Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Hedging | Capital Markets | Capital Expenditure | 2020 Guidance

Cabot Q1: Reaffirms 2020 Capex (No Cuts), But Will Curtail Output; Financials

Cabot Oil & Gas Corp. reported its Q1 2020 results.

Q1 Key Financial Developments & Production

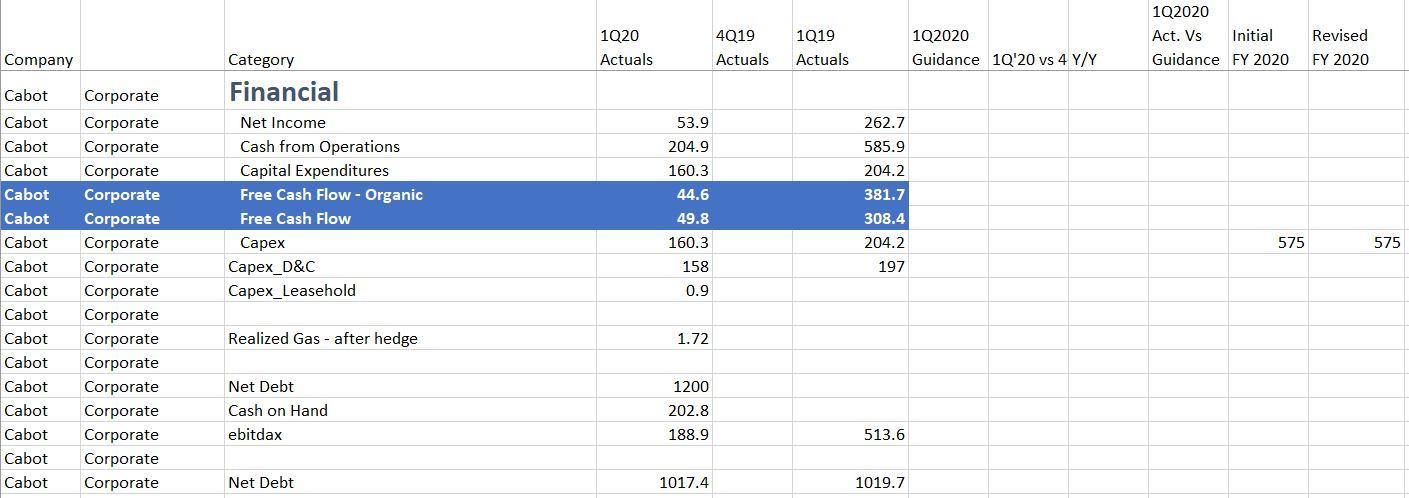

- Free Cash Flow of $50MM in Q1: Cabot cash from operations for Q1 was $204.9 million - less Q1 spending of $160.3 million, free cash was $50 million (down -84% YOY)

- No Change Borrowing Base: Lenders reaffirmed the $3.2 billion borrowing base. With bank commitments of $1.5B and no debt outstanding, Cabot has approximately $1.7 billion of liquidity.

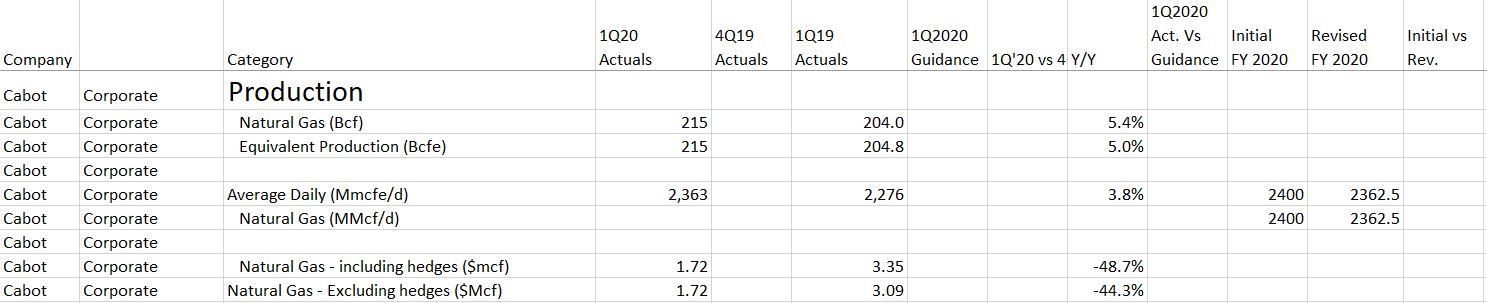

- Q1 Production Up 4% YOY: Net production averaged 2,363 Mmcfe/d (100% gas) during the first quarter, a 4% increase over the prior year period

- Q1 D&C Activity: Cabot drilled 22 and completed 13 net wells in Q1 (compared to 25 and 14 wells in 1Q19)

- Cash on Hand: Cabot had cash on hand of $202.8 million in 1Q20

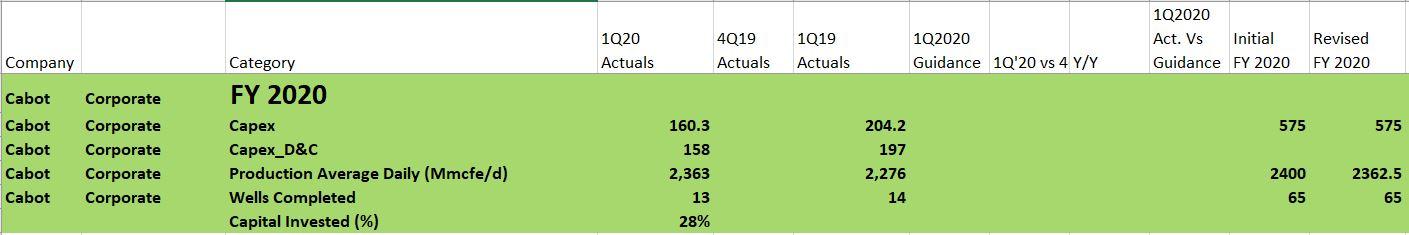

2020 Capex Reaffirmed at $575MM; Curtailments

While many operators are substantially cutting spending, Cabot is making no changes in that regard. Approximately 28% of 2020 capital was spent in Q1 (~$160 million).

However, production guidance was changed due to curtailment plans:

- Curtailments: Cabot is forecasting modest price-related curtailments during the natural gas shoulder season. Based on the current turn-in-line schedule for the year, approximately two-thirds of the Company's wells are expected to be placed on production between mid-May and late August, resulting in a significant sequential production increase in the third quarter of 2020.

- Other: Cabot has updated its full-year production guidance from 2,400 Mmcfe per day to a range of 2,350 to 2,375 Mmcfe per day (down 2%)

Q1 Snapshot

Q1 Press Release

Highlights:

- Net income of $53.9 million (or $0.14 per share); adjusted net income (non-GAAP) of $54.0 million (or $0.14 per share)

- Free cash flow (non-GAAP) of $49.8 million

- Return on capital employed (ROCE) (non-GAAP) for the trailing twelve months of 14.1 percent

- Daily production of 2,363 Mmcfe per day, a four percent increase relative to the prior-year period

CEO Dan O. Dinges said: "During these unprecedented times, I am reminded of the strength of our company and the resiliency of our business model, which are a result of our low cost structure, our strong balance sheet, and the tireless hard work of our employees. We have implemented preventative measures intended to minimize unnecessary risk of exposure and prevent infection among our employees and the communities in which we operate. Our operations team-in conjunction with our service and midstream providers-has continued to execute on our plan with little disruption. While natural gas prices are expected to remain challenged in the near-term as we manage through an oversupplied market exiting the winter heating season and the unexpected loss in demand resulting from COVID-19, we expect a much healthier supply and demand balance for natural gas later this year and in 2021. Our improved outlook for the natural gas markets is primarily driven by our expectation for significant declines in natural gas supply in 2020 and 2021 due to a continued reduction in natural gas-directed drilling and completion activity and less associated gas production from reduced operating activity in oil basins driven by the COVID-19 pandemic and recent production disagreements among members of OPEC+ and other producer countries."

Q1 Financials

First quarter 2020 daily production was 2,363 Mmcfe per day (100 percent natural gas), representing a four percent increase relative to the first quarter of 2019.

First quarter 2020 net income was $53.9 million, or $0.14 per share, compared to $262.8 million, or $0.62 per share, in the prior-year period. First quarter 2020 adjusted net income (non-GAAP) was $54.0 million, or $0.14 per share, compared to $307.8 million, or $0.73 per share, in the prior-year period. First quarter 2020 EBITDAX (non-GAAP) was $189.0 million, compared to $513.7 million in the prior-year period.

First quarter 2020 net cash provided by operating activities was $204.9 million, compared to $585.3 million in the prior-year period. First quarter 2020 discretionary cash flow (non-GAAP) was $198.5 million, compared to $505.9 million in the prior-year period. First quarter 2020 free cash flow (non-GAAP) was $49.8 million, compared to $308.4 million in the prior-year period.

First quarter 2020 natural gas price realizations, including the impact of derivatives, were $1.72 per thousand cubic feet (Mcf), a decrease of 49 percent compared to the prior-year period. First quarter 2020 natural gas price realizations represented a $0.23 discount to NYMEX settlement prices compared to a $0.06 discount in the prior-year period. First quarter 2020 operating expenses (including interest expense) decreased to $1.46 per thousand cubic feet equivalent (Mcfe), a one percent improvement compared to the prior-year period.

Cabot incurred a total of $160.3 million of capital expenditures in the first quarter of 2020 including $158.0 million of drilling and facilities capital, $0.9 million of leasehold acquisition capital, and $1.4 million of other capital. See the supplemental table at the end of this press release reconciling the capital expenditures during the first quarter of 2020.

Financial Position and Liquidity

As of March 31, 2020, Cabot had total debt of $1.2 billion and cash on hand of $202.8 million. The Company's net debt-to-adjusted capitalization ratio (non-GAAP) and net debt-to-trailing twelve months EBITDAX ratio (non-GAAP) were 31.9 percent and 0.9x, respectively, compared to 32.2 percent and 0.7x as of December 31, 2019.

On April 23, 2020, the Company's lender group unanimously reaffirmed the $3.2 billion borrowing base under its revolving credit facility. Aggregate bank commitments under the credit facility remain at $1.5 billion. The Company currently has no debt outstanding under its credit facility, resulting in approximately $1.7 billion of liquidity.

"Despite the lowest average quarterly NYMEX settlement price since the first quarter of 1999, Cabot was still able to deliver positive corporate returns and generate positive free cash flow while fully funding our dividend and maintaining an ironclad balance sheet," added Dinges. "I am proud of our team and these results given the unprecedented environment we are operating in today."

Second Quarter and Full-Year 2020 Guidance

Cabot has provided its second quarter 2020 production guidance range of 2,175 to 2,225 Mmcfe per day. As the Company previously disclosed, this sequential production decline in the second quarter is primarily driven by a lighter turn-in-line schedule during the first four and a half months of the year with only thirteen wells expected to be placed on production between the beginning of the year and mid-May. This is primarily a result of longer cycle times for larger pads with longer laterals during the first and second quarters. Additionally, the Company is forecasting modest price-related curtailments during the natural gas shoulder season. The Company's second quarter production guidance range also reflects the impact of unplanned downtime related to remedial work on one well on a large pad that resulted in the deferral of over 230 completed stages from the first quarter to the second quarter, which led to lower capital spending levels in the first quarter. Based on the current turn-in-line schedule for the year, approximately two-thirds of the Company's wells are expected to be placed on production between mid-May and late August, resulting in a significant sequential production increase in the third quarter of 2020.

Cabot has updated its full-year production guidance from 2,400 Mmcfe per day to a range of 2,350 to 2,375 Mmcfe per day to reflect the previously mentioned operational changes and has reaffirmed its capital program of $575 million. "The midpoint of our updated production guidance range implies flat production levels year-over-year, with fourth quarter 2020 exit volumes expected to be flat to the fourth quarter of 2019," said Dinges. Based on the current NYMEX futures curve, this plan is currently expected to generate enough free cash flow to fully fund the Company's dividend in 2020.

Dinges added: "As it relates to our outlook for 2021, we are extremely encouraged by the increase in the NYMEX natural gas futures for 2021 from a low of $2.28 per Mmbtu in early March to approximately $2.75 per Mmbtu today. Under a maintenance capital program in 2021, every $0.10 improvement in annual NYMEX price is expected to result in approximately $55 million of incremental free cash flow, highlighting our belief in our ability to deliver a significant expansion in free cash flow next year. We will continue to assess the natural gas market dynamics, including the impact of COVID-19 and lower crude oil prices on the natural gas supply and demand outlook, before formalizing our plans for 2021; however, we are optimistic that our improving outlook for free cash flow, return on capital employed, and return of capital to shareholders will further differentiate Cabot through these challenging times."

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Northeast News >>>

-

Large Marcellus E&P Talk 2024 Development Plan, Rigs, Wells & Frac Crews

-

Devon Said To be In Talks to Acquire Enerplus

-

CNX Resources Talks 2024 Rigs, Frac Crews & Well Count -

-

An Early Look at Company 2024 Capital & Development Plans

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?