Top Story | Deals - Acquisition, Mergers, Divestitures

Noble Energy to Acquire Rosetta Resources; Eagle Ford, Permian

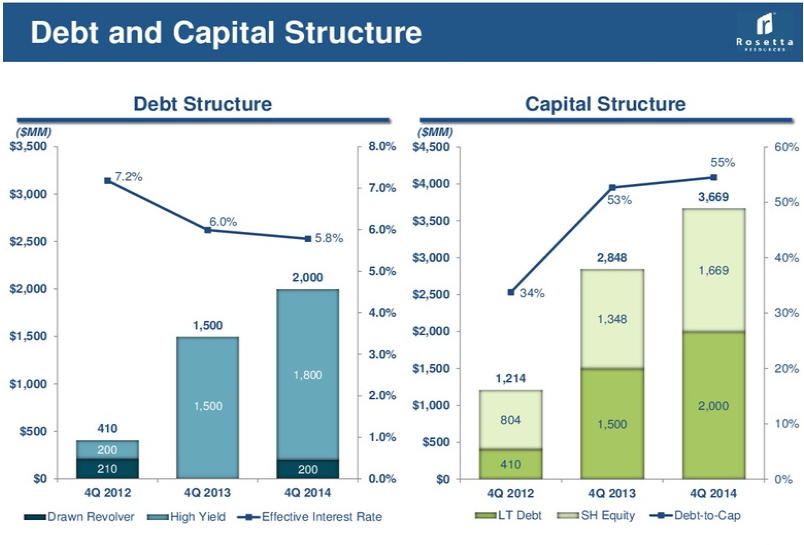

Noble Energy, Inc. and Rosetta Resources Inc. today announced a definitive acquisition agreement whereby Noble Energy will acquire all of the common stock of Rosetta in an all-stock transaction valued at $2.1 billion, plus the assumption of Rosetta's net debt of $1.8 billion as of March 31, 2015.

Source : Rosetta Resources via PetroleumResearch.org

Source : Rosetta Resources via PetroleumResearch.org Enlarge Image

Dave Stover, Noble Energy's Chairman, CEO, and President stated, "I am excited to announce this strategic transaction which adds two exceptional and material areas to our global portfolio. The Eagle Ford and the Permian are premier unconventional resource plays, two of the most economic in the U.S., which will expand our resource base and development inventory and further diversify our portfolio. The transaction will be immediately accretive to our per share production, reserves, earnings, and cash flow. Rosetta's team has a strong culture and track record of safe and efficient operations, and we look forward to adding their talents and capabilities to our company. The strengths of the combined assets and people will drive significant value creation for our existing and new shareholders."

Source : Rosetta Resources March 2015

Jim Craddock, Rosetta's Chairman, CEO and President, stated, "The combination with Noble Energy brings together two complementary companies with a deep and diverse portfolio of assets in key unconventional resource basins. The deal will accelerate value delivery from our strong asset base, and the all-stock nature of the transaction will allow our shareholders to continue to reap that value growth across commodity price cycles. I have long respected Noble Energy and its management team, which has a strong track record of delivering substantial value to shareholders, both from the U.S. onshore business as well as global offshore exploration and development. I am confident the combined team, strong balance sheet, and premier asset base is poised for further success and shareholder value creation."

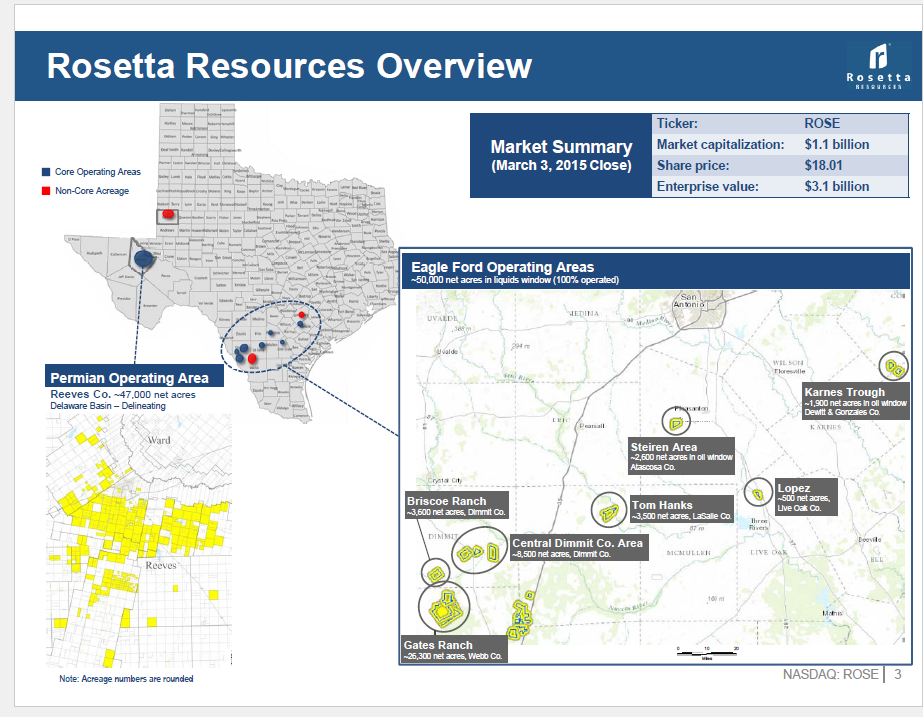

Rosetta's liquids-rich asset base includes approximately 50,000 net acres in the Eagle Ford Shale and 56,000 net acres in the Permian (46,000 acres in the Delaware Basin and 10,000 acres in the Midland Basin). Noble Energy has identified in excess of 1,800 gross horizontal drilling locations for development, providing net unrisked resource potential of approximately one billion barrels of oil equivalent.

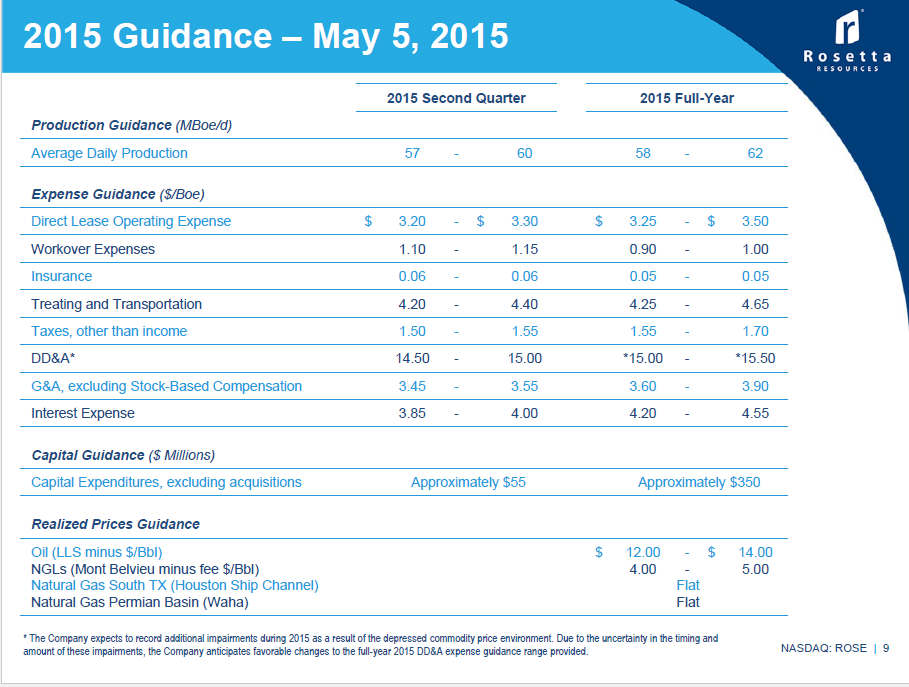

Rosetta's assets produced 66 thousand barrels of oil equivalent per day in the first quarter of 2015, and year-end 2014 proved reserves were 282 million barrels of oil equivalent. More than 60 percent of Rosetta's current production and proved reserves are liquids. Noble Energy anticipates a compounded annual production growth rate from these assets over the next several years of approximately 15 percent, generating positive free cash flow on an annual basis.

Under the definitive agreement, Rosetta shareholders will receive 0.542 of a share of Noble Energy common stock for each share of Rosetta common stock held. Based on the Noble Energy closing price on May 8, 2015, the transaction has an implied value to Rosetta shareholders of $26.62 per share, representing a 28 percent premium to the average price of Rosetta stock over the last 30 trading days. Following the transaction, shareholders of Rosetta are expected to own 9.6 percent of the outstanding shares of Noble Energy.

The boards of directors of both companies have unanimously approved the terms of the agreement, and Rosetta's board has recommended that its shareholders approve the transaction. Completion of the transaction is subject to the approval of the Rosetta shareholders and certain regulatory approvals and customary conditions. The transaction is expected to close in the third quarter of 2015.

Related Categories :

Gulf Coast - South Texas News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -