Top Story | Production Rates | Well Results - Negative / Dry Hole | Project Suspended

Apache's Alpine High a Flop; Suspends Activity; Impairment Charge

After spending hundreds of millions of dollars to lease and drill wells on its western Reeves County acreage, aka Alpine High, it seems like Apache Corp. is finally coming to grips with the fact that the play/area is a flop.

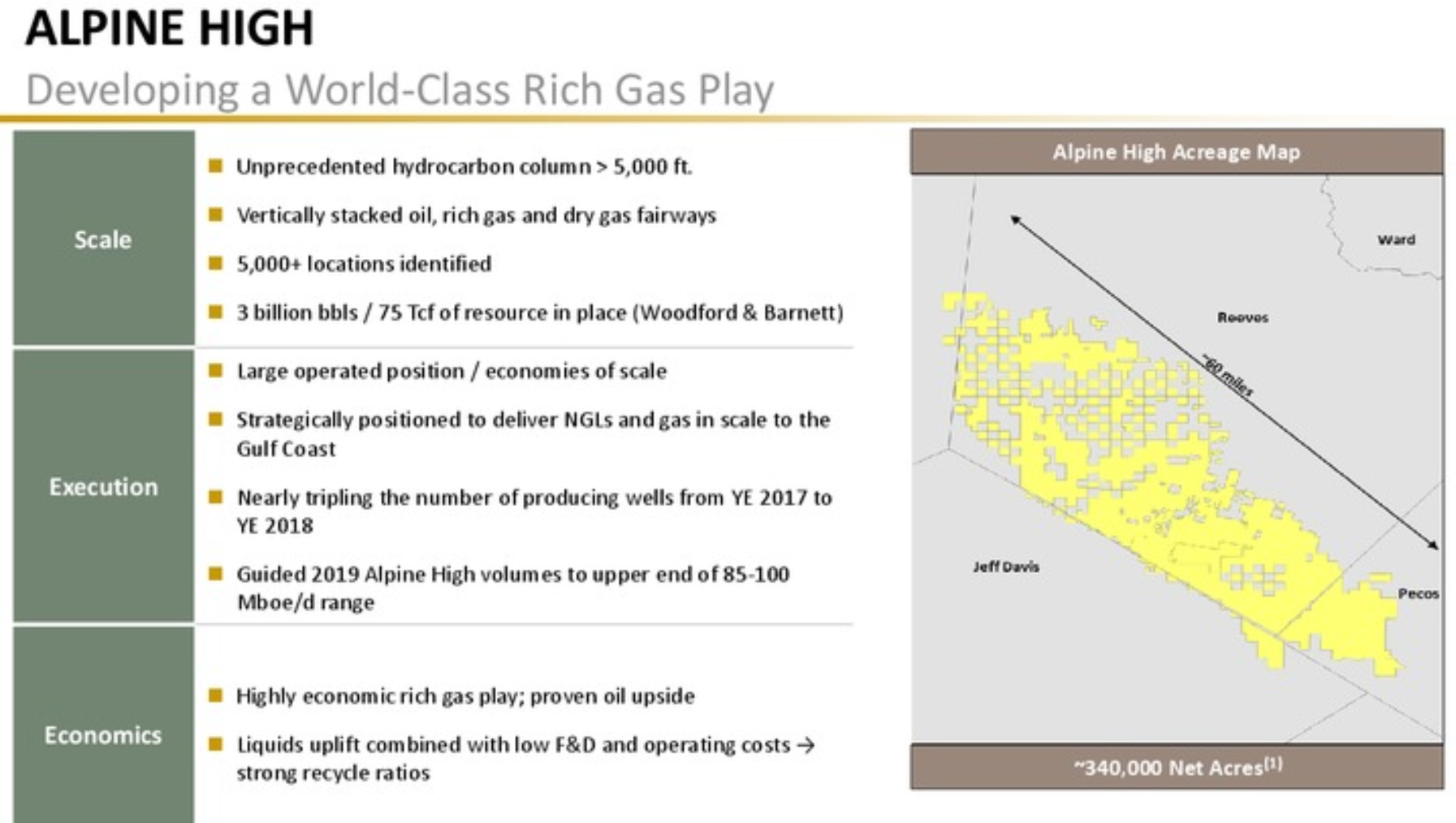

Before we dive into it, lets look back at how Apache described the play to much fanfare:

- World-Class Rich Gas Play

- 5,000 locations

- Unprecedented hydrocarbons column > 5000 ft

Here are a few key points from the most recent earnings call.

Well Results/ Spacing Flop

The company said: "At Alpine High, results were disappointing on a few fronts. In our second quarter 2019 earnings release, we spoke about the impact of the natural gas and NGL price collapse on the economic competitiveness of further investment in Alpine High. In the second half of 2019 extended flow data from key spacing and landing zone tests indicated disappointing performance of our multi-well development pads.

"While these tests are not fully conclusive for the entirety of Alpine High, given the prevailing price environment, further testing is not warranted at this time. As a result, we dropped the remainder of our drilling rigs in the fourth quarter and chose to defer some previously planned completions."

Impairment

"The most significant of these are noncash impairments of $1.4 billion related to Alpine High wells, facilities, leasehold and other upstream assets; and $1.3 billion for Altus Midstream, gathering, processing and transmission assets.

We also recorded a $528 million impairment of Alpine High unproved leasehold assets, which is included in exploration expense. Excluding these and other smaller items, adjusted earnings for the quarter were $31 million or $0.08 per share."

Firm Takeaway Commitment be Damned

"As you may recall, anticipating Alpine High volume growth, we contracted for around one Bcf per day of long-term natural gas transportation capacity out of the Permian Basin. Consistent with our decision to substantially curtail investment in Alpine High, we are taking steps now to reduce those commitments. To-date we have eliminated approximately 310 million cubic feet per day of take-or-pay obligations and we have more in progress."

Production Falls Off the Cliff / Wasted Capital

"In the first quarter, Alpine High volumes will be slightly below fourth quarter 2019 levels of 95,000 BOEs per day and we expect this to decline to around 50,000 to 60,000 BOEs per day by the end of the year. These numbers do not include the impact of potential production curtailments due to negative Waha hub pricing."

The Nail in the Coffin

CEO John Christmann commented: "I mean, what I'll say Mike, I'll go back and just take a few minutes here. But when Alpine High was announced in 2016, we had great hope for what it could mean for Apache. It had all the key ingredients of an impact play, large-scale, low-cost of entry and we had acquired the heart of the play. And in the end, a number of factors were problematic at Alpine High.

"First, as you just recognized gas NGL prices fell to less than half of the prices we anticipated for long-term economics. Second the lack of infrastructure prolonged the period to test full development. And this along with the sheer stratigraphic size and aerial extent increased the cost and time to do so. Third, the lack of cryogenic processing capacity did not allow us to test the NGL mix and yields until the middle of 2019, when we actually got the cryos on through Altus.

"Fourth, we anticipated a meaningful uplift in well productivity and a significant decrease in well cost as we move to pad and pattern development as is the case in almost all unconventional resource plays. We were able to drive cost down below our goals but the uplift in productivity did not materialize.

"So today it – we've got about 240,000 acres, there's about 200 of it that will kind of expire over the next three years and there's some optionality there. But if you look at the macro environment today, if we got back to an NGL market, where we were late 2018 then there's definitely some things that would be economic but how does it compete in our portfolio is another question. And so that's why we made the decision we made today."

Related Categories :

Project Suspended

More Project Suspended News

-

Dominion, Duke Energy Cancels Atlantic Coast Pipeline

-

Athabasca Cuts Capex 30%, Shuts In Hangingstone; Cuts Workforce by 15% -

-

Denbury Axes 2020 Capex by 44%; Defers CO2 Project -

-

Husky Suspends Ops at White Rose Field

-

Williams Co. Scraps Marcellus Gas Pipeline; Constitution Pipeline Project

Permian News >>>

-

Coterra Energy – 2025 Development Summary -

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

New E&P Company Just Raised $2.0 Billion, Hunting for Assets.

-

New Comapny : New Permian E&P Secures Funds From Large PE-Firm