Exploration & Production | Well Cost | Top Story | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Production Rates | Hedging | Capital Markets | Drilling Activity

Encana Touts Permian, Eagle Ford Well Cost Improvements

Encana has announced Q2 2015 Results.

Highlights:

- liquids production ~127,300 bbls/d, up 87% year-over-year

- over 80% capital invested in the company's four most strategic assets, the Permian, Eagle Ford, Duvernay and Montney

- 59 new wells brought on production in the Eagle Ford and Permian late in the second quarter, with another 76 planned in the third quarter

- reduced Eagle Ford drilling and completion costs by $1 million per well, or 18 percent, compared to the first quarter

- pace-setting Duvernay wells with production rates of up to 2,000 bbls/d of condensate and 11.5 million cubic feet per day (MMcf/d) of rich gas after 27 days on production

- significant expansion of liquids inventory in the Montney, with higher condensate yields in Dawson South and two recent Pipestone area wells each producing over 1,000 bbls/d

Operational Highlights

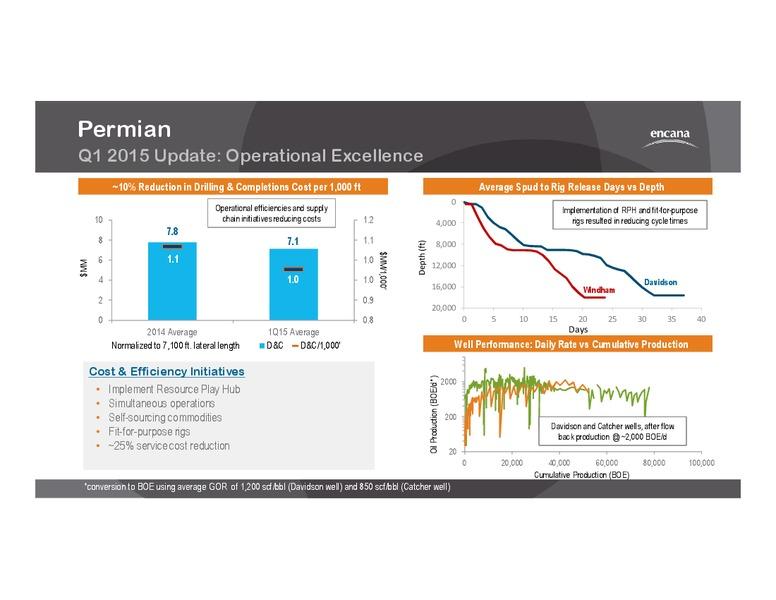

Permian

Building a long-term growth engine

- strong well performance with recent wells delivering early production rates of over 1,000 bbls/d of oil

- innovative casing designs for vertical and horizontal drilling programs are saving on average $350,000 per well

- average horizontal well cycle times reduced to 22 days from 26 days in the first quarter, with the best well at 15 days

- oil gathering agreement is expected to improve operating margins by up to $2 per barrel (bbl)

- drilled 23 net horizontal and 29 net vertical wells in the second quarter

- second quarter production of 35,800 BOE/d, comprising 29,500 bbls/d of liquids and 38 MMcf/d of natural gas

- significant growth expected in second half of the year as the company plans 16 horizontal wells to be brought on production in July and a further 70 wells through the remainder of 2015

- on track for average fourth quarter production of 50,000 BOE/d

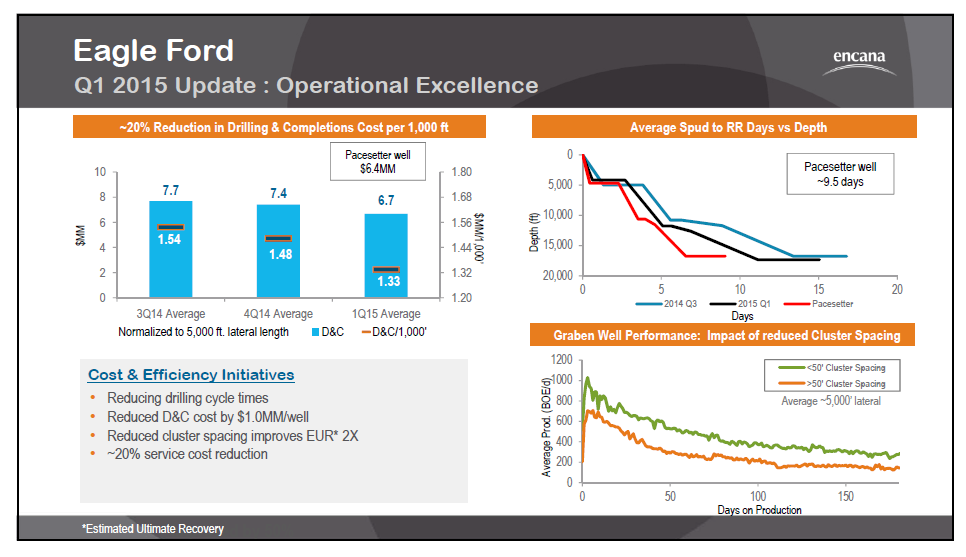

Eagle Ford

Growing inventory after successful first year

- potential to grow well inventory to over 600 drilling locations - up from the initial 400 since entering the play one year ago

- strong well results from the Graben area with a recent well on production at 1,300 bbls/d of oil and 675 thousand cubic feet per day (Mcf/d) of natural gas

- upgrades completed at Patton Trust South facility, increasing its capacity from 5,000 bbls/d to over 18,000 bbls/d

- drilling and completion costs lowered by $1 million per well, or 18 percent, compared to the first quarter of the year

- achieved spud-to-rig release cycle time of less than 10 days during the second quarter

- base decline reduced 50 percent year -to-date

- drilled 14 net wells in the second quarter

- second quarter production of 45,800 BOE/d, comprising 39,800 bbls/d of liquids and 36 MMcf/d of natural gas

- significant growth expected in second half of the year as the company plans 17 wells to be brought on production in July and a further 21 wells through the remainder of 2015

- on track for average fourth quarter production of 57,000 BOE/d

Duvernay

Improving well performance, driving down costs

- pace-setting wells with production rates up to 2,000 bbls/d of condensate and 11.5 MMcf/d of rich gas after 27 days on production

- industry-leading drilling and completions costs of approximately $10.4 million per well achieved on latest multi-well pad

- continued efficiency gains from dual-frac spread operations, averaging nine fracs per day

- savings of over $1 million per well in water handling costs due to the start-up of water infrastructure

- drilled one net well in the second quarter

- second quarter production of 5,800 BOE/d, comprising 3,000 bbls/d of liquids and 17 MMcf/d of natural gas

- expect to bring two wells on production in July and a further 11 wells through the remainder of 2015

- on track for average fourth quarter production of 17,000 BOE/d

Montney

Unlocking significant condensate potential

- well results in the South Dawson area of Cutbank Ridge confirmed the company's predicted higher condensate yields, increasing from five barrels per million cubic feet (bbls/MMcf) of natural gas to over 40 bbls/MMcf

- initial testing of the oil window in the Pipestone area showed strong potential with two recent wells each producing 1,000 bbls/d

- enhanced completion design delivering an average 33 percent production improvement

- liquids production increased by 1,000 bbls/d through optimization work at the 16-34 Pipestone plant

- realized $18 million in total cost savings at an average of $400,000 per well since the commissioning of the water resource hub near Dawson Creek, British Columbia in September 2014. The facility blends produced water with saline water and provides nearly 90 percent of the water needed for the company's operations in the area drilled six net wells in the second quarter

- second quarter production of 135,900 BOE/d, comprising 21,600 bbls/d of liquids and 685 MMcf/d of natural gas

- on track for average fourth quarter production of 146,000 BOE/d

Encana's risk management program - additional oil hedges secured during the second quarter

- At June 30, 2015, Encana has hedged approximately 1,000 MMcf/d of expected July to December 2015 natural gas production using NYMEX fixed price contracts at an average price of $4.29 per Mcf. In addition, Encana has hedged approximately 59.4 thousand barrels per day (Mbbls/d) of expected July to December 2015 oil production using WTI fixed price contracts at an average price of $61.96 per bbl and approximately 38 Mbbls/d of expected 2016 oil production at an average price of $62.83 per bbl.

Summary

- Second quarter liquids production increased more than five percent over the previous quarter, largely attributable to continued organic growth in the company's Eagle Ford and Permian positions. Second quarter natural gas production of approximately 1.6 billion cubic feet per day (Bcf/d) reflects a 16 percent decrease compared to the previous quarter, mainly due to divestitures, the company's seasonal production strategy for its Deep Panuke platform and takeaway restrictions in the Montney.

- Total company production averaged 389,000 (BOE/d) with Encana's four strategic assets contributing approximately 223,000 BOE/d or 57 percent. The company expects its Permian, Eagle Ford, Duvernay and Montney assets will contribute an average of approximately 270,000 BOE/d or 65 percent of total production during the fourth quarter of 2015.

- Consistent with its strategy to grow high-margin production, the company expects to focus its remaining 2015 capital budget on its four most strategic assets. Based on assumptions of $50 per barrel (bbl) WTI oil prices and NYMEX natural gas prices of $3 per million British thermal units (MMBtu), Encana expects to realize average operating margins of over $25 per BOE in the Permian, Eagle Ford and Duvernay, and $1.15 per thousand cubic feet equivalent (Mcfe) in the Montney.

- Encana remains on track to deliver its 2015 cash flow guidance of between $1.4 billion and $1.6 billion. The company generated second quarter cash flow of $181 million or $0.22 per share; an operating loss of $167 million or $0.20 per share; and a net loss of $1.6 billion or $1.91 per share primarily due to a $1.3 billion non-cash, after-tax ceiling test impairment. Year-to-date, Encana has generated $676 million in cash flow or $0.85 per share; an operating loss of $148 million or $0.19 per share; and net loss of approximately $3.3 billion or $4.15 per share, largely attributable to non-cash, after-tax ceiling test impairments of $2.6 billion.

- Encana is on track to fully fund its 2015 capital program and dividend with anticipated cash flow and the proceeds from previously announced and completed divestitures. In addition, the company continued streamlining its organization during the second quarter to align its structure with its transformed portfolio and disciplined capital program.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

Canada News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Gulf Coast - South Texas News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?