Exploration & Production | Quarterly / Earnings Reports | Third Quarter (3Q) Update | Production Rates | Capital Markets | Capital Expenditure | Drilling Program

Bonterra Energy Updates Third Quarter Operations

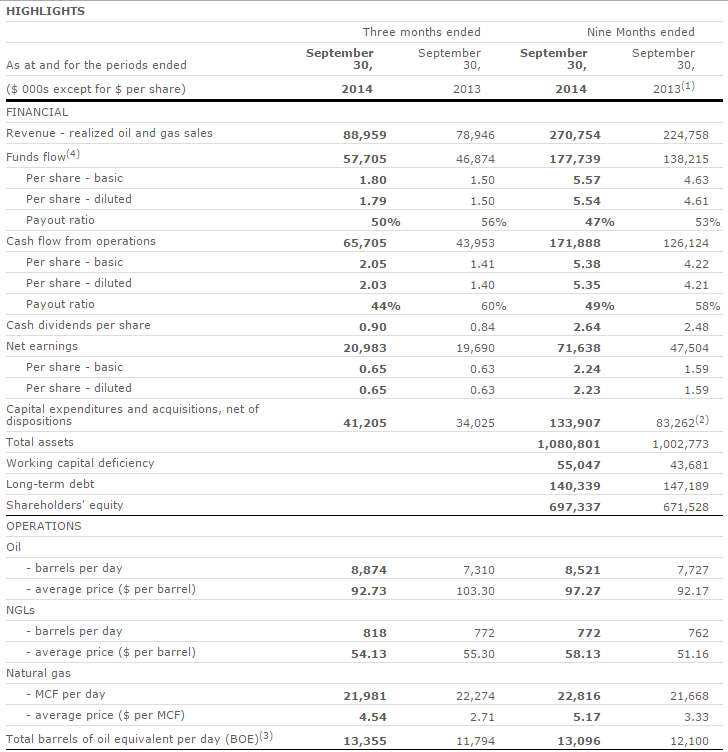

Bonterra Energy Corp. has announced its operating and financial results for the three months and nine months ended September 30, 2014.

Q3 2014 Highlights

- Production for the third quarter averaged 13,355 BOE per day and 13,096 BOE per day for the nine months ended September 30, 2014;

- Generated funds flow of $57.7 million ($1.80 per share) for the third quarter of 2014 compared to $46.9 million ($1.50 per share) for the same period in 2013 and $177.7 million ($5.57 per share) for the nine months ended September 30, 2104 compared to $138.2 million ($4.63 per share) for the same period in 2013;

- Average Canadian dollar realized commodity prices during the third quarter were: crude oil $92.73 per barrel, natural gas liquids $54.13 per barrel and natural gas $4.54 per mcf, and for the nine months ended September 30, 2013 were: crude oil $97.27 per barrel, natural gas liquids $$58.13 per barrel and $5.17 per mcf;

- Operating costs were $15.17 per BOE in Q3 2014 compared to $14.71 per BOE in Q3 2013 and for the nine months ended September 30, 2014 were $14.06 per BOE (excluding a non-recurring item) compared to $13.00 per BOE for the same period in the prior year;

- Corporate netback reflected a strong oil price environment relative to prior periods, and increased to $46.07 per BOE for the third quarter compared to $43.20 per BOE for the same period in 2013 and were $49.28 per BOE for the nine months ended September 30, 2014 compared to $41.54 per BOE for the same period in 2013;

- Paid out $0.90 per share in cash dividends in the third quarter compared to $0.84 per share for the same period in 2013 reflecting growth in production and funds flow and $2.64 per share for the nine months ended September 30, 2014 compared to $2.48 per share for the same period in 2013;

- The Company maintained a very strong balance sheet with a net debt to twelve months trailing cash flow of 0.86 to 1.0 times; and

- Drilled 55 gross (37.6 net) horizontal wells for the nine months ended September 30, 2014 with a 100 percent success rate.

Operations

Bonterra spent approximately $135.0 million on its capital program for the first nine months of 2014 primarily on 33 gross (32.7 net) wells and completing and tying-in 4 gross (3.9 net) wells that were drilled in 2013. This represents approximately 96 percent of the Company's revised 2014 annual capital program announced in Q2 which increased from $120 million to $140 million. Currently, 41 gross (40.6 net) operated wells and 26 gross (6.4 net) non-operated wells are planned for 2014, of which up to 8 gross (7.9 net) wells will be drilled, but not completed, equipped and tied-in until the beginning of the first quarter of 2015. The remaining budgeted capital will be directed to facilities, pipelines, and other areas within Bonterra's Cardium land base.

Bonterra's land position in the Carnwood area includes 38 gross (35 net) sections representing approximately 152 gross (140 net) locations at four wells per section. As the Company continues to explore increased well density within its land base to increase its ultimate oil recovery factor, it estimates that six to eight wells per section will likely become the standard for development of its Cardium assets. This would increase the Carnwood drilling inventory substantially to approximately 305 gross (280 net) locations at eight wells per section for this one area of its Cardium land base.

With Bonterra's ongoing drilling activities, the Company has successfully delineated the outer edges of the Carnwood area allowing it to increase well density throughout the area by implementing a targeted pad drilling program. This program involves drilling multiple horizontal wells from a single surface location which should result in fewer drilling days, reduced costs, improved on stream efficiencies and a smaller environmental footprint. Based on the results of the Carnwood program, the Company anticipates that increased well density and pad drilling will be used across its Cardium asset base to lower costs, drive higher recovery rates and ultimately generate higher rates of return.

Financial

With a decreasing benchmark oil price through the third quarter of 2014, the Company's average realized price for crude oil was $92.73 per barrel in the period, a decrease of 9.4 percent over the second quarter of 2014 and a decrease of 10.2 percent over the third quarter of 2013. However, relative to the first nine months of 2013, oil prices increased during the same period in 2014 and the Company realized an average crude oil price of $97.27 per barrel, an increase of 5.5 percent over the same period in 2013. As a result of this increased price environment for the nine month period coupled with a significant increase in production volumes for the first nine months of 2014, revenue and cash flow from operations increased 20.5 percent and 36.3 percent, respectively, over the same period in 2013.

This stronger commodity price environment drove the Company's netback to $49.28 per BOE for the first nine months of 2014, an increase of 18.6 percent year over year. The cash netback for the third quarter of 2014 was $46.07 per BOE compared to $43.20 per BOE for third quarter of 2013. As a function of growing production and funds flow, the Board of Directors approved an increase to the monthly dividend in June 2014 payable July 31, 2014 from $0.29 per share to $0.30 per share ($3.60 per share annually).

Bonterra has maintained its focus on preserving balance sheet strength and exercising conservative financial management, the importance of which is demonstrated during periods of significantly weaker commodity prices. At September 30, 2014, the Company net debt to cash flow at 0.86 to 1.0 times was below its guidance range of 1.0 to 1.0 times to 1.5 to 1.0 times. The Company will continue to closely monitor this ratio by managing cash flow and capital expenditure ranges over the year to ensure that it remains within its targeted annual guidance for 2014.

Outlook

Bonterra will continue to focus its drilling and completions activities in the Carnwood field, where approximately 70 percent of its capital will be allocated. The other 30 percent will be deployed in various operated and non-operated well locations across other areas of the Pembina Cardium field. Results from the wells that have commenced production in 2014 continue to be favorable and the Company is well positioned to carry this momentum through the remainder of 2014 and into 2015.

From a longer-term perspective, Bonterra has a sizable inventory from its Cardium locations that totals approximately 14 years, subject to the length of the horizontal laterals and the average number of wells per section. This inventory of undrilled locations does not include any Belly River or Edmonton sands or wells targeting deeper zones in the Pembina field, nor does it account for any drilling on the Company's Saskatchewan or British Columbia lands. As such, Bonterra has access to significant future development opportunities, and is very well positioned to capture the tremendous upside afforded by having a high quality asset base focused within the Pembina Cardium.

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)