Quarterly / Earnings Reports | Second Quarter (2Q) Update | Financial Results | Hedging | Capital Markets

Baytex Energy Second Quarter 2020 Results

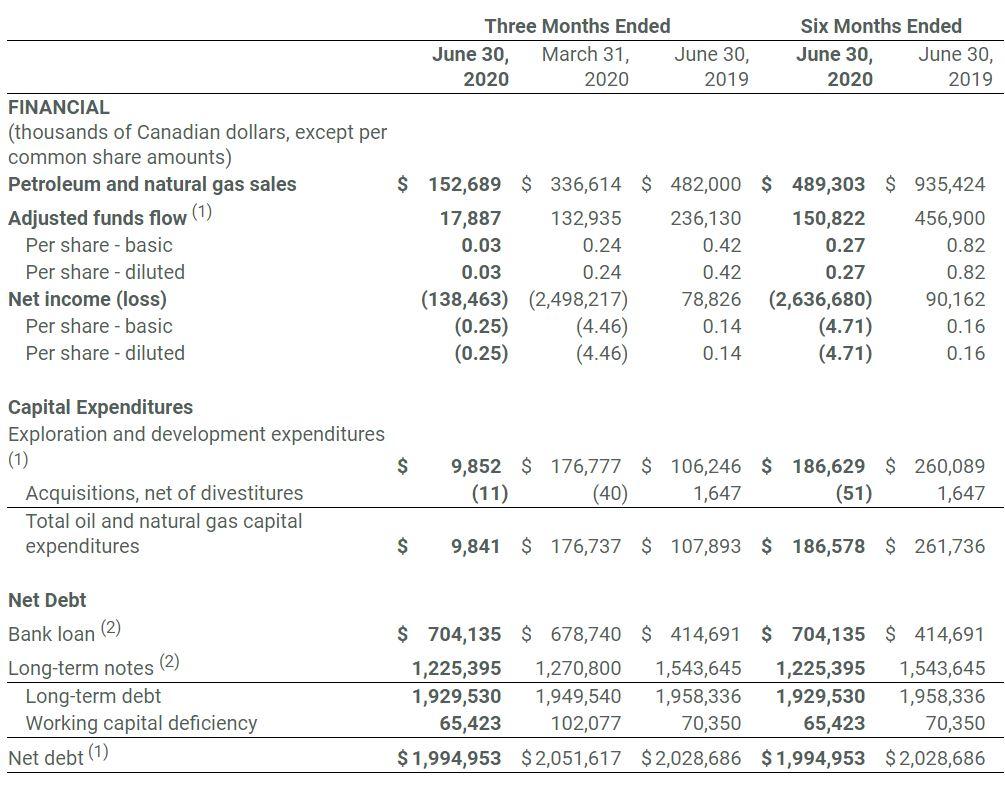

Baytex Energy Corp. reported its Q2 2020 results (all amounts are in Canadian dollars unless otherwise noted).

Ed LaFehr, President and Chief Executive Officer, said: “During the second quarter we took decisive steps to adjust our business model in the face of extremely volatile crude oil markets. We are now starting to benefit from the actions we have taken as we generated positive free cash flow during the quarter and maintained approximately $300 million of financial liquidity. We restarted approximately 80% of the previously announced shut-in volumes, which we expect will positively impact our adjusted funds flow for the remainder of the year."

Q2 2020 Highlights

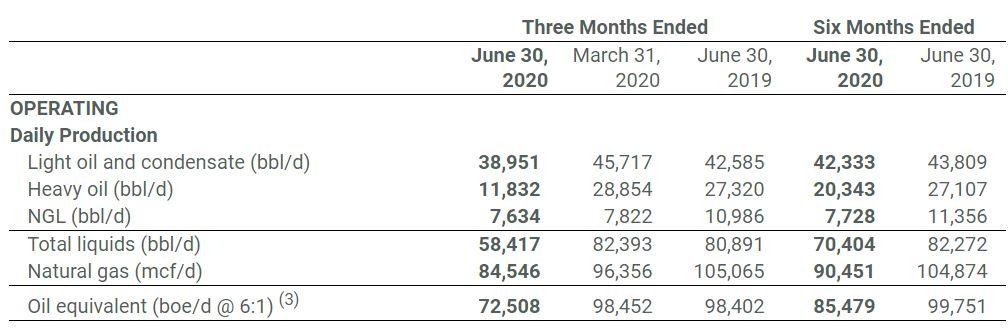

- Generated production of 72,508 boe/d (81% oil and NGL), consistent with our previously announced guidance range for the second quarter of 72,000 to 73,000 boe/d.

- Delivered adjusted funds flow of $18 million ($0.03 per basic share).

- Realized an operating netback (inclusive of realized financial derivatives gain) of $8.02/boe.

- Reduced net debt by $57 million as the Canadian dollar strengthened relative to the U.S. dollar and we generated positive free cash flow of $6 million.

- Maintained undrawn credit capacity of $363 million and liquidity, net of working capital, of approximately $300 million.

- Achieved a 15% reduction in our GHG emissions intensity in 2019 and remain committed to our 30% target by the end of 2021.

2020 Outlook

We continue to forecast annual capital spending of $260 to $290 million, an approximate 50% reduction from our original plan of $500 to $575 million. With this revised capital program, we suspended drilling operations in Canada and moderated the pace of activity in the Eagle Ford.

We previously announced voluntary production shut-ins of approximately 25,000 boe/d. These volumes remained off-line for April and May. As operating netbacks improved in June, we initiated plans to bring approximately 80% of these volumes back on-line. At current commodity prices, the resumption of production from these previously shut-in barrels is expected to have a positive impact on our adjusted funds flow and improve our financial liquidity. For the second half of 2020, we currently project about 5,000 boe/d of heavy oil production to remain shut-in.

On June 25, we revised our production guidance range for 2020 to 78,000 to 82,000 boe/d, from 70,000 to 74,000 boe/d previously, taking into account the production brought back on-line. Should operating netbacks change, we have the ability to shut-in additional volumes or restart wells in short order.

We remain intensely focused on driving further efficiencies to capture or sustain cost reductions identified during this downturn, while protecting the health and safety of our personnel.

Q2/2020 Results

During the second quarter we took decisive steps to adjust our business plan in the face of extremely volatile crude oil markets. In addition to voluntarily shutting-in production, we suspended drilling operations in Canada and moderated our pace of activity in the Eagle Ford. As a result, exploration and development spending totaled a modest $10 million during the second quarter.

Production during the second quarter averaged 72,508 boe/d (81% oil and NGL), as compared to 98,452 boe/d (83% oil and NGL) in Q1/2020. Production in Canada averaged 37,691 boe/d (83% oil and NGL), as compared to 62,262 boe/d in Q1/2020, while production in the Eagle Ford averaged 34,817 boe/d (77% oil and NGL), as compared to 36,190 boe/d in Q1/2020. Our second quarter production was reduced by approximately 20,000 boe/d due to the voluntary shut-ins.

We delivered adjusted funds flow of $18 million ($0.03 per basic share) in Q2/2020 and generated an operating netback of $5.96/boe ($8.02/boe inclusive of realized financial derivatives gain). The Eagle Ford generated an operating netback of $10.05/boe and our Canadian operations generated an operating netback of $2.19/boe.

We continue to emphasize cost reductions across all facets of our organization. We have identified approximately $98 million of cost reductions for 2020 (operating, transportation and general & administrative expenses). During the second quarter, our operating expense of $11.17/boe compared favorably to $11.66/boe in Q1/2020 as we strive to mitigate the costs associated with our field operations. In addition, we realized an approximate 35% reduction in our per boe transportation expense due to reduced volumes. General and administrative expense totaled $7.4 million ($1.13/boe) in Q2/2020, down from $9.8 million ($1.09/boe) in Q1/2020 as we implemented reductions to salaries and annual retainers and benefited from the Canadian Emergency Wage Subsidy.

Eagle Ford and Viking Light Oil

In the Eagle Ford, strong well performance continued across our acreage position. In Q2/2020, we commenced production from 17 (4.6 net) wells. These wells were brought on-stream in April and generated an average 30-day initial production rate of approximately 1,550 boe/d per well. We expect to bring approximately 16 to 18 net wells on production in the Eagle Ford in 2020, down from our original guidance of 22 net wells.

Production in the Viking averaged 19,717 boe/d (90% oil and NGL) during Q2/2020, as compared to 24,696 boe/d in Q1/2020. The quarterly impact of voluntary shut-ins in the Viking was approximately 2,000 boe/d. As operating netbacks improved in June, these volumes were brought back on-line. We suspended all drilling in the Viking, and as such, there was limited activity during the second quarter. In the first half of 2020, we invested $79 million on exploration and development in the Viking and commenced production from 83 (78.5 net) wells.

Heavy Oil

Our heavy oil assets at Peace River and Lloydminster produced a combined 13,082 boe/d (91% oil and NGL) during the second quarter, as compared to 31,211 boe/d in Q1/2020. The quarterly impact of voluntary shut-ins for heavy oil was approximately 17,000 boe/d. We suspended all heavy oil drilling, and as such, there was limited activity during the second quarter. In the first half of 2020, we invested $40 million on exploration and development and drilled 33 (33.0 net) wells. For the second half of 2020, we currently project about 5,000 boe/d of heavy oil production to remain shut-in.

Pembina Area Duvernay Light Oil

Production in the Pembina Duvernay averaged 717 boe/d (85% oil and NGL) during Q2/2020, as compared to 1,717 boe/d in Q1/2020. The quarterly impact of voluntary shut-ins for the Pembina Duvernay was approximately 1,000 boe/d. As operating netbacks improved in June, these volumes were brought back on-line.

In Q1/2020, we drilled two wells in the core of our Pembina acreage, bringing total wells drilled to nine in this area. Completion activities, originally scheduled for Q2/2020 have been deferred.

Financial Liquidity

Our credit facilities total approximately $1.1 billion and have a maturity date of April 2, 2024. These are not borrowing base facilities and do not require annual or semi-annual reviews. As of June 30, 2020, we had $363 million of undrawn capacity on our credit facilities, resulting in liquidity, net of working capital, of approximately $300 million. In addition, our first long-term note maturity of US$400 million is not until June 2024.

Our net debt, which includes our bank loan, long-term notes and working capital, totaled $2.0 billion at June 30, 2020. Based on the forward strip(1), we expect to maintain our financial liquidity and remain onside with our financial covenants through 2021.

Risk Management

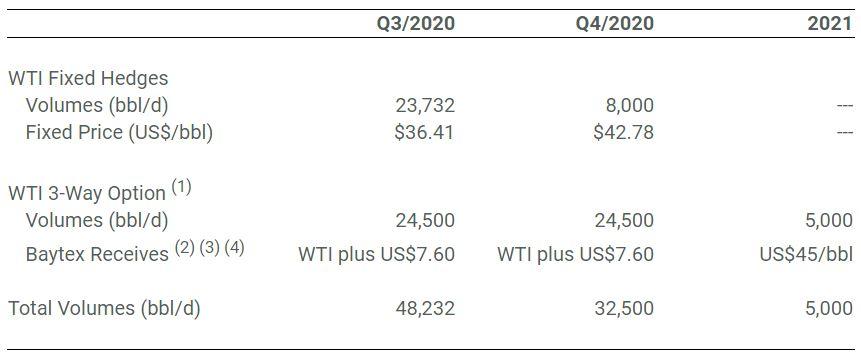

To manage commodity price movements, we utilize various financial derivative contracts and crude-by-rail to reduce the volatility of our adjusted funds flow. The following table summarizes our crude oil hedges in place.

For the remainder of 2020, we also have WTI-MSW basis differential swaps for 7,783 bbl/d of our light oil production in Canada at US$5.80/bbl and WCS differential hedges on 8,667 bbl/d at a WTI-WCS differential of US$14.57/bbl.

Crude-by-rail is an integral part of our egress and marketing strategy for our heavy oil production. For Q2/2020, we delivered approximately 5,250 bbl/d of our heavy oil volumes to market by rail.

A complete listing of our financial derivative contracts can be found in Note 17 to our Q2/2020 financial statements.

Sustainability

We are committed to managing the environmental and social impacts of our business and continual improvement is an important element of this commitment. In 2019, Baytex established for the first time a GHG emissions reduction target. Our objective is to reduce our corporate GHG emission intensity (tonnes of CO2 per boe) by 30% by 2021, relative to our 2018 baseline.

In 2019, we made significant improvements in our emissions profile, achieving a 15% reduction in our GHG emissions intensity as we commissioned our Peace River gas plant in mid-2018 and progressed our Viking gas conservation project. We remain committed to achieving our 30% target by the end of 2021.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Canada News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

Gulf Coast News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -