Top Story | Bankruptcy / Restructure Update | Financial Trouble | Capital Markets

Niobrara-Focused Extraction Oil & Gas Files for Bankruptcy

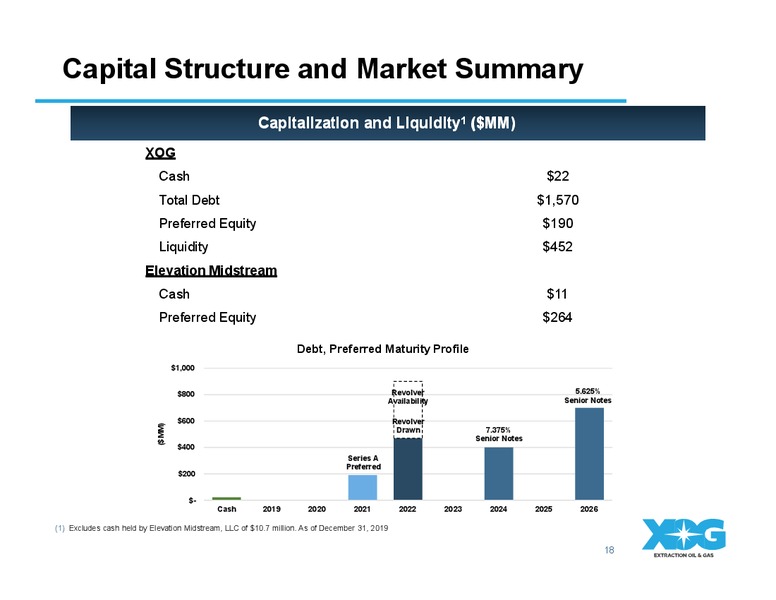

Extraction Oil & Gas after having missed its May 15, 2020 bond payment has decided to file chapter 11 bankruptcy. Ths company has ~$1.5 billion in debt and has been serverly distressed. The company had $221 million which was coming due in 2021. (see chart below)

- May 18, 2020: DJ Basin E&P Missed Interest Payment

- May 13, 2020: Extraction Borrowing base was cut, the company drew down the remaining cash on its credit facility and hired advisors.

Debt Maturity Schedule

Source : Extraction OIl & Gas Investor Presentation via Presentation Manager

This has come as no surprise as we saw the company adjusting retention compensation plans for executives last week. This has been seen as sign of an impending filing. Whiting who filed for bankruptcy earlier this year, deployed the same strategy before they themselves filed for bankruptcy.

Related Categories :

Bankruptcy - Filing

More Bankruptcy - Filing News

-

ION Geophysical Files for Bankruptcy

-

Basic Energy Services Files for Bankruptcy; Inks Stalking Horse Deals

-

HighPoint Files Chapter 11 Ahead of Merger with Bonanza Creek

-

SCOOP / STACK Operator Files for Bankruptcy

-

Superior Energy Services Files for Bankruptcy

Rockies News >>>

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -