Well Cost | Production Rates | Capital Markets | Capital Expenditure | Drilling Program

BHP Talks Black Hawk Well Cost Improvement

Total petroleum production for the December 2015 half year decreased by five per cent to 124.7 MMboe.

- Liquids production decreased by three per cent to 60.5 MMboe as higher Onshore US liquids volumes were more than offset by lower Conventional liquids production due to industrial action at Bass Strait and natural field decline across the portfolio.

- Natural gas production declined by seven per cent to 386 bcf as lower Onshore US gas volumes were partially offset by higher seasonal demand at Bass Strait.

- Total petroleum production guidance for the 2016 financial year remains unchanged at 237 MMboe.

- Strong performance by our Conventional business is expected to offset lower Onshore US volumes following a further reduction in development activity, a third party gas plant outage in the Permian and the successful divestment of our gas business in Pakistan.

Depreciation and impairment charges, excluding exceptional items, declined in the December 2015 half year as a result of US$328 million of impairment charges incurred in the previous period. This was partially offset by US$210 million of higher depreciation and amortisation charges in Onshore US due to a reduction in total reserves, primarily at Fayetteville and Hawkville due to acreage relinquishments and amended development plans.

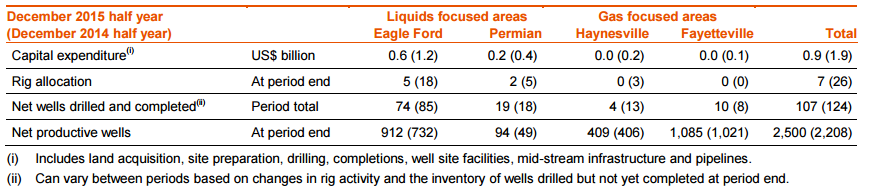

Depreciation and amortisation charges are expected to decline by approximately US$450 million in the second half of the 2016 financial year following an impairment charge of US$7.2 billion against the carrying value of the Onshore US assets in the December 2015 half year. Petroleum capital expenditure declined by 44 per cent to US$1.5 billion in the December 2015 half year.

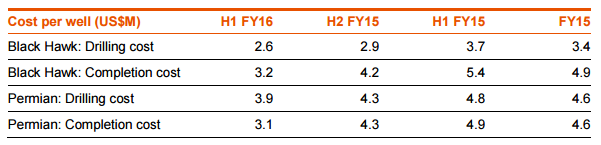

This included US$851 million of Onshore US drilling and development expenditure. We realised further improvements in shale drilling and completions efficiency during the period as our drill time and completion techniques showed marked improvement in the Black Hawk and Permian. We now expect to reduce Black Hawk drilling costs further to US$2.3 million per well in the 2016 financial year.

Petroleum capital expenditure of approximately US$2.7 billion is now planned in the 2016 financial year, a seven per cent decline from prior guidance of US$2.9 billion. This includes Conventional capital expenditure of US$1.4 billion, which remains focused on high-return infill drilling opportunities in the Gulf of Mexico and life extension projects at Bass Strait and North West Shelf, and Onshore US capital expenditure of US$1.3 billion, of which approximately US$200 million relates to a reduction in capital creditors.

Our Onshore US operated rig count has now reduced from seven to five as we defer development activity to preserve value. Completions activity will continue to be tailored to market conditions and we will exercise further flexibility should there be greater value in deferral. We have continued confidence in the quality of our Onshore US acreage, and our track record in operating performance and capital productivity is among the best in the industry. While we are focused on value and cash flow preservation as we manage through this period of lower prices, we retain the option to develop our resources as prices recover to maximise the value of these quality assets.

Petroleum exploration expenditure for the December 2015 half year was US$321 million, of which US$126 million was expensed. Activity for the period was largely focused in the deepwater Gulf of Mexico, the Caribbean and the Beagle sub-basin off the coast of Western Australia. We are pursuing high-quality oil plays in these three focus areas and continue to invest opportunistically in future growth options. Since August 2015, BHP Billiton has acquired 26 blocks in the Western Gulf of Mexico Lease Sale with a 100 per cent working interest. A US$600 million exploration program remains on plan for the 2016 financial year, largely focused on acreage access, seismic data acquisition and increased activity in our exploration drilling program.

Related Categories :

Gulf Coast - South Texas News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?