Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets

Battalion Oil Corp. Second Quarter 2020 Results

Battalion Oil Corp. announced its second quarter 2020 results.

Q2 Highlights

- Decreased Adjusted G&A to $2.08/Boe in 1H 2020 vs $5.47/Boe in 1H 2019 (see Selected Operating Data table for additional information)

- Capital Expenditure of $43 million

- Production Equivalent 14.2 Mboe/d down -24% vs first quarter.

- Oil Production down -17% sequentially.

- 9000 bbls/d hedged at $39.85 in the 2Q

Second Quarter Results

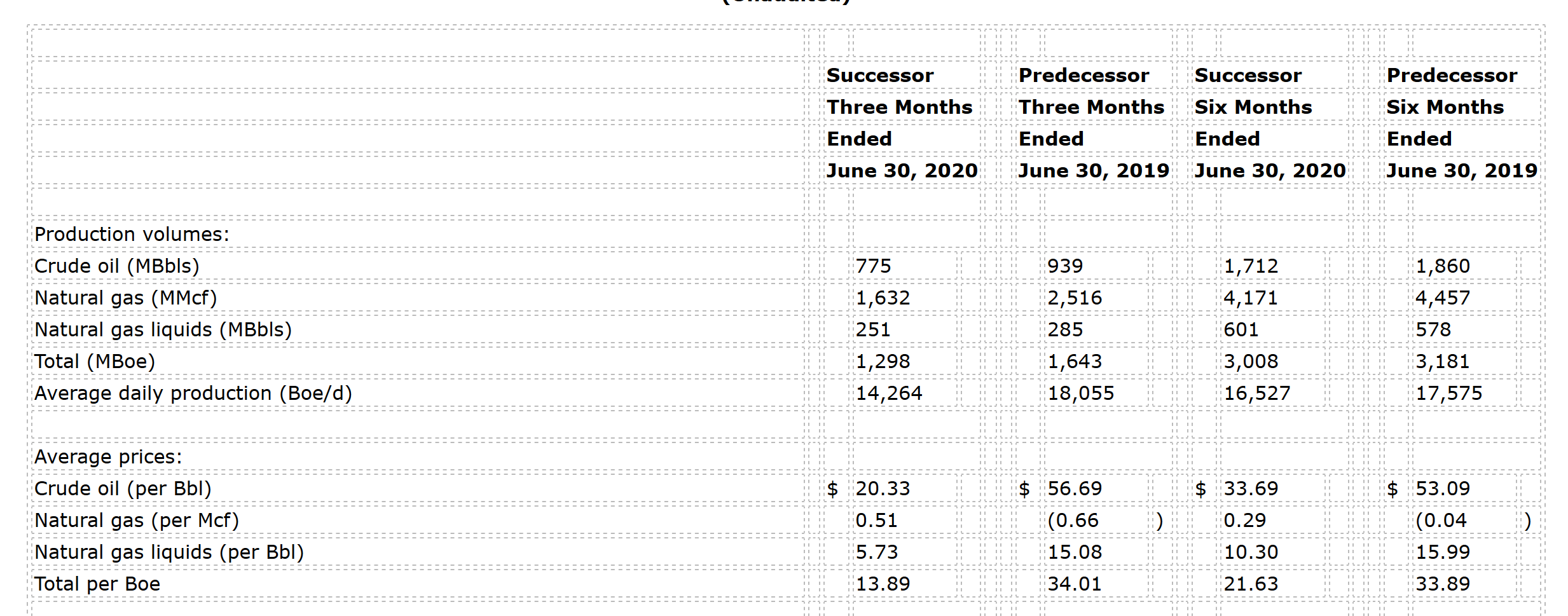

Average daily net production for the quarter ended June 30, 2020 was 14,264 Boe per day, of which oil represented 60%. Total revenue for the second quarter was $18.5 million, of which 85% related to crude oil. Realized gains on derivative settlements totaled $32.5 million for the second quarter.

Richard Little, the Company's CEO, commented, "The second quarter was particularly difficult because it forced us to put a hold on our plans for growth in 2020, which we had been making tremendous progress on up to that point. However, I am proud of our team's ability to work remotely and still keep our business on track to a brighter future. Current production is now back to or even above levels prior to shutting-in over 50% of our field, and we're now benefiting from our proactive workover and well optimization program during this downturn."

Adjusted G&A was $2.85 per Boe in the second quarter of 2020 compared to $4.99 per Boe in the second quarter of 2019 (see Selected Operating Data table for additional information). Lease operating and workover expense was $8.36 per Boe in the second quarter of 2020 and $9.03 per Boe in the second quarter of 2019.

The Company reported a net loss to common stockholders for the second quarter of $127.3 million including a full cost ceiling test impairment of $60.1 million. The Company reported a net loss per basic and diluted share of $7.86, and Adjusted LTM EBITDA of $98.2 million, compared to $56.4 million in the second quarter of 2019 (see Adjusted EBITDA Reconciliation table for additional information).

As of August 11, 2020, Battalion had 9,000 Bopd of oil hedged for the second half of 2020 at an average price of $39.85 per barrel. For 2021, the Company has 7,000 Bopd of oil hedged at an average price of $45.51 per barrel. For 2022, the Company has 4,000 Bopd of oil hedged at an average price of $52.38 per barrel. As of June 30, 2020, the mark-to-market value of derivative contracts was approximately $37.5 million.

Mr. Little commented further, "As we await a return to the drill bit next year, I'm pleased we have been able to optimize our base business, which will continue to serve as a foundation for generating free cash flow through these challenging times. We will benefit in the long term from allocating capital to price-agnostic projects in preparation for future activity as well as continue to pursue de-leveraging, responsible M&A opportunities."

Production

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

Saturn Oil & Gas Second Quarter 2022 Results

-

Empire Petroleum Second Quarter 2022 Results

-

ProFrac Holding Corp. Second Quarter 2022 Results

-

InPlay Oil Corp. Second Quarter 2022 Results

-

Vermilion Energy Inc. Second Quarter 2022 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian - Delaware Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?