Deals - Acquisition, Mergers, Divestitures | Capital Markets | Private Equity Activity

Marathon Enters Northern Delaware With $1.1 Billion

Marathon announced two deals this morning, signalling its entrance into the Delaware Basin while ditching its entire Canadian oil sands portfolio.

$1.1 Billion Delaware Basin Acquisition

Marathon is acquiring the acreage from PE-backed BC Operating (Quantum / Post Oak are BC's sponsors). BC Operating is owned equally by Crump Energy Partners II, LLC and Crown Oil Partners V, LP. Crump is backed by Quantum Energy Partners and Crown is backed by Post Oak Energy Partners and Wells Fargo Energy Capital.

This entrance by Marathon into the Delaware is effectively an exit for the private equity firm owners of BC Operating, continuing the trend of private equity backed companies selling off assets in the Permian. While this is Quantum’s first exit from the Permian, it is a continuing trend of relinquishing Permian assets by Post Oak Energy Partners. In February 2017, Post Oak backed Double Eagle Energy Partners sold 71,000 acres in the Permian to Parsley Energy. More recently, on March 3, 2017, Post Oak backed CPX II Operating sold 4,600 acres in the Delaware to Resolute.

Previously, in November 2015, BC Operating formed a JV with Nadel and Gussman to develop the Delaware Basin.

Transaction Details

- $1.1 billion purchase price ($13,900 / acre)

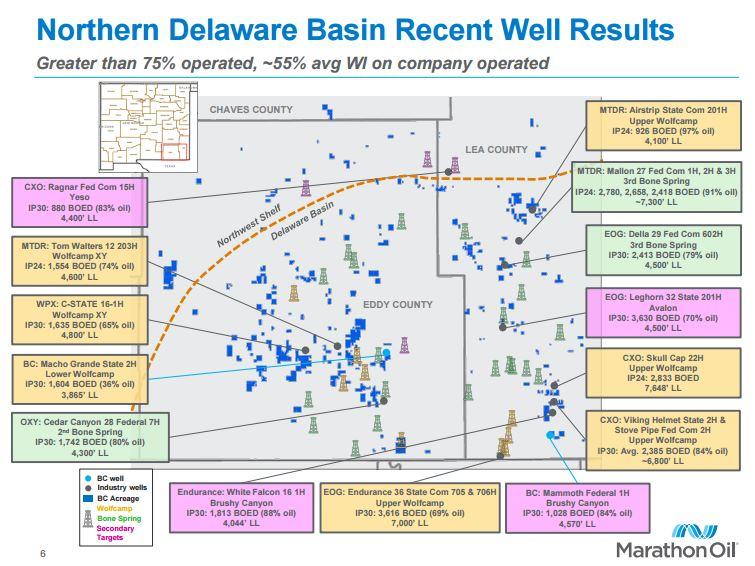

- Acquiring 70,000 net acres (Eddy, Lea, Chaves counties in NM)

- 5,000 BOEPD

- 900 MMBOE total resource potential

- Wolfcamp, Bone Spring targets

Canada Sale

Marathon is selling its assets to Shell and CNRL for $2.5 billion. This includes its stake in the Athabasca Oil Sands project.

Related Categories :

Canada News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?