Exploration & Production | Capital Markets | Private Equity Activity

Cequence Begins Pad Drilling at its Montney Assets

Cequence Energy Ltd. has announced that it has completed the previously announced disposition of its entire interest in its non-operated assets located in the Ansell area.

Proceeds from the Transaction will be used to accelerate growth at the Company's Simonette property in the Deep Basin of Alberta.

- Cequence expects to maintain an active two rig drilling program through March 2015 and grow production from the current rate of 10,400 boe/d to exit the first quarter of 2015 at 15,000 boe/d.

- Capital expenditures for the nine month period beginning July 1, 2014 and ended March 31, 2015 are budgeted to be $160 million, prior to dispositions, and include 17 gross (16.3 net) wells and a facility expansion at Simonette.

- The budget includes 15 Montney wells, one Dunvegan well and one Falher well all at Simonette.

This program will effectively double the number of completed gas wells in the Simonette field drilled to date.

Paul Wanklyn, President and Chief Executive Officer said: "Our team is excited to begin a development program to capitalize on the efficiencies of multi-well pad drilling and established field infrastructure.

Production is expected to increase by 44 percent over the next nine months while maintaining an excellent balance sheet and an expected debt to cash flow ratio of less than 1X. Single well economics in the Montney are compelling, and offer an approximate 60 percent rate of return driven by condensate yields of 27 Bbls/MMcf and field operating costs of approximately $5.50 per boe. Using our budgeted 2014 Simonette field operating netback of $29 per boe and historical finding costs of $11.61 per BOE, this results in a recycle ratio of 2.5 X. The added synergy of uphole targets in the Falher and Dunvegan formations makes the Simonette project truly exceptional."

Pad Drilling

Pad drilling results in staged future production growth as multiple wells are drilled prior to completion; however, management believes this development strategy is now appropriate for the Company given it is expected to result in greater efficiencies and ultimately cost savings for this program.

Cequence has prepared the field for this development and has constructed 23 padsites tied-in to Cequence operated facilities with an additional 12 pad-sites approved for construction.

Cequence expects to continue to complete its Montney wells using open-hole slick water multi-stage fracturing. Average condensate yields in the field have increased over the past year to 27 Bbls/MMcf, a 29 percent increase to the current base case model assumption.

Cequence has commenced drilling on its first six well Montney pad at 1-32-61-26W5. Cequence expects to complete the first three wells from this pad in October 2014 followed by the remaining three wells in the first quarter of 2015. A second drilling rig has begun operations on a 65% working interest Dunvegan location at 13-11-61-2W6. This rig is then scheduled to drill a Falher well at Simonette before beginning operations on the multi-well Montney padsite at 12-26-61-27W5.

Cequence currently has production capacity of approximately 70 mmcf/d through its facility at 13-11. Incremental capacity can be added to accommodate production growth through the expansion of the existing plant. The capital expenditure budget includes the expansion of the 13-11 facility to 95 mmcfd at a cost of $10 million.

Guidance

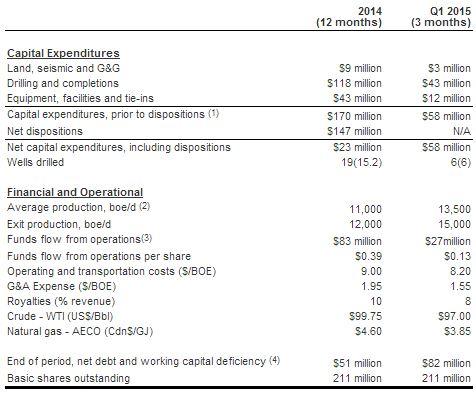

Cequence is pleased to provide the following updated guidance for 2014 and the first quarter of 2015:

The Company's lenders have completed a borrowing base review in connection with the Transaction and have revised the senior credit facility from $155 million to $135 million. On closing of the Transaction, Cequence estimates that it currently has net cash of approximately $10 million comprised of $70 million in positive net working capital and cash less $60 million of indebtedness under its senior subordinated five year notes. Based on budgeted capital expenditures for 2014, Cequence expects the senior credit facility to remain undrawn through December 2014.

Cequence will remain disciplined in its approach to capital spending and intends to manage its balance sheet accordingly.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)