Service & Supply | Deals - On The Market | Oilfield Services | Frac Markets - Pressure Pumping

Basic Energy Exits Frac Market; Selling Pressure Pumping Equipment

Basic Energy Services has reported that it plans to exit the frac business.

The company said its plans to divest its pumping services assets in multiple transactions and expect proceeds of approximately $30-$45 million.

We are not surprised by the move Basic has made to exit the business. Last year, we noted that Basic's decision to exit the Permian market was a flawed one considering it accounts for 57% of the US Frac Market.

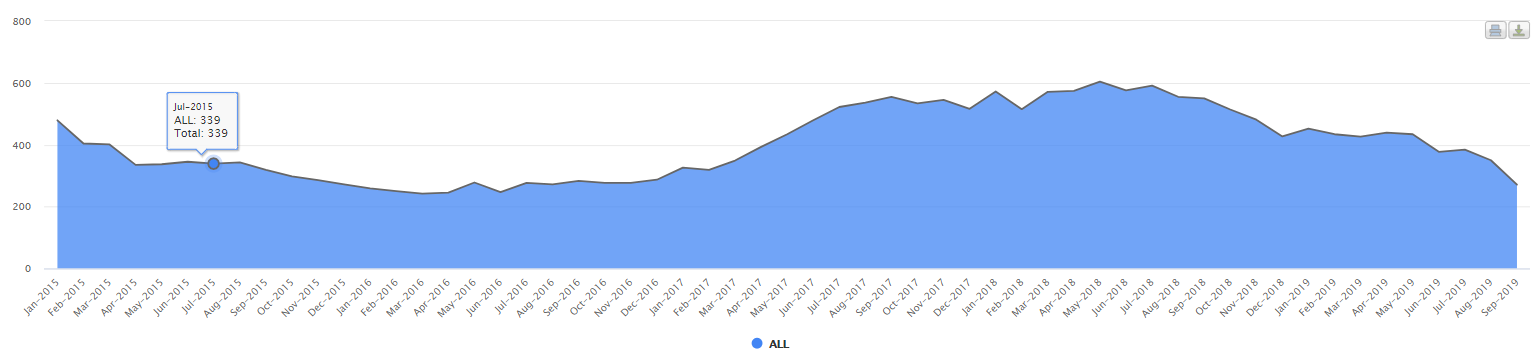

In the months since, Basic's remaining service areas (Mid-Con / Appalachia) have seen frac demand fall flat (see chart below). As of the end of the quarter, the company had 4 working frac crews. As of 2Q 2019, Basic had 460,000 Horse Power.

As for its new strategy, the company has been taking steps, shifting its focus to water logistics business.

Here is what the company said "Despite the recent repositioning and restructuring in the pumping business, activity and pricing remain difficult, inhibiting the potential for positive free cash flow in the near- to medium-term."

Roe Patterson, President and CEO, stated, “While the overall energy service market remains highly competitive, we continue to see high value potential in our Agua Libre Midstream subsidiary; this business continues to outperform in this very challenging market. With additional disposal barrels from 2019 growth capital expenditures, we expect the midstream business to contribute significantly to incremental margins in 2020.

“The decision to exit the pumping services market in no way reflects on the employees that make up our pumping services team. This team has aggressively cut costs and continued to win business in a highly competitive market. Unfortunately, these pumping business lines currently remain in a structurally-disadvantaged position, as they are our most capital-intensive businesses. These divestitures will also reduce our capital lease exposure and the Company’s total debt. The transaction will allow us to focus our efforts in the production-focused businesses in which we excel and generate higher returns on capital."

Shale Experts frac database reported that as of 12/6/2019, there are now 328 active frac fleets, down from 335 last week.

Related Categories :

Frac Markets - Pressure Pumping

More Frac Markets - Pressure Pumping News

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Service Companies Talk Bleak Outlook for Remainder of 2024 -

-

Shale Experts Frac Maket Forecast 2024 -

-

Frac Sand Providers Rush to Add Capacity as Demand Jumps -

-

Private Equity Ready to Add Frac Capacity in Sold Out Market -

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

Mid-Continent - Anadarko Basin News >>>

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -