Exploration & Production | Quarterly / Earnings Reports | First Quarter (1Q) Update | IP Rates-30-Day | Production Rates | Initial Production Rates | Capital Markets | Capital Expenditure | Drilling Program

Anderson Energy Completes First Long Reach Well

Anderson Energy Inc. has announced its operating and financial results for the first quarter ended March 31, 2015.

2014/2015 Winter Drilling Program

The Company has completed its 2014/2015 winter drilling program with 9 gross (8.1 net capital, 7.0 net revenue) new Cardium oil wells. The nine Cardium oil wells drilled have more than 30 days of initial production and an average IP 30 of 413 BOED (85% oil, condensate and NGL). Included in the most recent drilling program was the Company's first long-reach well which had an IP 30 of 651 BOED (92% oil, condensate and NGL). The best well in the nine-well program had an IP 30 of 707 BOED (71% oil, condensate and NGL).

Of the nine Cardium wells drilled in the 2014/2015 program, five are in the central land block, three are in the northern land block and one is in the southern land block of the greater Willesden Green area.

The IP 30 and product mix results from the Cardium wells in the 2014/2015 winter drilling program compares favourably with the 2013/2014 winter drilling program, which had an average IP 30 of 511 BOED (53% oil, condensate and NGL). A comparison of the oil, condensate and NGL components of the BOED production for the two drilling programs shows an average IP 30 of 349 barrels per day for the 2014/2015 program and 272 barrels per day for the 2013/2014 winter drilling program. Notwithstanding the market perception of the current oil price environment, oil, condensate and NGL remain more valuable than solution gas and a higher percentage of oil, condensate and NGL in the Company's product mix can be more important to overall revenue and profitability than overall BOED production rate.

The average IP 30 for the 19 Cardium wells completed with slick water fracture stimulation in the Willesden Green area on Company lands since June 2012 was 469 BOED (68% oil, condensate and NGL). The best single well IP 30 result from these wells was 1,119 BOED (67% oil, condensate and NGL). A recent industry publication indicated an industry average IP 30 of 322 BOED (60% oil, condensate and NGL) for the greater Willesden Green area since 2012.

Technology

By using selective positioning of the horizontal well trajectory, the Company is realizing higher IP 30 production rates than historical Willesden Green area industry averages. The Company has now adopted the use of dissolvable frac balls for toe fracs and has moved to less nitrogen usage in heel fracs. Other changes made this year include a redesigned stage tool to reduce mechanical wellbore failure.

2015 Capital Program

The Company estimates production will be 2,200 to 2,400 BOED (46% oil, condensate and NGL) in the first half of 2015, net of the impact of approximately 500 BOED of production sold on January 23, 2015. As the TCPL outages in the first quarter of 2015 were less than originally estimated, the production estimate for the first half of the year is now expected to be at the higher end of this range, assuming TCPL outages of approximately 370 BOED in the second quarter. Field capital spending is estimated to be $7 million for the first half of 2015, most of which occurred in the first quarter of the year. The Company has shut in or is proceeding to abandon 172 BOED of shallow gas production in the first half of the year. The capital budget will be revisited in the second half of the year and the Company will be in a better position to provide full year production and capital guidance at that time. The Company is currently marketing the remainder of it shallow gas assets for disposition in the second quarter of this year and that potential disposition is not reflected in the guidance. The greatest risk to the guidance is the extent and duration of current or future TCPL outages and potential oil supply disruptions related to continuing concerns regarding Cushing, Oklahoma and other US oil storage.

Highlights

- The average initial production rate over the first 30 days (IP 30) for the nine Cardium horizontal light oil wells drilled in the 2014/2015 winter program was 413 BOED per well (85% oil, condensate and NGL). The program includes the Company's first long-reach well which had an IP 30 of 651 BOED (92% oil, condensate and NGL). The best well in the program had an IP 30 of 707 BOED (71% oil, condensate and NGL).

- Production in the first quarter of 2015 was 2,704 BOED (46% oil, condensate and NGL), compared to 3,396 BOED (35% oil, condensate and NGL) for the fourth quarter of 2014. Production was affected by the sale of approximately 500 BOED of non-core, predominantly shallow gas production as part of a corporate reorganization completed on January 23, 2015. Production was also affected by the shut-in of approximately 320 BOED of Cardium production as a result of the TransCanada Pipelines Ltd. (TCPL) outages. Cardium production was 2,006 BOED (58% oil, condensate and NGL) in the first quarter of 2015. The Company is currently marketing the remainder of its shallow gas assets for disposition in the second quarter of 2015.

- Capital expenditures, before proceeds on dispositions, were $6.9 million, as budgeted. As of March 31, 2015 the Company had adjusted positive working capital of $2.8 million, with $14.9 million of cash in the bank. The Company is currently undrawn on its $31 million bank facility.

- In light of the changes in commodity prices, the Company has made significant changes to its administrative cost structure that are estimated to result in a 15% reduction in general and administrative costs in 2015 when compared to 2014. The Company has also implemented changes in the field, which are estimated to result in operating costs being reduced from the 2014 average of $12.43/BOE to an average of approximately $10.30/BOE in 2015. The Company is looking at opportunities to re-engineer its completions operations and is also working with its suppliers and service providers with the goal of reducing capital costs by 30%. These changes, combined with better commodity prices, could motivate the Company to commence drilling again in the second half of 2015.

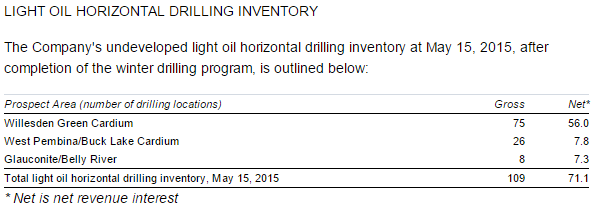

- 109 gross (71.1 net) light oil horizontal drilling locations have been identified in the Cardium, Glauconite, and Belly River zones (90% of net locations are in the Cardium zone). Only 31% of the net locations are recognized as P&P locations in the year end reserves report. Approximately 97% of the net locations are Company operated.

- On January 23, 2015, the Company completed a corporate reorganization pursuant to a plan of arrangement under the Business Corporations Act (Alberta) whereby substantially all of the oil and gas assets previously owned and operated by Anderson Energy Ltd. were transferred to the Company and all of the outstanding shares of Prior Anderson were sold to a third party together with approximately 500 BOED of non-core, predominantly shallow gas assets for aggregate consideration of $35 million, subject to certain adjustments. The Company has the same directors, management, employees and shareholders as Prior Anderson.

TCPL Outages

On December 15, 2014, TCPL issued a notice to all shippers upstream of James River, Alberta, including the Willesden Green area, regarding the restriction of natural gas volume receipts to certain limits. This notice now remains in effect until September 30, 2015.

As a result of the actions taken by TCPL, disruptions to pipeline transportation service in the affected areas (referred to as "outages") resulted in a restriction on the Company's production of certain properties within its Willesden Green Cardium area.

Although some of the impact of the TCPL outages during the first quarter of 2015 involved restrictions to a historical stream of production, much of the impact related to the estimated production from new wells drilled during the 2014/2015 winter drilling program that was deferred as a result of the outages. The impact of the TCPL outages for the first half of 2015 is currently estimated to be approximately 345 BOED including the estimated restriction of production from these new wells. The restrictions affect the production of oil, condensate and NGL as well as natural gas. These restrictions on production are expected to be temporary and affect production at varying rates and times through the second and third quarters of 2015, and will defer the affected production until future periods. However, due to the fluctuating nature of the outages and the changing forecasts provided by TCPL, it is difficult to estimate the extent of the impact of the outages on the Company's future results.

Cost Saving Measures

1) General and administrative (G&A) expenses: In 2014, the Company's gross G&A (cash) expenses were $8.3 million. Changes were made to the Company's G&A in the first quarter of 2015 which are estimated to reduce G&A (cash) expenses by approximately $1.3 million in 2015 to approximately $7 million. Most of the reductions will impact the last three quarters of 2015. These changes include the cancellation of bonuses for management, the reduction in bonuses for staff, the reduction in salaries and benefits for both management and staff and the renegotiation of contracts for other services. Approximately 15% of the Company's G&A (cash) expenses are capitalized and the balance is expensed. Overhead recoveries are estimated to be similar to the prior year. The Company had approximately $0.5 million in gross non-cash stock based compensation costs in 2014, which is estimated to remain essentially unchanged in 2015.

2) Operating expenses: With the reduction in commodity prices, the Company has been focusing on reducing field operating expenses. A significant portion of the Company's operating expenses are fixed and relates to legacy shallow gas assets. The Company has or is proceeding to shut in or abandon 74 gross (42.7 net) shallow gas wells and suspend 10 natural gas compressor stations. These wells were producing approximately 172 BOED. The Company has also improved its operating expenses by attracting and collecting third-party processing income. The Company's overall operating expenses in 2014 averaged $12.43 per BOE. The Company estimates that it can reduce operating expenses to $10.30 per BOE in 2015, which would be a 17% improvement relative to 2014.

3) Capital expenditures: During past commodity price down cycles, the industry capitalized on the opportunity to make significant reductions in per unit capital costs to improve the economic equation. Similarly, the Company is taking steps to reduce capital costs during the current commodity price down cycle. The Company's goal was to achieve average well payouts of approximately one year when oil prices were in the range of $90 to $100 US WTI per bbl. Today, the Company's payout goal has not changed, but the Company needs to reduce capital costs, reduce operating costs in the field, and admittedly receive better oil pricing than it receives today. Anderson is looking at opportunities to re-engineer its completions operations and is also working with suppliers and service providers for improved cost efficiency and operations, and believes a 30% reduction in capital costs may be achievable as a result of these initiatives. The Company historically has been a leader in low cost Cardium horizontal drilling and completions and is working towards achieving even lower costs.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

-

Operator Reports 1Q'24 Results; Chop Frac Plans Again -

-

Range Resources Talks 1Q Results; 2024 Wells Plan Unchanged -

Canada News >>>

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results