Fourth Quarter (4Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | Drilling Program-Rig Count | Capital Expenditure - 2021

Whiting Details 2021 Plans; Fourth Quarter, Full Year 2020 Results

Whiting Petroleum Corp. announced fourth quarter and full year 2020 results.

2021 Plan

- Capex: $228-252 million - down 7% at the midpoint vs. 2020 levels

- Production: 82-88 MBOEPD - down 14% from full year 2020 output

- Oil Production: 48-52 MBOPD - down 18% from full year 2020

- Rig Count: 1 rig running

- Frac Crews: 1 crew

No well plans were disclosed.

Quarterly Results

Fourth Quarter and Full-Year 2020 Highlights

- Revenue was $212 million and $732 million for the quarter and year ending December 31, 2020, respectively

- Net loss was $1.2 million or $0.03 per diluted share for the quarter ending December 31, 2020

- Adjusted EBITDAX was $120 million and $382 million for the quarter and year ending December 31, 2020, respectively (see further discussion regarding the calculation of adjusted EBITDAX in "About Non-GAAP Financial Measures" below)

Lynn A. Peterson, President and CEO of WLL commented, "2020 was a demanding year for the Company and its staff, as it managed through bankruptcy and the significant impacts of the Covid-19 pandemic. As an organization, we had to change the way we operate, and the staff worked tirelessly through the year adapting to new work habits while facing the challenges that the pandemic caused in almost all aspects of life. For that I want to commend our employees for their efforts. The Company has made significant strides in driving down costs as evidenced by our previous operational release. We have attempted to right size the staff to the Company's current activity levels and these efforts can be evidenced by the $71 million in net cash provided by operating activities and nearly $90 million of free cash flow during the fourth quarter of 2020. We believe Whiting exited the year well positioned financially and operationally with an exciting opportunity ahead of us to redefine how we fit within the energy sector."

Q4 2020 Financials

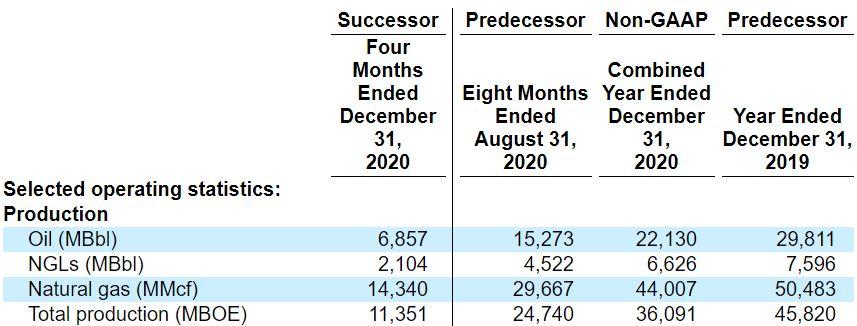

On September 1, 2020 (the "Emergence Date") the Company emerged from voluntary bankruptcy under Chapter 11 of the Bankruptcy Code. Beginning on the Emergence Date, the Company applied fresh start accounting, which resulted in a new basis of accounting, and became a new entity for financial reporting purposes. As a result of the application of fresh start accounting and the effects of the implementation of the Company's chapter 11 plan of reorganization, the consolidated financial statements after September 1, 2020 are not comparable with the consolidated financial statements on or prior to that date. References to "Successor" refer to the Whiting entity after emergence from bankruptcy on the Emergence Date. References to "Predecessor" refer to the Whiting entity prior to emergence from bankruptcy. References to "Successor Period" refer to the period from September 1, 2020 through December 31, 2020. References to "Current Predecessor YTD Period" refer to the period from January 1, 2020 through August 31, 2020.

Although GAAP requires that the Company report on results for the Successor Period and Current Predecessor YTD Period separately, our operating results are discussed below for the year ended December 31, 2020 by combining the results of the applicable Predecessor and Successor periods in order to provide the most meaningful comparison of our current results to prior periods.

Revenue for the fourth quarter of 2020 decreased $168 million to $212 million when comparing to the fourth quarter of 2019. A decrease in total production, which was primarily due to reduced development activity during 2020, accounted for approximately $114 million of the change in revenue. Lower commodity prices realized accounted for the remaining $54 million decrease in revenue between periods.

Net loss for the fourth quarter of 2020 was $1.2 million, or $0.03 per share, as compared to a net loss of $147 million, or $1.62 per share, for the fourth quarter of 2019. Adjusted net income for the fourth quarter of 2020 was $56 million or $1.46 per share. Adjusted net income and adjusted net income per share that exclude the effect of certain items are non-GAAP financial measures. Adjusted net income and adjusted net income per share represent net income (loss) and diluted net income (loss) per share, respectively, as determined under U.S. GAAP excluding the effects of non-cash gains and losses on derivative instruments, property impairments, gains and losses on asset sales and gains and losses on extinguishment of debt as applicable.

Adjusted EBITDAX for the fourth quarter of 2020 was $120 million compared to $241 million for the fourth quarter of 2019. Adjusted EBITDAX for the full-year of 2020 was $382 million compared to $979 million for the full-year of 2019. The Company's revenues and EBITDAX for 2020 were similarly affected by lower production volumes due to reduced development activity during the year in response to the prevailing commodity price environment. This depressed commodity price environment also directly affected the Company's results with lower prices received for its products. These effects were partially offset by reduced general and administrative expenses and DD&A primarily due to cost control measures implemented by the Company and its reorganization under bankruptcy. Select operating statistics are presented in the following tables:

Liquidity

As of December 31, 2020, the Company had a $750 million revolving credit facility with borrowings of $360 million and letters of credit of $2 million outstanding. The resulting total availability of $388 million along with $26 million in unrestricted cash resulted in total liquidity of $414 million. The Company has continued to pay down its revolver facility, with outstanding borrowings estimated to be $275 million as of February 28, 2021. Since emergence from bankruptcy on September 1, 2020, the Company is estimated to have reduced its outstanding borrowings on its revolver facility by approximately $150 million as of February 28, 2021. Whiting expects to continue to fund its operations fully within operating cash flow while reducing its debt through at least 2021.

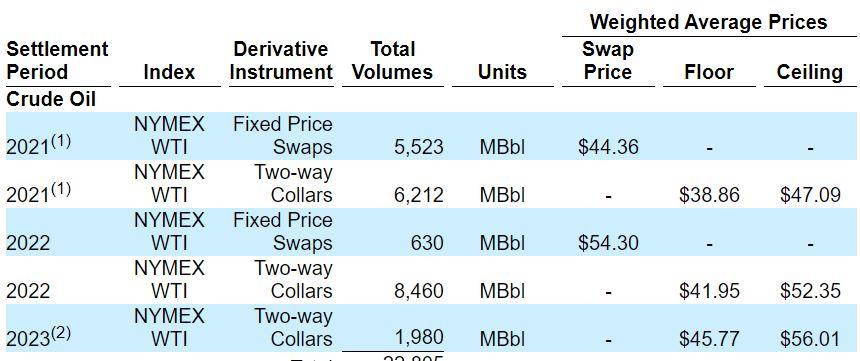

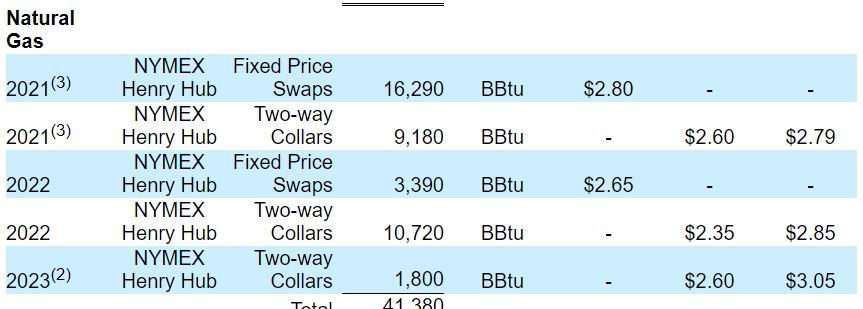

Commodity Price Hedging

Whiting currently has approximately 70% of its forecasted crude oil production and 75% of its natural gas production hedged for 2021. The Company uses commodity hedges in order to reduce the effects of commodity price volatility and to adhere to the requirements of its credit facility. The following table summarizes Whiting's hedging positions as of February 24, 2021:

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Rockies News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

-

Contrary to the Noise from Top Service Companies; Activity to Slow For Remainder 2024 -

Rockies - DJ Basin News >>>

-

Shale Experts Frac Maket Forecast 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans