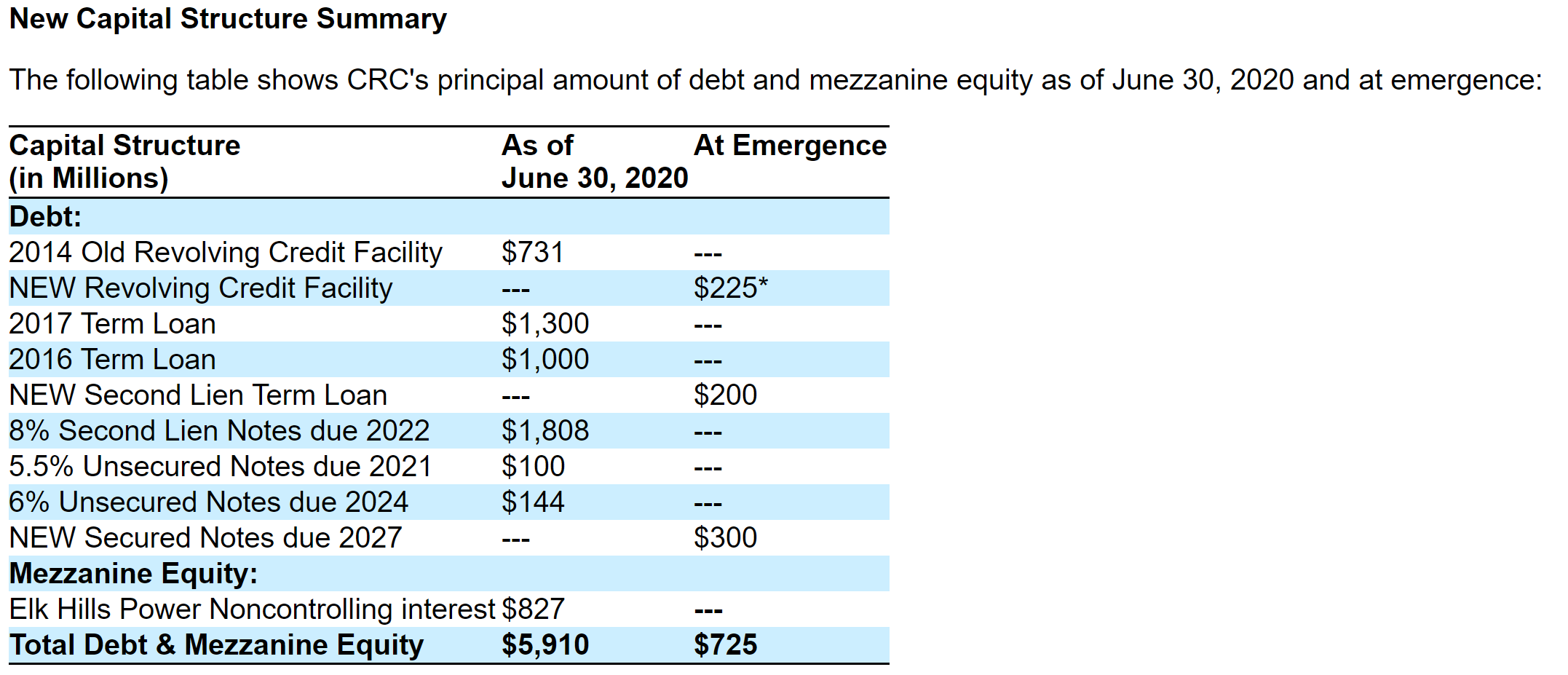

California Resources Corporation completed its chapter 11 restructuring and will begin trading today under the ticker NYSE:CRC . The company emerged with $540 million revolving credit facility , #300 million of secured senior notes and $200 million second lien term loan.

Todd Stevens, President and CEO of CRC, noted, "With the full support of our stakeholders and a much stronger balance sheet, the restructured CRC is well designed to withstand price cycles and continue delivering affordable, sustainable and reliable energy that is so essential to Californians. You can expect CRC to build upon the fundamental strengths of our business that provide us a high degree of operating flexibility, including our low-decline conventional oil production, low capital intensity, exposure to the Brent crude oil markets, substantial mineral ownership in fee, and integrated infrastructure. We believe the streamlined CRC and our commitment to disciplined capital allocation will serve as a strong foundation to deliver free cash flow. CRC is committed to fostering sustainable energy production to meet the future needs of all Californians. I would also like to thank our employees for their dedication, focus and effort to sustain our proven track record of safety, environmental stewardship and operational excellence during the restructuring process."

Related Categories :

Bankruptcy Exit

More Bankruptcy Exit News

-

Vista Proppants Emerges from Bankruptcy; Rebrands as V SandCo LLC

-

Gulfport Energy Emerges from Bankruptcy

-

Report: Chesapeake Poised to Emerge from Bankruptcy

-

Lonestar Resources Emerges from Bankruptcy

-

FTS International Exits Bankruptcy

West Coast News >>>

-

Kosmos Energy Ltd. First Quarter 2023 Results

-

California Resources Corporation First Quarter 2023 Results -

-

Berry Corporation First Quarter 2023 Results -

-

CPP Investments to acquire 49% stake in Aera Energy -

-

California Resources Third Quarter 2022 Results -