Quarterly / Earnings Reports | Second Quarter (2Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Hedging | Capital Markets | Private Equity Activity

MRD Brings Three HZ Well Online in Q2 Ahead of Range Merger

Memorial Resource Development Corp. reported its operating and financial results for the three months ended June 30, 2016.

Highlights from the quarter include:

- Increased average daily production 68% to 451 MMcfe/d for the second quarter 2016 compared to 268 MMcfe/d for the second quarter 2015

- Entered into an Agreement and Plan of Merger on May 15, 2016 with Range Resources Corporation and Medina Merger Sub, Inc., a wholly owned subsidiary of Range, pursuant to which Range will acquire MRD in exchange for shares of Range common stock

- Closed the divestiture of Memorial Production Partners GP LLC, the general partner of MEMP, to Memorial Production Partners LP on June 1, 2016

- MRD has no ownership interest in MEMP's outstanding common units, incentive distribution rights or general partner interest

Operational Update

During the second quarter 2016, MRD brought online 3 gross horizontal wells targeting the Lower Red interval. Year-to-date, MRD has completed drilling the vertical "pilot hole" portion of two expansion acreage wells and has spud its third expansion well. For reservoir evaluation purposes, MRD drilled these wells vertically through the full Lower Cotton Valley section, ran extensive open hole log suites and recovered sidewall cores for petrophysical analysis. These wells have been constructed such that they can readily be re-entered for the drilling of their horizontal lateral sections. MRD expects production results from these wells by the end of the year.

Financial Update

Total debt outstanding as of June 30, 2016 was approximately $1.1 billion, including $514.0 million of debt outstanding under MRD's revolving credit facility and $600.0 million of senior notes due 2022. As of June 30, 2016, MRD's liquidity consisted of $486.0 million of availability under its revolving credit facility. MRD's net debt to annualized second quarter 2016 Adjusted EBITDA ratio was 2.5 times at quarter-end 2016. MRD expects the available borrowings under its revolving credit facility to provide sufficient liquidity to finance anticipated working capital and capital expenditure requirements.

On June 1, 2016, MRD closed the previously announced divestiture of Memorial Production Partners GP LLC, the general partner of MEMP, to Memorial Production Partners LP. MEMP GP is the general partner of MEMP and held the general partner interest and 50% of the IDRs of MEMP. MRD has no ownership interest in MEMP's outstanding common units, IDRs or general partner interest. MRD is now fully separated from MEMP subject to a transition services agreement to manage certain post-closing separation expenses and transition services.

Hedging Update

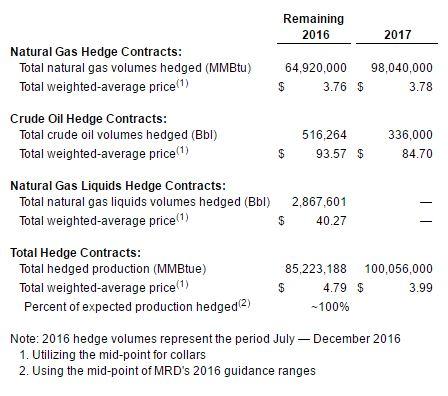

MRD utilizes its hedging program to mitigate financial risks and the effects of commodity price volatility. Total hedged production in the second quarter of 2016 was 34.0 Bcfe, or 82.9% of second quarter production of 41.0 Bcfe, which settled at an average hedge price of $4.88 per Mcfe. As of June 30, 2016, MRD has hedged approximately 100% of its expected remaining 2016 production (using MRD's updated 2016 guidance range announced on May 10, 2016). As of June 30, 2016, the mark-to-market value of MRD's hedge book was approximately $162.4 million.

The following table reflects MRD's hedged volumes and corresponding weighted-average price, as of July 28, 2016.

Proposed Merger with Range Resources Corporation

On May 15, 2016, MRD, Range and Merger Sub entered into the Merger Agreement pursuant to which Range will acquire MRD in exchange for shares of Range common stock. The Merger Agreement provides that, upon the terms and subject to the conditions set forth therein, Merger Sub will be merged with and into MRD, with MRD continuing as the surviving entity and a wholly owned subsidiary of Range. Under the terms of the Merger Agreement, each issued and outstanding share of MRD common stock will be converted into the right to receive 0.375 of a share of Range common stock. Following the approval by MRD shareholders and Range stockholders and certain closing conditions, the merger is expected to close during the third quarter 2016.

Second Quarter 2016 Results

Net production increased 68% year-over-year to 451 MMcfe/d for the second quarter 2016 compared to 268 MMcfe/d for the second quarter 2015. Second quarter 2016 net production consisted of 345 MMcf/d of natural gas (77%), 13.7 MBbls/d of natural gas liquids ("NGLs") (18%) and 3.9 MBbls/d of crude oil (5%).

Total revenues for the second quarter 2016 were $99.0 million compared to $78.6 million for the second quarter 2015. Total revenues were higher primarily due to increased production, which were partially offset by lower commodity prices. Production increased 16.6 Bcfe (approximately 68%) primarily due to drilling activities in North Louisiana. The average realized sales price decreased $0.82 per Mcfe (approximately 25%) due to lower commodity prices. The volume and pricing variance contributed to an approximate $53.7 million increase which was partially offset by a $33.3 million decrease in revenues. Total revenues do not include the impact of realized hedges.

Lease operating expense for the second quarter 2016 was $8.2 million, or $0.20 per Mcfe, compared to $3.9 million, or $0.16 per Mcfe, for the second quarter 2015. The increase in LOE on a per unit basis is largely attributable to increased workover expenses and saltwater disposal costs associated with the significant new completion activity during the first quarter 2016.

Gathering, processing and transportation expense for the second quarter 2016 was $36.8 million, or $0.90 per Mcfe, versus $18.1 million, or $0.74 per Mcfe, in the second quarter 2015. The per unit increase was largely due to other fees associated with securing long-term access to high-efficiency cryogenic facilities. MRD now has the option to adjust ethane recovery to continuously optimize its barrel composition maximizing the value of its NGL stream.

Taxes other than income were $3.0 million for the second quarter 2016, or $0.07 per Mcfe, compared to $3.1 million, or $0.13 per Mcfe, for the second quarter 2015. Second quarter 2016 taxes other than income decreased on a per unit basis compared to second quarter 2015 due to a higher percentage of production receiving tax exemptions related to horizontal drilling.

General and administrative ("G&A") expense for the second quarter 2016 was $24.0 million, or $0.59 per Mcfe, compared to $10.3 million, or $0.42 per Mcfe, for the second quarter 2015. Non-cash, stock-based compensation for the quarter was $10.5 million, or $0.26 per Mcfe. Notably, $7.3 million, or $0.18 per Mcfe, of MRD's total non-cash, stock-based compensation during the quarter was accelerated and associated with the closing of the divestiture of MEMP GP. Transaction related costs which included expenses associated with the divestiture of MEMP GP and the proposed merger with Range were $6.2 million, or $0.15 per Mcfe. Excluding non-cash, stock-based compensation and transaction related costs, G&A expense for the second quarter 2016 was $7.3 million, or $0.18 per Mcfe.

Incentive unit compensation expense of $74.3 million and $16.1 million for the second quarter 2016 and 2015, respectively, was recognized and offset by a deemed capital contribution from MRD Holdco LLC, a holding company that, together with a group, owns a majority of MRD's common stock.

Depreciation, depletion, and amortization expense for the second quarter 2016 was $65.6 million compared to $35.8 million for the second quarter 2015. The increase was primarily due to an increase in production volumes.

MRD recognized net losses on commodity derivative instruments of $90.6 million during the second quarter 2016, which consisted of $61.8 million of cash settlement receipts and offset by a $152.4 million decrease in the fair value of open hedge positions. Net losses on commodity derivative instruments of $30.5 million were recognized during the second quarter 2015, consisting of $37.5 million of cash settlement receipts and a $68.0 million decrease in the fair value of open hedge positions.

Net interest expense during the second quarter 2016 was $12.8 million, including amortization of deferred financing fees of approximately $0.8 million. This compares to net interest expense during the second quarter 2015 of $9.6 million, including amortization of deferred financing fees of approximately $0.7 million.

MRD recorded a net loss from continuing operations of $195.8 million during the second quarter 2016 compared to a net loss from continuing operations of $26.6 million during the previous year period.

MRD increased Adjusted EBITDA(1) 37% to $113.5 million for the second quarter 2016 compared to $82.8 million for the second quarter 2015.

MRD reported Adjusted Net Income(1) for the second quarter 2016 of $21.3 million compared to $17.3 million for the second quarter 2015.

D&C capital expenditures, excluding leasehold and including facilities and capital workovers, were approximately $70.7 million in the second quarter 2016 and compares to $156.5 million in the first quarter 2016.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Gulf Coast News >>>

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Top E&P Outline Drilling & Frac Program For 2025; 18 Rigs & 5 Frac Crews

-

Liberty Energy Reducing Frac Fleets As Market Activity Slows; Talks 2025 -

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market