In our Weekend edition of what's news.

From Shale Experts CEO Rons Dixon: A Word of Caution

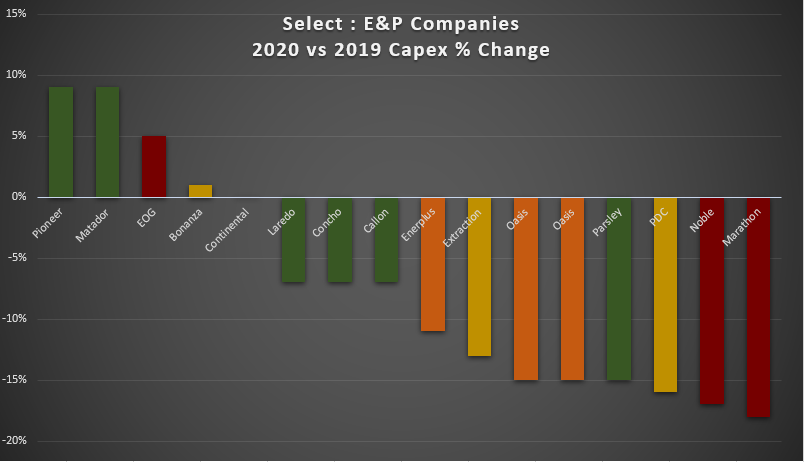

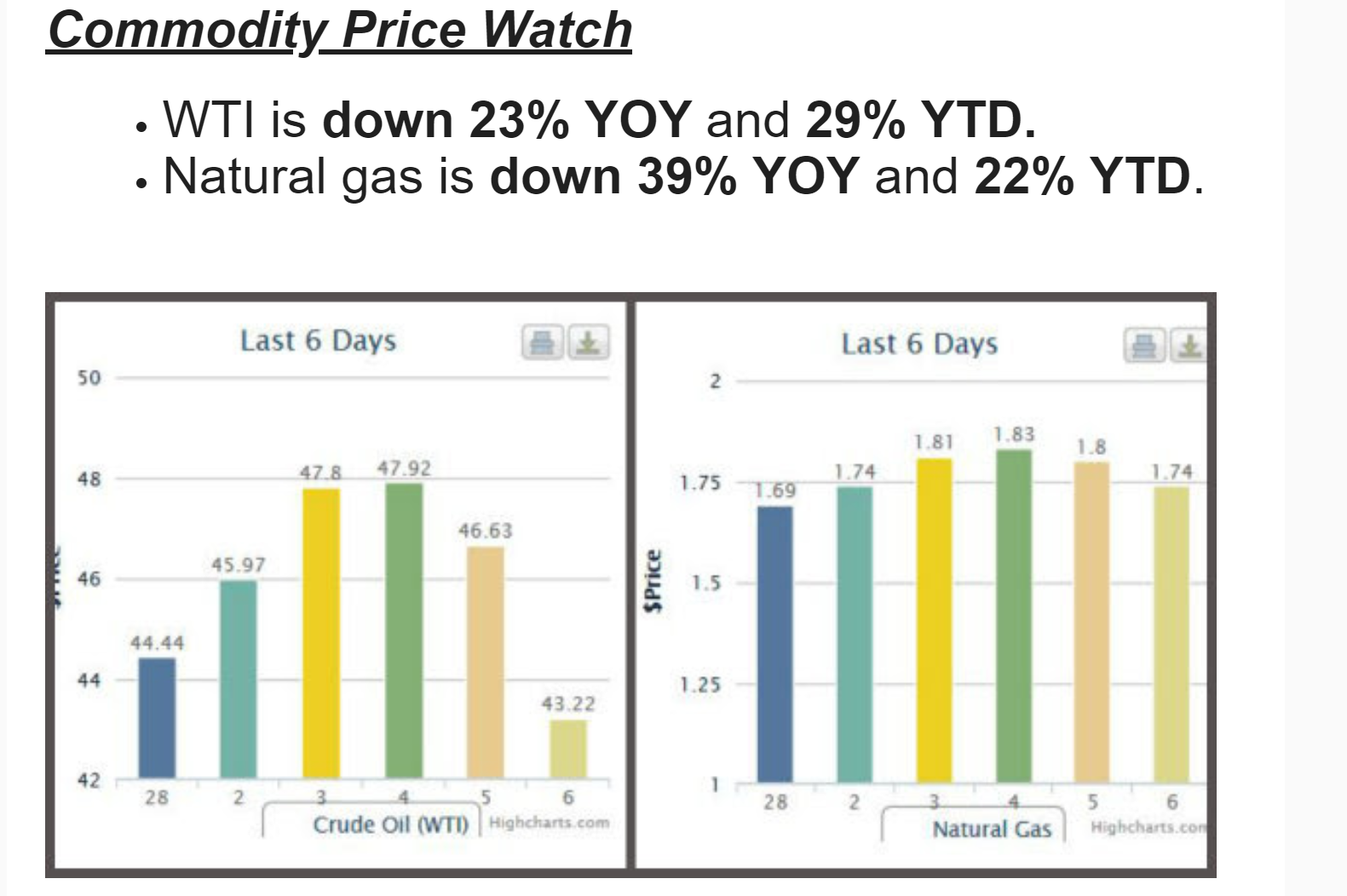

Since most budgets were originally set using $50 WTI and $2.25 Henry Hub, the fact that crude oil futures are now trading around $43/bbl WTI could pose a problem for E&Ps. If commodity prices follows the forward curve ($43/bbl WTI) then we could see further downward revision of D&C / E&D budgets which would cause spending to fall to the tune of ~25% in 2020 vs 13% currently forecasted. (currently trending down -13% according to data from 51 U.S. E&Ps).

Here is a chart from select U.S. E&Ps showing % change in Capex for 2020.

What This Means for Rigs, Frac Crews: This would translate into oil rig counts in the high 500s (10-15% reduction) and frac spreads at ~270ish.

Hedges May Not Be Enough: Even though operators have hedges in place, it is likely not enough to cover the existing drilling & completion programs for 2020. On average, we noticed most U.S. E&Ps were only 45% hedged. However, several companies including EOG, Continental, Centennial and several others have no oil hedges in place.

Prices as of 3/6/2020

New Startups.

New Houston Based Company Gets Startup Capital from Large PE Firm

San Antonio Midstream Firm Scores $500 Million Startup Capital

People on the move.

Extraction CEO Departs Company; Owen Takes Helm

Bonanza Creek Reports Resignation of Director

Capital Markets (at market close 3/6/2020)

Stock trading under $1.00 : Chesapeake (NYSE:CHK), HighPoint (NYSE:HPR), Extraction (NYSE:XOG, Denbury (NYSE:DNR), Chaparral (NYSE:CHAP), Laredo Petroleum (NYSE:LPI), Oasis Petroleum (NYSE:OAS), Rosehill Resources (NYSE:ROSE) , Lonestar Resources (NYSE:LONE)

Stocks Trading between $1 and $2 : Ring Energy (NYSE:REI), Southwestern Energy (NYSE:SWN), Callon (NYSE:CPE), Antero (NYSE:AR), QEP Resources (NYSE:QEP), Centennial Resource (NYSE:CDEV), Whiting (NYSE:WLL)

EP Energy plan to emerge from bankruptcy in the next few months. The company's $3.3 billion in debt was removed.

A&D Transactions

Deal Close : WPX closed on its acquisition of Felix Energy Holdings

PE-backed Crestone Peak Acquired ConocoPhillips DJ Basin Property for $380 million.

Assets for sale : Oklahoma E&P with assets in the STACK looking for buyer.

Completions/ Frac' Activity

As of March 7, 2020 there were 309 Active Frac fleets/Spreads.

Based on Data compiled from 41 U.S. E&Ps, 2020 completion/frac activity is only planned to be down 7% vs last year. The 41 companies plan to complete 5,770 wells in 2020 vs 6,176 they completed/frac'd in 2019.

The deflation in oilfield service prices is on full display when you look look and see that operators plan to spend (-13%) less capital in 2020.

Related Categories :

Weekly News

More Weekly News News

-

Oil & Gas News - Week Ending May 22, 2020

-

News - Week Ending - December 6, 2019 - Drilling, Frac Market, Job Cuts, Capital

-

Oil & Gas Quick Read: Highlights from Week Ending 9/27/2019

-

Oil & Gas Quick Read: Highlights from Week Ending 9/20/2019

-

Oil & Gas News and Activity, Week Ending 9/13/2019

Gulf Coast News >>>

-

Oilfield Services Talk What To Expect In Remainder of 2024 -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs

-

Operator Reports 1Q'24 Results; Chop Frac Plans Again -

Mid-Continent News >>>

-

Range Resources Talks 1Q Results; 2024 Wells Plan Unchanged

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023