Drilling & Completions | Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity

Gulfport Energy Fourth Quarter, Full Year 2021 Results

Gulfport Energy Corp. reported financial and operating results for the three and twelve months ended December 31, 2021.

Fourth Quarter 2021 Highlights:

- Delivered total net production of 1,068.9 MMcfe per day

- Reported $558.1 million of net income and $224.9 million of adjusted EBITDA(1)

- Generated $128.3 million of net cash provided by operating activities and $133.9 million of free cash flow(1)

- Amended credit facility increasing liquidity by more than $160 million

- Authorized previously announced stock repurchase program to acquire up to $100 million of outstanding common stock

Full Year 2021 Highlights

- Delivered total net production 2% above and capital expenditures 2% below the midpoint of original 2021 guidance

- Reported $138.2 million of net income and $716.8 million of adjusted EBITDA(1)

- Reduced total per unit expense(3) by approximately 20% when compared to 2020

- Generated $465.1 million of net cash provided by operating activities and $361.0 million of free cash flow(1)

- Achieved leverage target of below 1.0x at year end 2021

- Reported total proved reserves of 3.9 Tcfe and total discounted future net cash flows of $4.1 billion

Tim Cutt, CEO of Gulfport, said: "During 2021, we significantly improved our balance sheet and cost structure through the restructuring process and emerged with a continuous improvement mindset, focused on disciplined capital allocation and free cash flow generation. The team executed extremely well, delivering total 2021 net production at the high end of the guidance range with total capital expenditures at the low end of the range. We also successfully achieved numerous financial objectives, including refinancing our credit facility and reaching our target leverage ratio ahead of schedule."

Operational Update

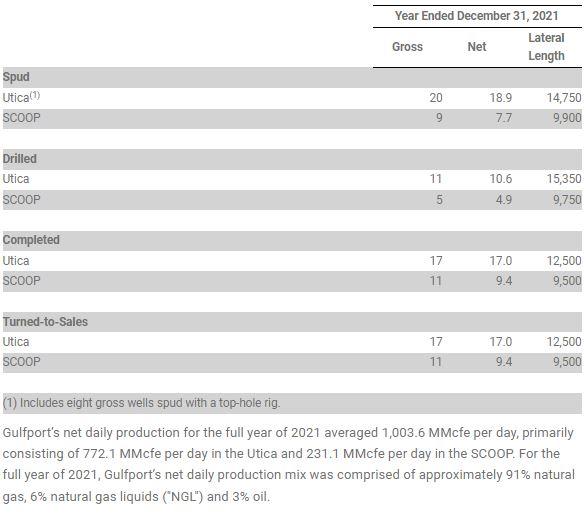

The table below summarizes Gulfport's operated drilling and completion activity for the full year of 2021:

Gulfport's net daily production for the full year of 2021 averaged 1,003.6 MMcfe per day, primarily consisting of 772.1 MMcfe per day in the Utica and 231.1 MMcfe per day in the SCOOP. For the full year of 2021, Gulfport's net daily production mix was comprised of approximately 91% natural gas, 6% natural gas liquids ("NGL") and 3% oil.

Capital Investment

Capital investment was $292.9 million (on an incurred basis) for the full year of 2021, of which $275.6 million related to drilling and completion ("D&C") activity and $17.3 million related to leasehold and land investment.

Financial Position and Liquidity

As of December 31, 2021, Gulfport had approximately $3.3 million of cash and cash equivalents, $164.0 million of borrowings under its revolving credit facility, $122.1 million of letters of credit outstanding and $550 million of outstanding 2026 senior notes.

Gulfport's liquidity at December 31, 2021, totaled approximately $417.2 million, comprised of the $3.3 million of cash and cash equivalents and approximately $413.9 million of available borrowing capacity under its new revolving credit facility.

As of February 25, 2022, Gulfport had $7.1 million of cash and cash equivalents, zero borrowings under its revolving credit facility, $109.8 million of letters of credit outstanding and $550 million of outstanding 2026 Notes.

During 2021, the company paid dividends on its Preferred Stock, which included 3,071 shares of New Preferred Stock paid in kind, approximately $55 thousand of cash-in-lieu of fractional shares and $1.5 million of cash dividends.

Stock Repurchase Program

On November 2, 2021, Gulfport announced the authorization by its Board of Directors to repurchase up to $100 million of its outstanding shares of common stock through December 31, 2022. Purchases under the repurchase program may be made from time to time in open market or privately negotiated transactions, and will be subject to available liquidity, market conditions, credit agreement restrictions, applicable legal requirements, contractual obligations and other factors. The repurchase program does not require the Company to acquire any specific number of shares. The Company intends to purchase shares under the repurchase program opportunistically with available funds while maintaining sufficient liquidity to fund its capital development program. The repurchase program may be suspended from time to time, modified, extended or discontinued by the board of directors at any time. The Company did not repurchase any common stock during the year ended December 31, 2021.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Mid-Continent News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs

-

Top E&P Outline Drilling & Frac Program For 2025; 18 Rigs & 5 Frac Crews

Mid-Continent - Anadarko Basin News >>>

-

Liberty Energy Reducing Frac Fleets As Market Activity Slows; Talks 2025 -

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

-

Top Gas E&P To Keep 2025 Drilling & Completion Program Flat; Rigs & FRac Crews

-

This Large E&P Will Run 10 Rigs & 6 Frac Crews In 2025

-

Top Mergers & Acquisitions Deals To Date In Q3 2024