Drilling & Completions | Well Lateral Length | Reserves | Well EUR

CNX Resources Details Year-End Reserves; Up 13% YOY

CNX Resources Corp. reported total proved reserves of 9.55 Tcfe, as of December 31, 2020, which is a 13% increase compared to the previous year.

CNX organically added 2,247 Bcfe of proved reserves through extensions and discoveries, which resulted in the company replacing over 440% of its 2020 net production of 511 Bcfe.

Yemi Akinkugbe, Chief Excellence Office, said: "The take-in transaction of CNX Midstream Partners LP resulted in a positive impact to our year-end PV-10 and proved reserves by structurally lowering CNX's operating costs, which materially offset the impact of the lower SEC commodity price in 2020. We do not believe that our peers can replicate our cost structure, which should provide CNX with superior economic inventory for decades to come."

In 2020, drilling and completion costs incurred directly attributable to extensions and discoveries were $480 million. When divided by the extensions and discoveries of 2,247 Bcfe, this yields a drill bit F&D cost of $0.21 per Mcfe.

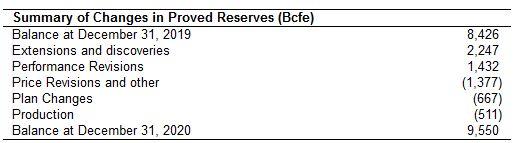

The following table shows the summary of changes in reserves:

During the year, total net revisions were negative 612 Bcfe. Proved developed and undeveloped reserves were 5,200 Bcfe (54%) and 4,350 Bcfe (46%), respectively, for 2020. PUDs at year-end 2020 represent 74% of the total wells the company expects to drill over the next five years. The low PUD to 5-year plan percentage implies meaningful future upside in both the Marcellus and Utica shales in Pennsylvania and West Virginia.

MarcellusDuring 2020, in the Marcellus Shale, CNX turned-in-line (TIL) 34 gross wells with an average completed lateral length of approximately 11,700 feet and EURs averaging 2.7 Bcfe per thousand feet of completed lateral. The company continues to achieve superior economics and production performance through the use of extended reach laterals in the Marcellus Shale, which have allowed CNX to drive value through maximizing the ultimate recovery of the company's in-place resources. These advancements have also allowed CNX to book Marcellus Shale PUDs with average EURs of approximately 2.7 Bcfe per thousand feet of completed lateral.

UticaDuring 2020, in the Ohio and Pennsylvania Utica Shale, CNX turned-in-line (TIL) 11 gross wells with an average completed lateral length of approximately 8,300 feet and EURs averaging 2.3 Bcfe per thousand feet of completed lateral. The majority of the company's proved undeveloped Utica Shale locations exist in its CPA operating region with average EURs of approximately 3.5 Bcfe per thousand feet of completed lateral.

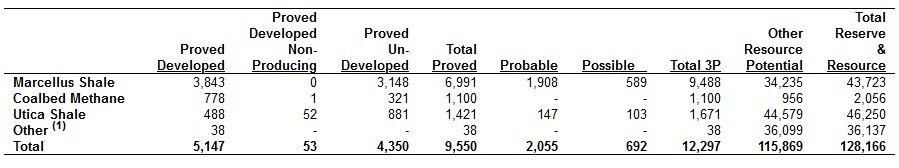

As of December 31, 2020, CNX has total proved, probable, and possible reserves (also known as "3P reserves") of 12.3 Tcfe, which are comprised only of reserves expected to be developed in the company's five-year plan. There are an additional 116 Tcfe of recoverable resources in the Other Resource Potential that the company expects to develop beyond the five-year plan.

The following table shows the breakdown of reserves, in Bcfe, from the company's current development and exploration plays:

Related Categories :

Reserves

More Reserves News

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Coterra Energy Q4, Full Year 2022 Results; 2023 Plans

-

Civitas Resources Q4, Full Year 2022 Results; 2023 Capital Plans

-

Coterra Energy Third Quarter 2022 Results

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

Northeast - Appalachia News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

EQT's Completion Efficiency Drove Outperformance In 2Q

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD