we delivered strong operational execution and cost performance in the second quarter, which has helped position the business to deliver free cash flow in 2020 and maintain our top-quartile balance sheet strength."

Net Loss of $609MM; $427MM Impairment Charge

Cash flow from operating activities for the second quarter was $90.6 million and adjusted funds flow was $70.0 million. Enerplus reported a second quarter net loss of $609.3 million, or $2.74 per share.

The Company recognized a $426.8 million non-cash impairment on property, plant and equipment ("PP&E") and a $202.8 million non-cash impairment on goodwill as a result of the continued market volatility and low commodity price environment. Excluding these impairments and certain other non-cash or non-recurring items, Enerplus' second quarter 2020 adjusted net loss was $41.2 million, or $0.19 per share.

2020 Guidance / 2021 Maintenance Capital

Although there remains significant uncertainty regarding the timing and path forward for a global economic recovery from the impacts of COVID-19, given the relative stability in oil prices since late in the second quarter, Enerplus is reinstating 2020 guidance.

Enerplus expects its 2020 production to average 88,000 to 90,000 BOE per day, including 49,000 to 50,000 barrels per day of crude oil and natural gas liquids. Enerplus is maintaining its $300 million capital budget in 2020. Remaining activity is primarily focused on non-operated drilling and completions in the Marcellus and North Dakota, along with four operated completions in North Dakota planned for the fourth quarter. In total, the Company expects to complete approximately six net wells (operated and non-operated) in North Dakota and two net wells in the Marcellus in the second half of 2020. Enerplus expects this plan to generate free cash flow in 2020 based on current market conditions.

With this outlook, Enerplus estimates it could maintain its second half 2020 liquids production flat in 2021 for approximately $300 million. This maintenance capital estimate includes an allocation for drilling in 2021 to provide an inventory of wells to complete in 2022, and an allocation for the Company's Marcellus natural gas asset.

In early July, a U.S. district court ordered the Dakota Access Pipeline ("DAPL") to cease operations after it found that, due to deficiencies in the original environmental review, the U.S. Army Corps of Engineers are required to complete a more thorough Environmental Impact Statement. On August 5, an appeals court granted the pipeline owners' request for a stay over the lower court order requiring the pipeline to cease operations. As a result, there is no outstanding court order in place requiring DAPL to shut down at this time and the legal process is ongoing.

As a result of the above and assuming DAPL continues to operate, the Company expects the market price for Bakken oil to remain constructive and estimates its realized 2020 Bakken oil price differential will average approximately US$5.00 per barrel below WTI. For the second half of 2020, Enerplus has fixed differential sales agreements in North Dakota for approximately 16,000 barrels per day at an estimated price of US$6.00 per barrel below WTI, based on current market prices.

2020 Guidance SummaryQ2 Summary

ProductionProduction in the second quarter of 2020 was 87,360 BOE per day, a decrease of 13% compared to the same period a year ago, and 11% lower than the prior quarter. Crude oil and natural gas liquids production in the second quarter of 2020 was 48,097 barrels per day, a decrease of 9% compared to the same period a year ago, and 12% lower than the prior quarter.

The lower production was due to the temporary curtailment of production during the second quarter and the suspension of all operated drilling and completion activity in response to the significant decline in crude oil prices. Enerplus curtailed approximately 25% of its liquids volumes in May to protect against selling oil at negative margins. The Company began restoring curtailed volumes in June as oil prices improved, with curtailed volumes largely restored in July.

Financial HighlightsEnerplus reported adjusted funds flow for the second quarter of 2020 of $70.0 million compared to $186.0 million in the second quarter of 2019. The decrease from the prior year period was due to lower commodity prices and production levels in the second quarter of 2020.

The Company reported a net loss of $609.3 million in the second quarter of 2020 compared to net income of $85.1 million in the same period in 2019. The decrease from the prior year period was primarily the result of non-cash impairments and lower commodity prices and production in the second quarter of 2020. In the second quarter of 2020, Enerplus recorded a $426.8 million non-cash impairment on PP&E and a $202.8 million non-cash impairment on goodwill as a result of the continued market volatility and low commodity price environment. Excluding these impairments and certain other non-cash or non-recurring items, Enerplus' second quarter 2020 adjusted net loss was $41.2 million, or $0.19 per share, compared to adjusted net income of $74.4 million, or $0.32 per share in the second quarter of 2019. Enerplus recorded a current tax recovery of $14.4 million in the second quarter of 2020 related to the recognition of the Company's final U.S. Alternative Minimum Tax refund.

Enerplus' second quarter 2020 realized Bakken oil price differential was US$4.36 per barrel below WTI, compared to US$3.00 per barrel below WTI in the second quarter of 2019. Bakken oil differentials materially weakened during April as refineries reduced purchases given the significant reduction in demand for refined products due to the COVID-19 pandemic. Despite this weakness, Enerplus outperformed the benchmark index (Bakken DAPL - WTI) by temporarily curtailing production during the weakest period and through the diversification of sales into higher priced markets.

The Company's realized Marcellus natural gas price differential was US$0.49 per Mcf below NYMEX during the second quarter of 2020 compared to US$0.57 per Mcf below NYMEX in the second quarter of 2019. The second quarter differentials reflect lower seasonal natural gas demand in the local market.

In the second quarter of 2020, Enerplus' operating expenses were $6.84 per BOE, compared to $7.84 per BOE during the same period in 2019. The lower unit operating expenses were primarily driven by the proactive price related shut-in of the Company's highest unit expense oil wells, and from reduced well servicing activity and lower service costs.

Second quarter transportation costs were $4.28 per BOE and cash general and administrative expenses were $1.14 per BOE.

Exploration and development capital spending in the second quarter was $40.1 million, reflecting strong operational execution which drove continued improvement in total well costs. Capital activity in the quarter was associated with drilling 2.5 net wells and bringing 8.9 net wells on production, including operated and non-operated activity across the Company.

Enerplus ended the second quarter of 2020 with a strong balance sheet and significant liquidity. The Company had total debt of $524.3 million, cash of $6.2 million and US$599 million available on its US$600 million bank credit facility. The Company's net debt to adjusted funds flow ratio was 1.0 times at quarter-end. During the second quarter, Enerplus made scheduled principal repayments of US$81.6 million on its 2009 and 2012 senior notes.

Asset Activity

Williston Basin production averaged 44,081 BOE per day (81% oil) during the second quarter of 2020, a decrease of 6% compared to the same period a year ago, and 11% lower than the prior quarter, reflecting the curtailed production during the second quarter of 2020. During the second quarter, and prior to the suspension of the Company's drilling and completion program in mid-April, the Company drilled one gross operated well and completed a seven-well pad (97% average working interest). The seven-well pad was brought on production during June concurrent with improving oil prices. Enerplus currently has 33 gross (27 net) operated drilled uncompleted wells in inventory in North Dakota.

Marcellus production averaged 197 MMcf per day during the second quarter of 2020, a decrease of 17% compared to the same period in 2019, and 9% lower than the prior quarter. The Company participated in drilling 15 gross non-operated wells (4% average working interest) and brought 10 gross non-operated wells (2% average working interest) on production during the quarter.

Canadian waterflood production averaged 6,338 BOE per day (94% oil) during the second quarter of 2020, a decrease of 31% compared to the same period in 2019, and 23% lower than the prior quarter, reflecting the curtailed production during the second quarter of 2020.

In the DJ Basin, the Company participated in drilling 15 gross non-operated wells (6% average working interest) in the second quarter and brought two gross operated wells (90% average working interest) on production. Enerplus currently has three gross (2.6 net) operated drilled uncompleted wells in inventory in the DJ Basin.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Canada News >>>

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

Northeast News >>>

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs

-

Top E&P Outline Drilling & Frac Program For 2025; 18 Rigs & 5 Frac Crews

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

-

Top Gas E&P To Keep 2025 Drilling & Completion Program Flat; Rigs & FRac Crews

-

This Large E&P Will Run 10 Rigs & 6 Frac Crews In 2025