Drilling / Well Results | Quarterly / Earnings Reports | First Quarter (1Q) Update | Key Wells | IP Rates-24 Hour | Initial Production Rates | Capital Markets | Capital Expenditure | Drilling Activity

Matador Resources First Quarter 2021 Results

Matador Resources Co. reported financial and operating results for the first quarter of 2021.

Joseph Wm. Foran, Matador’s Chairman and CEO, commented, “On both our website and the webcast planned for tomorrow’s earnings conference call is a set of six slides identified as ‘Chairman’s Remarks’ (Slides A through F) to add color and detail to my remarks. We invite you to review these slides in conjunction with my comments below, which are intended to provide context for the first quarter of 2021 compared to Matador’s goals for the year.

“The first quarter of 2021 was an outstanding quarter for Matador highlighted by a number of significant achievements (see Slide A). The Board and I would like to acknowledge the various efforts of the Matador team to deliver these excellent results despite the challenges we faced in the first quarter due to the pandemic and historically prolonged cold weather conditions experienced in New Mexico and Texas during Winter Storm Uri. In particular, we salute the efforts of the production and marketing teams and our entire field staff for keeping a significant portion of Matador’s oil and natural gas production online and for finding available markets for our products during this unprecedented winter storm. We also express our appreciation to San Mateo, our midstream affiliate, for keeping its gathering, processing and disposal systems operational throughout the winter storm. Notably, we believe San Mateo’s Black River natural gas cryogenic processing plant (the “Black River Processing Plant”) was one of only about 5% of plants in the Delaware Basin to remain operational for the duration of the storm.

“Matador is also pleased to report positive free cash flow once again in the first quarter of 2021. Net cash provided by operating activities in the first quarter was $169.4 million, a 7% sequential increase, leading to first quarter 2021 adjusted free cash flow of $63.9 million, about 5% higher than we achieved in the fourth quarter of 2020 and significantly better than our initial expectations. Given this strong free cash flow, Matador repaid $100 million in borrowings outstanding in the first quarter of 2021, which was in addition to the $35 million repaid during the fourth quarter of 2020. As a result, Matador’s leverage ratio under the reserves-based credit facility has now declined to 2.5x (see Slide B). Matador expects to continue to generate adjusted free cash flow in aggregate for full year 2021 and plans to use a significant portion of this discretionary cash flow primarily to continue reducing the borrowings outstanding under its reserves-based credit facility and then to pay a quarterly dividend to shareholders.

Operations Tracking Key 2021 Milestones, Including Strong Rodney Robinson and Voni Well Results

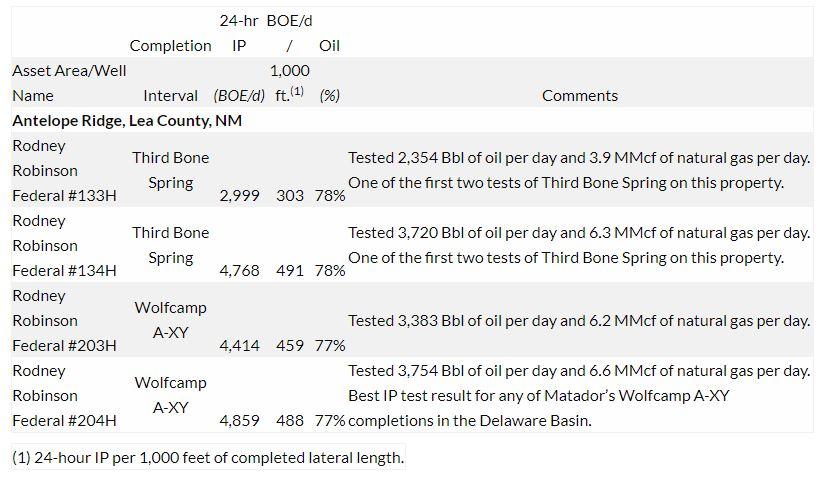

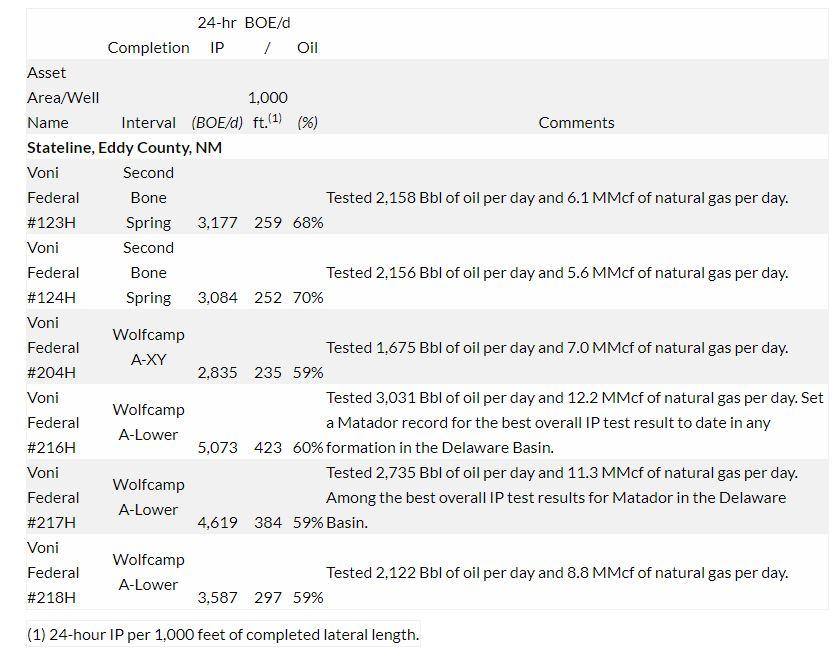

“Matador’s 2021 priorities and milestones are shown on Slide C. During the first quarter of 2021, we achieved our first significant operational milestone for 2021 when we turned to sales four new Rodney Robinson wells in mid-March. Matador is very pleased with the strong 24-hour initial potential (“IP”) test results from these most recent Rodney Robinson wells, including excellent results from our first two tests of the Third Bone Spring formation on this leasehold (see Slide D). In April 2021, Matador achieved its second key operational milestone for 2021 when we began turning to sales the first 13 Voni wells in the Stateline asset area. The 13 Voni wells all have completed lateral lengths of approximately 12,000 feet, or about 2.3 miles, making them the longest horizontal laterals that Matador has completed to date in the Delaware Basin. Matador has now turned to sales all 13 Voni wells, slightly ahead of schedule, and today we have reported 24-hour IP test results from the first six of these wells (see Slide D). Matador is very excited by the strong 24-hour IP test results from these six wells, especially the Voni Federal #216H well, a Wolfcamp A-Lower completion, which set a new Matador record for best overall 24-hour IP test result to date in any formation in the Delaware Basin at 5,073 barrels of oil equivalent per day.

Drilling and Completion Costs Continue to Move Lower

“Matador’s operations and asset teams continue to achieve new milestones in their efforts to improve our capital efficiency. Drilling and completion costs per completed lateral foot for the 13 Voni wells turned to sales in April 2021 averaged $610 per completed lateral foot, an all-time low for Matador (see Slide E). This improvement in capital efficiency through our transition to drilling and completing longer laterals has been and continues to be a high priority for Matador.

Looking Ahead

“Matador is already off to a great start in 2021, and we believe the year will continue to be exciting for Matador and its stakeholders as we work to generate free cash flow, pay down debt, pay dividends to our shareholders and grow the value of our midstream assets and our oil and natural gas reserves. As a result, we anticipate our total oil equivalent production should increase by about 20% sequentially in the second quarter while our leverage ratio should continue to shrink. As the asset teams continue generating plenty of new opportunities and San Mateo continues to build revenue and value for Matador and its joint venture partner Five Point (see Slide F), it makes one think, ‘what a difference a year makes.’”

Q1 2021 Financial and Operational Highlights

Realized Oil and Natural Gas Prices

- First quarter 2021 weighted average realized oil and natural gas prices, excluding hedging impacts, were $57.05 per barrel and $5.88 per thousand cubic feet, sequential increases of 39% and 98%, respectively, from $40.99 per barrel and $2.97 per thousand cubic feet in the fourth quarter of 2020. Weighted average realized oil and natural gas prices, excluding hedging impacts, also increased year-over-year 24% and 3.5-fold, respectively, from $45.87 per barrel and $1.70 per thousand cubic feet in the first quarter of 2020 to $57.05 per barrel and $5.88 per thousand cubic feet in the first quarter of 2021. These stronger-than-anticipated realized commodity prices, and particularly, the realized natural gas price, resulted in better-than-expected net income, Adjusted EBITDA and adjusted free cash flow during the first quarter of 2021.

Achieved Better-Than-Expected Adjusted Free Cash Flow and Repaid $100 Million in First Quarter 2021

- First quarter 2021 net cash provided by operating activities was $169.4 million (GAAP basis), leading to first quarter 2021 adjusted free cash flow (a non-GAAP financial measure) of $63.9 million, which includes $15.4 million in performance incentives received from a subsidiary of Five Point Energy LLC (“Five Point”), Matador’s joint venture partner in San Mateo (as defined below). These cash flow measures were above Matador’s expectations for the first quarter and allowed the Company to repay $100 million in borrowings outstanding under its reserves-based revolving credit facility in the first quarter and to pay its first quarterly cash dividend of $0.025 per share of common stock.

Net Income, Earnings Per Share and Adjusted EBITDA

- First quarter 2021 net income (GAAP basis) was $60.6 million, or $0.51 per diluted common share, a significant improvement from a net loss of $89.5 million in the fourth quarter of 2020, but a 52% year-over-year decrease from net income of $125.7 million in the first quarter of 2020. The changes in net income (loss) between periods were significantly impacted by a non-cash, unrealized loss on derivatives of $43.4 million in the first quarter of 2021, as compared to a non-cash, unrealized loss on derivatives of $22.7 million in the fourth quarter of 2020, and a non-cash, unrealized gain on derivatives of $136.4 million in the first quarter of 2020.

- First quarter 2021 adjusted net income (a non-GAAP financial measure) was $84.5 million, or $0.71 per diluted common share, a 162% sequential increase from adjusted net income of $32.3 million in the fourth quarter of 2020, and a 265% year-over-year increase from adjusted net income of $23.1 million in the first quarter of 2020.

- First quarter 2021 adjusted earnings before interest expense, income taxes, depletion, depreciation and amortization and certain other items (“Adjusted EBITDA,” a non-GAAP financial measure) were $198.1 million, a 32% sequential increase from $150.1 million in the fourth quarter of 2020, and a 41% year-over-year increase from $140.6 million in the first quarter of 2020.

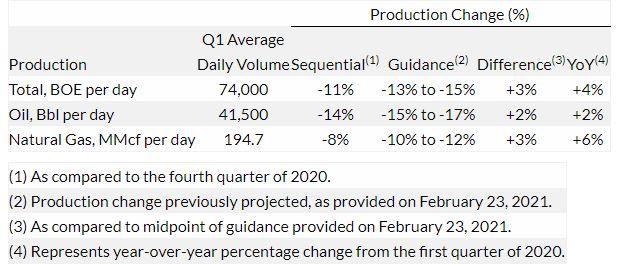

Oil, Natural Gas and Oil Equivalent Production

- As summarized in the table below, Matador’s first quarter 2021 average daily oil, natural gas and total oil equivalent production all exceeded the Company’s expectations. The majority of the production outperformance resulted from a prompt return to full production by late February following the partial production shut-ins necessitated by the historically prolonged cold weather conditions experienced in New Mexico and Texas in mid- to late February due to Winter Storm Uri. First quarter 2021 production was also impacted positively by the continued better-than-expected performance from the 13 Boros wells in the Stateline asset area, which were turned to sales in September 2020, as well as by strong initial well performance from four new Rodney Robinson wells turned to sales in mid-March. Natural gas production was also positively impacted by continued strong production from the two significant non-operated Haynesville shale wells turned to sales in the third quarter of 2019 that continue to outperform expectations.

Drilling and Completion Costs Continue at Record Lows

- Drilling and completion costs for the six operated horizontal wells turned to sales in the first quarter of 2021 averaged $785 per completed lateral foot, a decrease of 8% from average drilling and completion costs of $850 per completed lateral foot achieved in full year 2020. Including the record-low drilling and completion costs associated with the 13 Voni wells noted below, drilling and completion costs associated with these 19 operated horizontal wells turned to sales in 2021 averaged $657 per completed lateral foot.

- Drilling and completion costs for the 13 Voni wells turned to sales in April 2021 averaged $610 per completed lateral foot, a decrease of 28% from average drilling and completion costs of $850 per completed lateral foot in full year 2020 and below the $625 per completed lateral foot realized for all operated horizontal wells turned to sales in the fourth quarter of 2020. Drilling and completion costs of $610 per completed lateral foot for these 13 Voni wells marked a new record low for Matador.

- Matador incurred capital expenditures for drilling, completing and equipping wells (“D/C/E capital expenditures”) of approximately $126 million in the first quarter of 2021, or 11% below the Company’s estimate of $142 million for D/C/E capital expenditures during the quarter. Matador estimates that approximately $6 million of these savings were directly attributable to improved operational efficiencies and lower-than-expected drilling and completion costs in the Delaware Basin. The remainder of these cost savings primarily resulted from the timing of both operated and non-operated drilling and completion activities, and most of these costs are currently expected to be incurred in the second quarter of 2021.

Borrowing Base Reaffirmed and Total Borrowings Better Than Expectations

- As noted above, Matador repaid $100 million in borrowings outstanding under its reserves-based revolving credit facility in the first quarter of 2021. At March 31, 2021, total borrowings outstanding under Matador’s reserves-based credit facility were $340 million, $50 million less than the Company’s expectations for the end of the first quarter. These higher-than-anticipated repayments of borrowings were primarily attributable to Matador’s continued capital and operating cost efficiencies and higher than expected revenues, particularly for natural gas, during the first quarter. Matador plans to use the majority of its anticipated free cash flow in future periods to reduce borrowings and pay quarterly dividends.

- In April 2021, as part of the spring 2021 redetermination process, Matador’s 11 different commercial lenders unanimously reaffirmed the Company’s borrowing base under its reserves-based credit facility at $900 million. Matador’s elected commitment also remained constant at $700 million, and no material changes were made to the terms of the Company’s reserves-based credit facility.

Quarterly Cash Dividend Declared

- On April 26, 2021, Matador announced that its Board of Directors declared a quarterly cash dividend of $0.025 per share of common stock payable on June 3, 2021 to shareholders of record as of May 13, 2021.

Federal Permits Update

Matador is pleased to report that it has received nine new federal drilling permits since the Company’s last update on February 23, 2021. Eight of these new permits are in the Antelope Ridge asset area and one is in the Ranger asset area. Matador has also received several sundries, or amendments, to existing permits over the last two months, which have been beneficial to ongoing drilling operations on its federal leasehold. The Company also continues to submit new applications for permits to drill on its federal leasehold on an ongoing basis.

At April 28, 2021, Matador had secured 174 approved and undrilled federal drilling permits and had 106 additional permits under review by the Bureau of Land Management for future drilling on federal lands across its various asset areas in the Delaware Basin. In the period between February 23 and April 28, 2021, Matador received the nine new permits noted above and used 12 permits in its ongoing drilling operations.

Operations Update

Drilling and Completion Activity

Matador operated three drilling rigs in the Delaware Basin during most of the first quarter of 2021. In late March, the Company added a fourth rig, and Matador expects to operate these four drilling rigs in the Delaware Basin throughout the remainder of 2021 but has the flexibility to reduce the number of rigs based upon market conditions or other factors. Two of these rigs are currently drilling in the Stateline asset area in Eddy County, New Mexico and are expected to operate in the Stateline asset area for the remainder of 2021. The other two rigs are currently drilling in the southern portion of the Arrowhead asset area in Eddy County (the “Greater Stebbins Area”) and are expected to operate primarily in the Greater Stebbins Area and the Rodney Robinson leasehold in the western portion of the Antelope Ridge asset area in Lea County, New Mexico for the remainder of 2021.

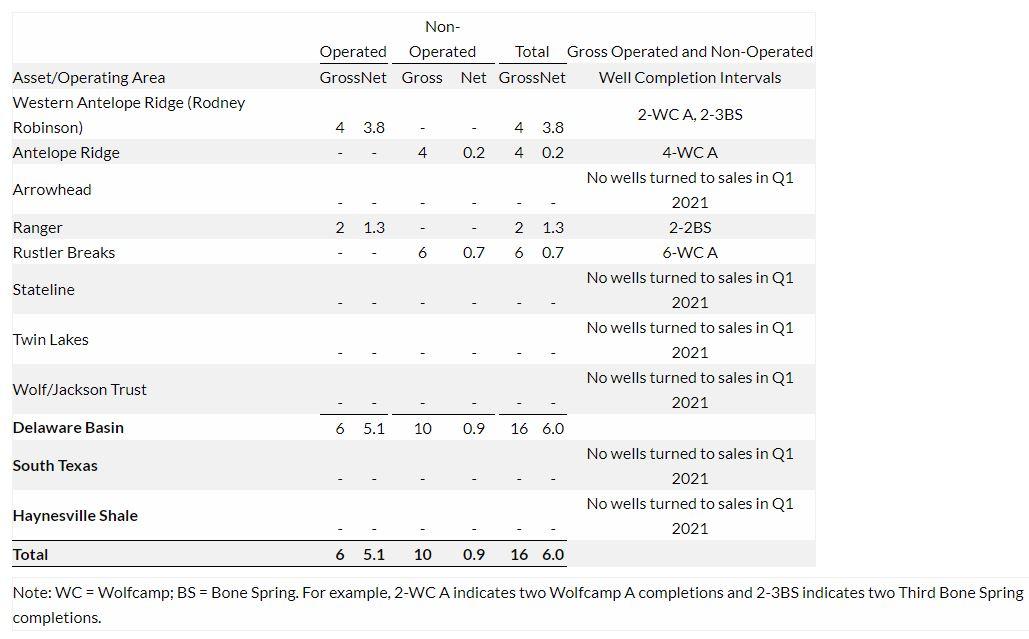

Wells Completed and Turned to Sales

During the first quarter of 2021, Matador completed and turned to sales a total of 16 gross (6.0 net) wells in its various Delaware Basin operating areas. This total was comprised of six gross (5.1 net) operated wells and 10 gross (0.9 net) non-operated wells. All six operated wells were two-mile laterals, including four gross (3.8 net) wells on the Rodney Robinson leasehold and two gross (1.3 net) Uncle Ches wells in the Ranger asset area. These six operated wells were turned to sales in mid-March 2021. As a result, these wells did not contribute significantly to Matador’s first quarter production but are expected to be important contributors to Matador’s production in the second quarter of 2021. Matador expects all of the operated wells it turns to sales in 2021 will have lateral lengths greater than one mile, and almost all (98%) of these wells are expected to have lateral lengths of two miles or greater.

Notable Well Results

Rodney Robinson and Uncle Ches Wells

The following table highlights the 24-hour IP test results from the four new Rodney Robinson wells completed and turned to sales in the first quarter of 2021, which continue to show the excellent reservoir quality in multiple formations associated with this leasehold. IP tests for the two Uncle Ches wells are expected to be conducted after these wells are equipped with electrical submersible pumps (ESPs), which is customary for many wells completed and turned to sales in the Ranger and Arrowhead asset areas. Initial flowback results from the Uncle Ches wells, both Second Bone Spring completions, exceeded Matador’s expectations for flow rates and flowing casing pressures, and both wells exhibited initial oil cuts above 90%.

Voni Wells

In April 2021, as anticipated, Matador began turning to sales the 13 Voni wells in the western portion of the Company’s Stateline asset area. As a result, Matador has now held by production all 4,000 net acres of its federal acreage in the Stateline and Rodney Robinson leaseholds. In addition, Matador estimates that approximately 75% of its federal leasehold in the Delaware Basin is held by production and that almost all of the Company’s remaining federal leasehold in the Delaware Basin is not subject to expiration before 2028. All 13 Voni wells have completed lateral lengths of approximately 12,000 feet, or about 2.3 miles, making them the longest horizontal laterals that Matador has completed to date in the Delaware Basin. The 13 Voni wells include one First Bone Spring completion, four Second Bone Spring completions, four Wolfcamp A-XY completions and four Wolfcamp A-Lower completions. These 13 wells were all drilled and completed without any material deviations from the Company’s initial drilling plans.

The table below highlights the 24-hour IP test results from the first six Voni wells, which reflect the excellent reservoir quality in multiple formations associated with the Stateline asset area. These six Voni wells are currently producing at restricted flow rates through the Company’s production facilities in the Stateline asset area while the additional seven wells are cleaning up, but 24-hour IP tests have not yet been conducted on the additional wells. All oil, natural gas and water from these wells are being gathered via pipeline by San Mateo.

Realized Prices

Oil Prices

Matador’s weighted average realized oil price, excluding derivatives, increased 39% sequentially from $40.99 per barrel in the fourth quarter of 2020 to $57.05 per barrel in the first quarter of 2021. Matador’s weighted average oil price differential relative to the West Texas Intermediate (“WTI”) benchmark, inclusive of the monthly roll and transportation costs, improved from ($1.71) per barrel in the fourth quarter of 2020 to ($1.09) per barrel in the first quarter of 2021.

For the second quarter of 2021, Matador’s weighted average oil price differential relative to the WTI benchmark price, inclusive of the monthly roll and transportation costs, is anticipated to be in the range of ($1.00) to ($2.00) per barrel.

Matador’s realized loss on derivatives of approximately $25.9 million in the first quarter of 2021 was primarily attributable to the significant increase in WTI oil prices during the first quarter of 2021, resulting in WTI oil prices that were above the strike prices for most of the Company’s oil swaps and costless collars. Please see the accompanying slide presentation for a more complete summary of Matador’s current hedging positions.

Natural Gas PricesMatador’s weighted average realized natural gas price, excluding derivatives, increased 98% sequentially from $2.97 per thousand cubic feet in the fourth quarter of 2020 to $5.88 per thousand cubic feet in the first quarter of 2021, well above the Company’s expectations for the first quarter. While most of Matador’s natural gas production is typically sold at prices established at the beginning of each month by the various markets where the Company sells its natural gas production, certain volumes of its natural gas production are sold at daily market prices. During the first quarter of 2021, and particularly during the period associated with Winter Storm Uri, these daily market prices for natural gas were often well above the monthly market prices, resulting in an associated increase in the Company’s weighted average realized natural gas price for the first quarter of 2021. NGL prices were also strong in the first quarter of 2021, which further contributed to Matador’s first quarter weighted average realized natural gas price. Matador is a two-stream reporter, and the revenues associated with its NGL production are included in the weighted average realized natural gas price.

For the second quarter of 2021, Matador’s weighted average natural gas price differential relative to the Henry Hub benchmark price is anticipated to be in the range of +$0.50 to +$1.00 per thousand cubic feet.

Operating Expenses

On a unit of production basis:

- Production taxes, transportation and processing expenses increased 45% sequentially from $3.53 per BOE in the fourth quarter of 2020 to $5.13 per BOE in the first quarter of 2021. This increase was primarily attributable to increased production taxes associated with record oil and natural gas revenues of $316.2 million reported by Matador in the first quarter.

- Lease operating expenses increased 22% sequentially from an all-time low of $3.20 per BOE in the fourth quarter of 2020 to $3.90 per BOE in the first quarter of 2021. This increase was primarily attributable to additional operating expenses associated with Winter Storm Uri. In any given year, lease operating expenses historically tend to be higher during the first quarter due to additional costs associated with preparing for and handling winter weather. Although higher than the prior quarter, lease operating expenses of $3.90 per BOE in the first quarter of 2021 still marked a record low for lease operating expenses per BOE reported by Matador during the first quarter of any year since Matador became a public company in February 2012.

- General and administrative expenses per BOE increased 54% sequentially from an all-time low of $2.16 per BOE in the fourth quarter of 2020 to $3.33 per BOE in the first quarter of 2021. This increase was primarily attributable to an increase in stock-based compensation expense recorded during the first quarter associated with cash-settled stock awards, the values of which are remeasured for each reporting period based upon changes in the Company’s share price during the period. Matador’s share price increased by 94% from $12.06 at December 31, 2020 to $23.45 at March 31, 2021. In March 2021, Matador also restored the COVID-related Company-wide compensation reductions implemented beginning in the first quarter of 2020.

In addition to the specific reasons noted above, Matador’s operating expenses on a unit-of-production basis were also impacted during the first quarter of 2021 by the 11% sequential decline in total oil equivalent production (which was better than anticipated) in the first quarter. Matador anticipates that each of these operating expenses on a unit-of-production basis will improve in the second quarter of 2021 as the Company’s total oil equivalent production is expected to increase by 19 to 22% sequentially as noted in the following section.

Full-Year 2021 Guidance Estimates

At April 28, 2021, Matador made no changes to its full-year 2021 guidance estimates for oil, natural gas or total oil equivalent production or capital expenditures from those originally provided on February 23, 2021.

Second Quarter 2021 Estimated Drilling and Completion Activity

As noted above, Matador expects to operate four drilling rigs in the Delaware Basin during the second quarter of 2021, with two of these rigs operating in the Stateline asset area and the other two rigs operating primarily in the Greater Stebbins Area. Matador expects to complete and turn to sales 15 gross (14.7 net) operated wells in the second quarter of 2021, including the first 13 Voni wells in the Stateline asset area and two wells, both Second Bone Spring completions, in the Wolf asset area.

Second Quarter 2021 Estimated Oil, Natural Gas and Oil Equivalent Production

The table below provides Matador’s estimates for anticipated quarterly sequential changes in the Company’s average daily total oil equivalent, oil and natural gas production for the second quarter of 2021 as of April 28, 2021.

|

|

Estimated Sequential Change from Q1 2021 |

|||||

|

Period |

Average Daily Total |

Average Daily Oil |

Average Daily Natural |

|||

|

Q2 2021 |

+19% to +22% |

+21% to +24% |

+16% to +19% |

|||

San Mateo Highlights and Update

San Mateo’s operations in the first quarter of 2021 were highlighted by sequentially lower but better-than-expected volumes and financial results. As anticipated, sequential natural gas gathering and processing, water handling and oil gathering and transportation volumes all declined in the first quarter of 2021, primarily as a result of the sequential declines noted above in Matador’s oil, natural gas and water production, but also due to production impacts suffered by San Mateo’s other customers resulting from Winter Storm Uri. In addition, first quarter 2021 volumes do not include the full quantity of volumes that would have otherwise been delivered by San Mateo customers subject to minimum volume commitments, but for which San Mateo recognized revenues during the first quarter of 2021. San Mateo anticipates that natural gas gathering and processing, water handling and oil gathering and transportation volumes should all increase significantly in the second quarter of 2021 as the first 13 Voni wells are turned to sales in the Stateline asset area, along with two new wells in the Wolf asset area.

Operating Highlights

During the first quarter of 2021, San Mateo:

- Handled an average of 233,000 barrels of produced water per day, an 11% sequential decrease, as compared to 260,000 barrels per day in the fourth quarter of 2020, but an 8% year-over-year increase, as compared to 216,000 barrels per day in the first quarter of 2020.

- Gathered or transported an average of 35,000 barrels of oil per day, an 18% sequential decrease, as compared to 42,500 barrels of oil per day in the fourth quarter of 2020, but a 31% year-over-year increase, as compared to 26,800 barrels per day in the first quarter of 2020.

- Gathered an average of 191 million cubic feet of natural gas per day, a 12% sequential decrease, as compared to 216 million cubic feet per day in the fourth quarter of 2020, and a 5% year-over-year decrease, as compared to 201 million cubic feet per day in the first quarter of 2020.

- Processed an average of 158 million cubic feet of natural gas per day at its Black River Processing Plant, a 10% sequential decrease, as compared to 175 million cubic feet per day in the fourth quarter of 2020, and an 11% year-over-year decrease, as compared to 177 million cubic feet per day in the first quarter of 2020.

Financial Results

During the first quarter of 2021, San Mateo achieved better-than-anticipated financial results as described below, including:

- Net income (GAAP basis) of $18.1 million, a 31% sequential decrease from $26.2 million in the fourth quarter of 2020, and a 5% year-over-year decrease from $19.1 million in the first quarter of 2020. This quarterly result was above the Company’s expectations for the first quarter, primarily resulting from better-than-expected volumes from Matador and other customers attributable to San Mateo maintaining operations during Winter Storm Uri and lower-than-projected operating costs.

- Adjusted EBITDA (a non-GAAP financial measure) of $27.6 million, a 22% sequential decrease from $35.4 million in the fourth quarter of 2020, but a 5% year-over-year increase from $26.2 million in the first quarter of 2020. This quarterly result was above the Company’s expectations for the first quarter by about $6 million for the reasons noted above. San Mateo’s net income and Adjusted EBITDA are both expected to increase sequentially in the second quarter of 2021.

- Net cash provided by San Mateo operating activities (GAAP basis) of $41.2 million, leading to San Mateo adjusted free cash flow (a non-GAAP financial measure) of $17.0 million. San Mateo expects to continue generating adjusted free cash flow, assuming a maintenance level of capital expenditures in future periods.

- In April 2021, San Mateo repaid $19 million in total borrowings under its credit facility. Total borrowings outstanding under the San Mateo credit facility at April 28, 2021 were $315 million. The San Mateo credit facility is non-recourse with respect to Matador.

Capital Expenditures

Matador’s portion of San Mateo’s capital expenditures was approximately $5 million in the first quarter of 2021, about $2 million less than the Company’s estimate of $7 million for the quarter, primarily attributable to both cost savings on completed projects and the timing of various operations.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

-

Operator Reports 1Q'24 Results; Chop Frac Plans Again -

Permian News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

New Comapny : New Permian E&P Secures Funds From Large PE-Firm

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -