Deals - Acquisition, Mergers, Divestitures | Capital Markets | Private Equity Activity

Marathon Enters Northern Delaware With $1.1 Billion

Marathon announced two deals this morning, signalling its entrance into the Delaware Basin while ditching its entire Canadian oil sands portfolio.

$1.1 Billion Delaware Basin Acquisition

Marathon is acquiring the acreage from PE-backed BC Operating (Quantum / Post Oak are BC's sponsors). BC Operating is owned equally by Crump Energy Partners II, LLC and Crown Oil Partners V, LP. Crump is backed by Quantum Energy Partners and Crown is backed by Post Oak Energy Partners and Wells Fargo Energy Capital.

This entrance by Marathon into the Delaware is effectively an exit for the private equity firm owners of BC Operating, continuing the trend of private equity backed companies selling off assets in the Permian. While this is Quantum’s first exit from the Permian, it is a continuing trend of relinquishing Permian assets by Post Oak Energy Partners. In February 2017, Post Oak backed Double Eagle Energy Partners sold 71,000 acres in the Permian to Parsley Energy. More recently, on March 3, 2017, Post Oak backed CPX II Operating sold 4,600 acres in the Delaware to Resolute.

Previously, in November 2015, BC Operating formed a JV with Nadel and Gussman to develop the Delaware Basin.

Transaction Details

- $1.1 billion purchase price ($13,900 / acre)

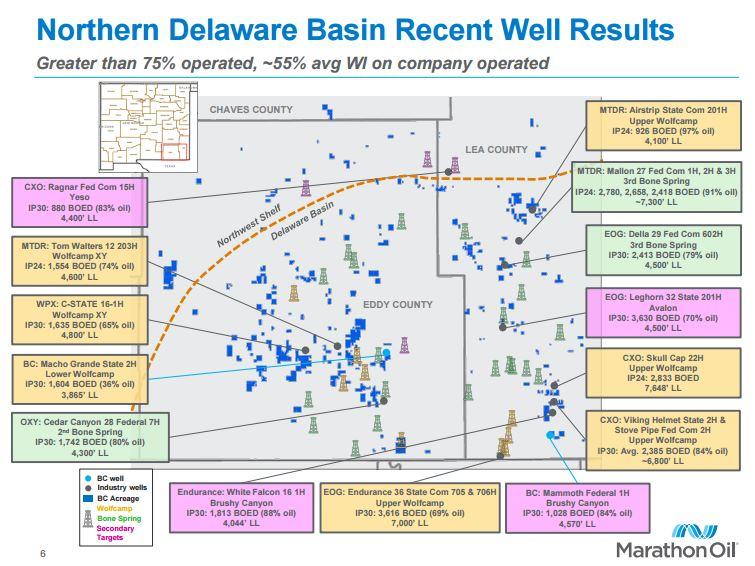

- Acquiring 70,000 net acres (Eddy, Lea, Chaves counties in NM)

- 5,000 BOEPD

- 900 MMBOE total resource potential

- Wolfcamp, Bone Spring targets

Canada Sale

Marathon is selling its assets to Shell and CNRL for $2.5 billion. This includes its stake in the Athabasca Oil Sands project.

Related Categories :

Canada News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Permian News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -