After combing through the Q2 2019 annoucements from Appalachian focused E&Ps, below are some interesting trends.

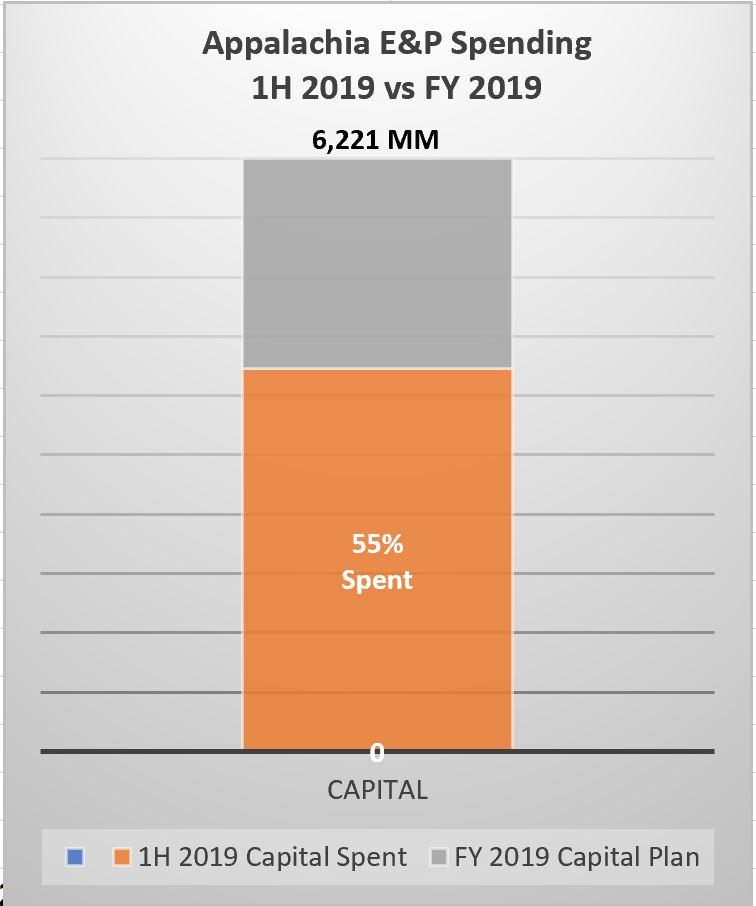

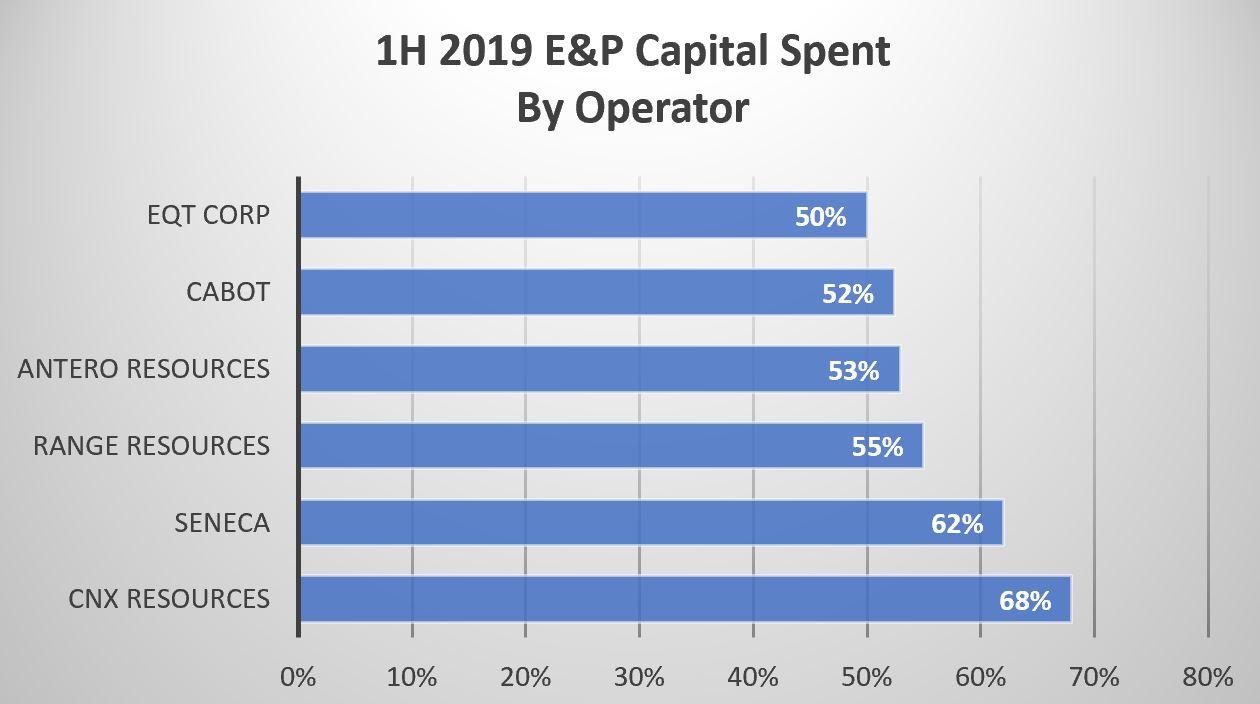

1. All E&Ps already spent more than 50% of their 2019 budgets so expect activity to slow in the later part of the year. This is similar to 2018.

2. The expected slow down is not evenly distributed. CNX Resources, who have spent close to 70% of its capex in the first half will mostly slow its completions and rig activity the most.

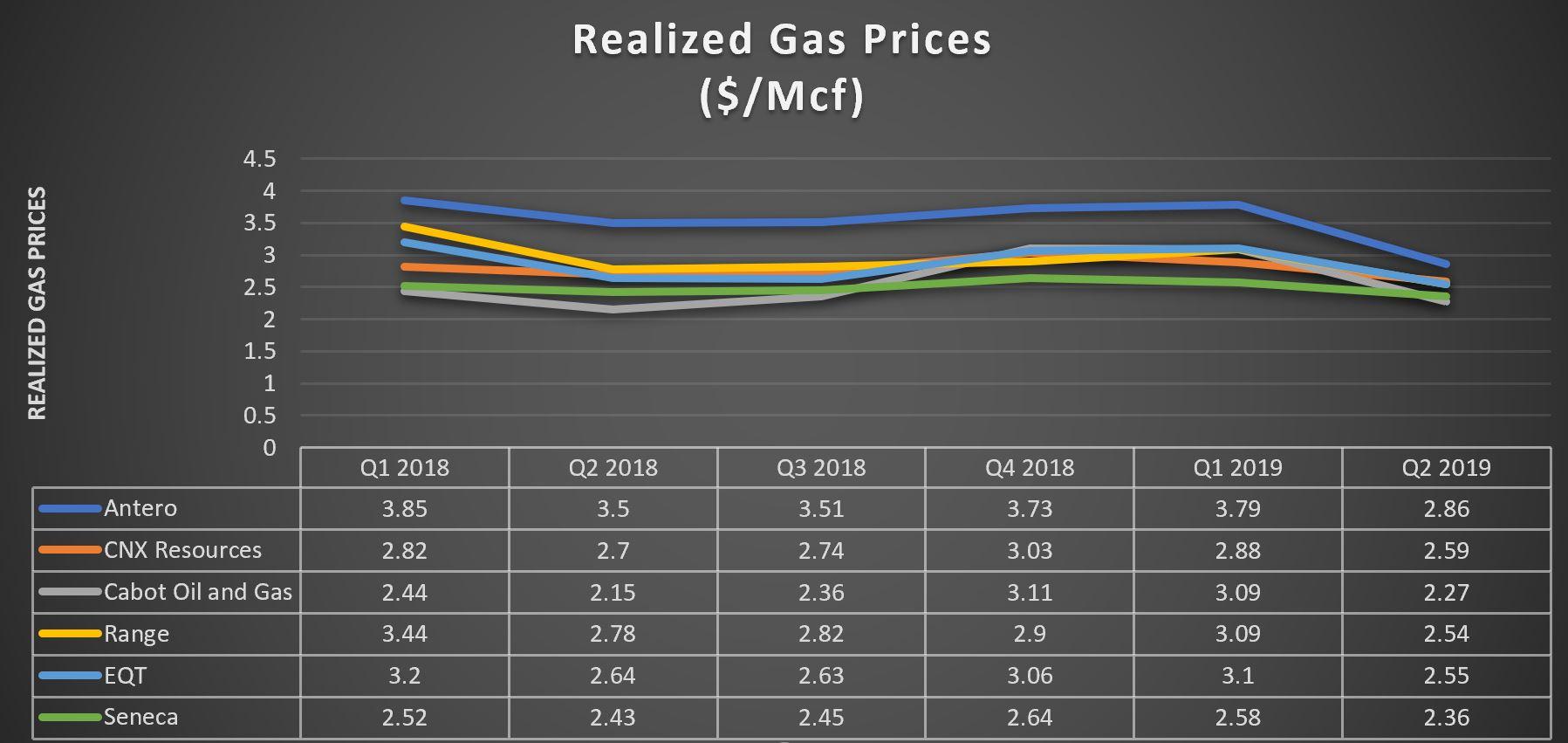

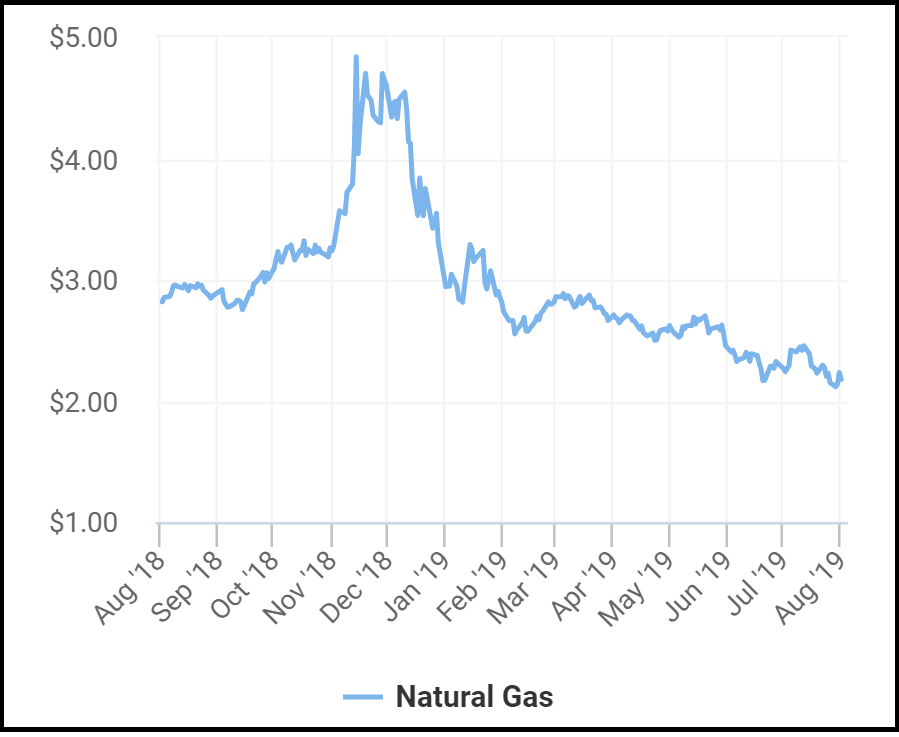

3. Low Natural gas price is to be blamed, realized (after hedge) gas prices has been some of the lowest this quarter,

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -