Exploration & Production | Quarterly / Earnings Reports

Berry Production Above Forecast, Possible Merger with Linn

Berry Petroleum Company reported net earnings of $28 million, or $0.50 per diluted share, for the third quarter of 2013.

Berry's third quarter 2013 production averaged 41,413 BOE/D, up 14% from the third quarter of 2012. The Company's oil production was 32,997 BOE/D in the third quarter, up 20% from the third quarter of 2012. Average daily production by project area is listed in the following table:

| Average Daily Production for the Quarter Ended (BOE/D): | |||||||||||||||||||||||||

| Project Area |

September 30, 2013 |

September 30, 2012 |

3Q12 to 3Q13 Change |

June 30, 2013 |

2Q13 to 3Q13 Change |

||||||||||||||||||||

| SMWSS—Steam Floods | 12,275 | 12,720 | (3 | %) | 12,395 | (1 | %) | ||||||||||||||||||

| NMWSS—Diatomite | 5,260 | 3,500 | 50 | % | 4,735 | 11 | % | ||||||||||||||||||

| NMWSS—New Steam Floods | 3,290 | 1,925 | 71 | % | 2,645 | 24 | % | ||||||||||||||||||

| Permian | 8,355 | 6,860 | 22 | % | 8,000 | 4 | % | ||||||||||||||||||

| Uinta | 8,055 | 5,940 | 36 | % | 7,315 | 10 | % | ||||||||||||||||||

| Oil assets | 37,235 | 30,945 | 20 | % | 35,090 | 6 | % | ||||||||||||||||||

| Gas assets | 4,178 | 5,341 | (22 | %) | 4,439 | (6 | %) | ||||||||||||||||||

| Total | 41,413 | 36,286 | 14 | % | 39,529 | 5 | % | ||||||||||||||||||

| Oil volumes | 32,997 | 27,493 | 20 | % | 31,456 | 5 | % | ||||||||||||||||||

| Gas volumes | 8,416 | 8,793 | (4 | %) | 8,073 | 4 | % | ||||||||||||||||||

Bob Heinemann, President and Chief Executive Officer, commented, “As the main focus of our oil-growth strategy, we have been concentrating our capital investment into five assets in three oily basins and they have delivered strong performance in the third quarter. Production from these assets increased 6% over the second quarter of 2013 and 20% over the third quarter of 2012. The performance of the Company’s New Steam Floods, Diatomite, and Uinta assets were particularly encouraging, all of which grew at double-digit rates for the quarter. Our oil volumes of 32,997 BOPD comprised 80% of the Company’s total compared to 66% in 2010 when we began shifting all of our capital into oil assets.”

California Operations

Production from the Company's South Midway asset team averaged 12,275 BOE/D in the third quarter of 2013, relatively flat with second quarter 2013 production. The team continues to maximize cash flows while striving for a shallow, 5-8% base production decline from the Company’s legacy assets. Berry drilled 18 new producing wells in the third quarter, including nine at Placerita, seven at Poso Creek, and two at Ethel D.

Diatomite production increased for the sixth consecutive quarter and averaged 5,260 BOE/D in the third quarter of 2013, up 11% from second quarter levels.

Mr. Heinemann said, “By utilizing our integrated surveillance systems and enhanced knowledge of the reservoir, in conjunction with a continuous drilling program and expanded infrastructure, we have been able to demonstrate steady quarterly production growth.”

New Steam Floods production averaged 3,290 BOE/D in the third quarter of 2013, up 24% from second quarter levels, led by a positive response from steam flood activities at the Company’s McKittrick 21Z asset. In the third quarter, the asset team continued to expand its infrastructure and increased steam injection into these evolving projects.

Uinta Operations

Uinta production averaged 8,055 BOE/D in the third quarter of 2013, up 10% from second quarter levels. The Company continued to focus on vertical commingled Wasatch/Green River wells and the asset team drilled 31 net wells in the third quarter. Berry utilized a two-rig drilling program and focused its drilling activity in the Ashley National Forest. The Company continued to expand its marketing options through its initiative of shipping crude oil to markets outside of Utah.

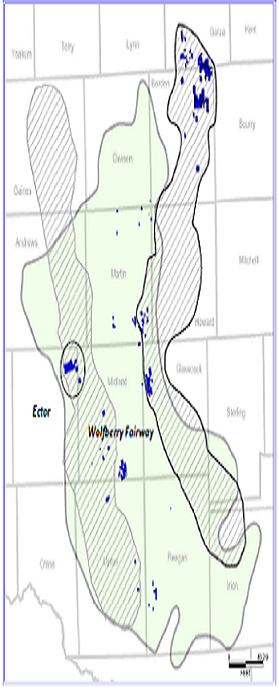

Permian Operations

Permian production averaged 8,355 BOE/D in the third quarter of 2013, up 4% from second quarter levels. The Company drilled 11 net wells utilizing a three-rig drilling program and focused in its productive northeastern Ector County area. This has enabled the asset team to increase production by 22% over 2012 at much lower levels of capital spend. Berry is assessing the economic potential for horizontal drilling in its Permian basin assets and is closely monitoring activity near the Company’s acreage.

Natural Gas

Production from the Company’s two natural gas assets totaled 4,178 BOE/D in the third quarter of 2013, down 6% from the second quarter. The Company expects production from these assets to decline by approximately 1,300 BOE/D in 2013, as it continues to focus capital investment on development of its oil assets.

Additional Updates

Berry now expects 2013 company production to average between 40,500 - 40,800 BOE/D, above its previous forecast of 38,000 - 40,000 BOE/D. Capital spending in 2013 should total around $600 million. Oil production for 2013 should average approximately 80% of Berry's total production. The Company is currently in the process of establishing its 2014 capital budget, and will provide details around those plans at a future date.

Berry Petroleum Company is party to an agreement and plan of merger with Linn Energy, LLC and LinnCo, LLC. The proposed merger transaction can only be put to a vote of the Berry stockholders, Linn Energy unitholders, and LinnCo shareholders if and when the Form S-4 Registration Statement is approved by the Securities and Exchange Commission. Linn filed a 5th amended Form S-4 Registration Statement with the Securities and Exchange Commission on Tuesday, October 22nd, 2013.

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020