Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Hedging | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Activity | Capital Expenditure - 2021

Range Slowing D&C Ops 12% for 2021, Flat Capex / Output; Talks 2020 Results

Range Resources Corp. announced its fourth quarter 2020 financial results, proved reserves and plans for 2021.

2021 Capital Program

- Capex: $425 million - relatively flat vs. 2020 levels of $411MM

- D&C: $400 million

- Land & Other: $25 million

- Production: 2,150 Mmcfe/d (30% liquids) - relatively flat from Q4 2020 output

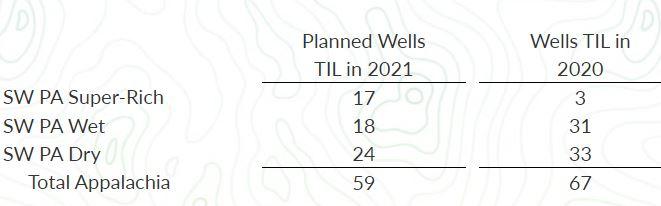

- Wells TIL: 59 wells - down 12% vs. 2020

- The Company expects average lateral length of approximately 12,000 feet. Approximately 65% of lateral feet turned to sales in 2021 is expected to be in Range's liquids rich acreage.

Hedging Status

Range hedges portions of its expected future production volumes to increase the predictability of cash flow and to help maintain a strong, flexible financial position. As of January 31st, Range had approximately 70% of its expected 2021 natural gas production hedged at an average ceiling price of $2.79 per Mmbtu and an average floor price of $2.60 per Mmbtu. Similarly, Range hedged approximately 50% of projected 2021 crude oil production at an average floor price of $46.84 per barrel and approximately 20% of its expected 2021 NGL revenue. Please see the detailed hedging schedule posted on the Range website under Investor Relations - Financial Information.

Range has also hedged Marcellus and other basis differentials for natural gas and NGL exports to limit volatility between benchmarks and regional prices. The combined fair value of the natural gas basis, NGL freight and spread hedges as of December 31, 2020 was a net gain of $5.6 million.

Q4 / Full Year 2020 Results

Highlights:

- All-in 2020 capital spending was $411 million, approximately $109 million less than original budget

- Fourth quarter cash unit costs improved by $0.07 per mcfe compared to prior year period

- Company record for lease operating expense of $0.08 per mcfe during the quarter

- Reduced debt in 2020 by $86 million compared to year-end 2019

- All-in 2021 capital budget of $425 million maintains production at ~2.15 Bcfe per day

- 2021 well costs expected to average $570 per lateral foot, or less, lowest in Appalachia

- PV-10 of year-end proved reserves of $8.6 billion, or $22 per share net of debt, assuming NYMEX prices of $2.75 per Mmbtu of natural gas and $50 per barrel of oil

- In January 2021, issued $600 million in 2029 notes extending the Company's debt maturities and enhancing liquidity to $2.0 billion

- Updated executive compensation framework to enhance alignment with shareholders and support the Company's focus on financial strength, environmental leadership, cost improvements, safety and generating sustainable returns for shareholders

Commenting on the results and 2021 plans, Jeff Ventura, the Company's CEO said, "During 2020, Range reduced debt while purchasing over eight million shares, refinanced near-term maturities, lowered well costs, improved our cost structure and delivered our operational plan safely and for less than budgeted. These results reflect the organization's continuing focus on capital discipline and further strengthening our financial position as we develop the most prolific natural gas and NGL play in North America. Our resilience is further demonstrated by the underlying efficiency of our 2021 capital program that can maintain production at 2.15 Bcfe per day for only $425 million of all-in capital. Further, our corporate sustainability report displays our industry-leading environmental and safety efforts and aggressive emissions targets. Looking forward, I believe Range's high-quality asset base, capital discipline, operational efficiencies and leading environmental efforts provide a sustainable business generating competitive free cash flow and returns for shareholders."

Capital Expenditures

Fourth quarter 2020 drilling and completions expenditures were $93 million and $15 million was invested in acreage and gathering facilities. Total 2020 capital expenditures were $411 million, including $377 million on drilling and completion, and a combined $34 million on acreage, gas gathering systems and other.

Financial Position

Range reduced outstanding debt by $86 million during 2020, marking the third consecutive year of debt reduction which totals $1.0 billion since the end of 2017. As of December 31, 2020, Range had total debt outstanding of $3.1 billion, consisting of $702 million in bank debt, $2.4 billion in senior notes and $37 million in senior subordinated notes.

During the year, Range repurchased in the open market and retired approximately $161 million in principal amount of its senior and subordinated notes at a weighted average discount to par of 25%. Range also repurchased 8.2 million shares of the Company's common stock during the year at an average price of $2.80 per share.

In January 2021, Range issued $600.0 million aggregate principal amount of 8.25% senior notes due 2029 and used net proceeds to repay borrowings under its bank credit facility. Proforma the offering, the Company has approximately $2.0 billion of borrowing capacity available under the commitment amount. Range has less than $0.3 billion in notes that mature through 2022, which are expected to be redeemed via free cash flow at strip pricing.

Fourth Quarter 2020 Results

GAAP revenues for fourth quarter 2020 totaled $599 million, GAAP net cash provided from operating activities (including changes in working capital) was $90 million, and GAAP net income was $38 million ($0.15 per diluted share). Fourth quarter earnings results include a $86 million mark-to-market derivative gain due to decreases in commodity prices.

Non-GAAP revenues for fourth quarter 2020 totaled $531 million, and cash flow from operations before changes in working capital, a non-GAAP measure, was $108 million. Adjusted net income comparable to analysts' estimates, a non-GAAP measure, was $4 million ($0.02 per diluted share) in fourth quarter 2020.

Range's fourth quarter production was approximately 2.1 Bcfe net per day, including the impact of curtailed production during fourth quarter in response to low prices and infrastructure maintenance. The deferred production has benefited from improving prices across all products into mid-December and early 2021. By area, southwest Marcellus production averaged 2.0 Bcfe per day while the northeast Marcellus assets averaged 83 net Mmcf per day during the quarter.

Fourth quarter 2020 natural gas, NGLs and oil price realizations (including the impact of cash-settled hedges and derivative settlements which correspond to analysts' estimates) averaged $2.41 per mcfe.

- The average natural gas price, including the impact of basis hedging, was $2.10 per mcf, or a ($0.57) per mcf differential to NYMEX. The fourth quarter natural gas differential was impacted by storage levels in multiple regions as well as a late start to winter weather. Starting in December and into 2021, basis in each region has normalized, improving the Company's first quarter 2021 natural gas differential to NYMEX within an expected range of ($0.20) to ($0.25) per mcf.

- Pre-hedge NGL realizations were $18.02 per barrel, an improvement of $1.75 per barrel versus the previous quarter driven by an improving market for propane and heavier products. NGL prices have improved further in early 2021, as the Mont Belvieu weighted equivalent is currently trading above $25 per barrel in the first quarter. In addition, Range continues to see strong NGL export premiums at Marcus Hook and expects to maintain an average 2021 pre-hedge premium differential of between $0.00 - $2.00 per barrel to Mont Belvieu equivalent, as a result of access to international markets and a diversified portfolio of sales agreements.

- Crude oil and condensate price realizations, before realized hedges, averaged $31.79 per barrel, or $10.91 below WTI (West Texas Intermediate). Range expects an improving condensate differential to WTI during 2021, between $7-$9 below NYMEX, as regional production continues to decline and demand for transportation fuels is expected to recover.

Transportation and Gathering

Since the end of 2018, Range has reduced transportation and gathering expenses per unit of production by $0.17 per mcfe, from $1.51 to $1.34 in the fourth quarter of 2020. The two-year improvement has been driven by full utilization of both gathering and firm transport infrastructure. In 2021, Range will have an additional 5,000 barrels per day of Mariner East capacity, which is expected to be fully utilized with existing production. Range continues to expect near-term and long-term benefits of NGL exports out of the Northeast as international demand for NGL products continues to grow. NGL export out of Marcus Hook provides a unique supply option for that demand. In 2021, Range expects to export over 80% of its propane and butane, the highest percentage of propane and butane exported by any U.S. independent, leading to strong year-over-year improvements in NGL pricing and margins. Higher realized NGL prices for Range in 2021 will lead to a slight increase in processing costs as Range's processing costs are based on the price received, providing a natural hedge against NGL price changes as the expense follows the direction of NGL prices.

Beyond 2021, Range anticipates transportation and gathering expenses to decline in absolute terms assuming continued maintenance of existing production levels. By 2025 Range expects annual gathering expense relative to 2021 to decline by approximately $70 million, and more than $100 million per year by 2030. Importantly, the cost improvements are a result of existing gathering arrangements and do not reflect targeted amounts. Further improvements are also expected beyond 2030 in a production maintenance scenario. Range also has multiple firm transportation agreements with renewal elections during this timeframe and Range will have the option of letting capacity expire depending on market conditions. Transportation renewals relative to 2021 represent an additional $175 million in potential cost improvements by 2030.

2020 Proved Reserves

Year-end 2020 proved reserves were 17.2 Tcfe, essentially unchanged year-over-year after adjusting for asset sales and price revisions. By volume, proved reserves were 65% natural gas, 33% natural gas liquids and 2% crude oil and condensate. Proved developed reserves represent 57% of the Company's reserves.

During 2020, Range added 1.3 Tcfe of proved reserves through the drill-bit, driven by the Marcellus shale development. Field level performance increased reserves by 312 Bcfe due to continued improvement in the well performance of existing Marcellus producing wells and 109 Bcfe of reserves associated with proved undeveloped locations which have re-entered the Company's five-year drilling program. Range removed 961 Bcfe of proved undeveloped reserves that now fall outside the SEC mandated five-year development window, but the Company expects these proved undeveloped reserves to be added back in future years. The Company sold approximately 828 Bcfe of reserves during the year, associated with the North Louisiana asset. As shown in the table below the present value (PV10) of reserves under SEC methodology was $3.1 billion at December 31, 2020. The valuation was impacted by lower first-of-month pricing required under SEC methodology. For comparison, the PV10 using NYMEX reference prices of $2.75 per Mmbtu for natural gas and $50 per barrel of oil would have been $8.6 billion, assuming the same proven reserve volumes.

Year-end 2020 reserves included 7.4 Tcfe of proved undeveloped reserves from 361 wells planned to be developed within the next five years with an expected development cost of $0.32 per Mcfe. Beyond the five-year reserve calculation window, Range has approximately 2,700 additional Marcellus locations available for development in Southwest Pennsylvania. Range also has a network of over 200 existing well pads designed to accommodate an average of 20 wells per pad from any combination of Marcellus, Utica or Upper Devonian horizons. On average, existing pads currently contain six producing wells, providing Range the opportunity to develop thousands of future wells while utilizing existing roads, pads and infrastructure. In 2021, over 60% of the wells planned to turn to sales are from pad sites with existing production, similar to recent years.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Northeast News >>>

-

Coterra Energy – 2025 Development Summary -

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs

Northeast - Appalachia News >>>

-

Top E&P Outline Drilling & Frac Program For 2025; 18 Rigs & 5 Frac Crews

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

-

Top Gas E&P To Keep 2025 Drilling & Completion Program Flat; Rigs & FRac Crews

-

This Large E&P Will Run 10 Rigs & 6 Frac Crews In 2025

-

Service Companies Talk Bleak Outlook for Remainder of 2024 -