Drilling & Completions | Well Cost | Quarterly / Earnings Reports | First Quarter (1Q) Update | Capital Markets | Capital Expenditure | Drilling Activity

Carrizo's Eagle Ford Drilling Leaps +167% YOY; Delaware Completions Up +350%

Carrizo Oil & Gas reported its Q1 2019 results. Below are highlights fom its report and presentation.

Q1 Summary

- Well Activity (gross): Drilled 32 net wells / Completed 41 net wells - up +31% and down -13% YOY, respectively

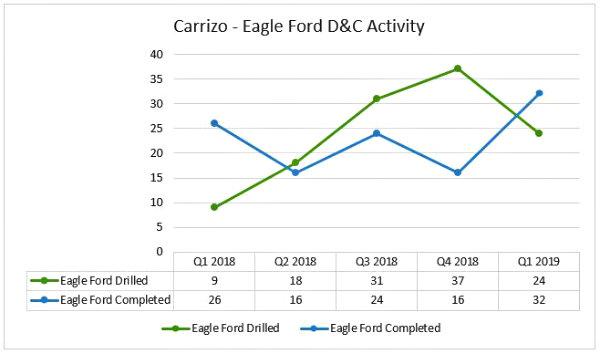

- Eagle Ford: Drilled 24 net wells / Completed 32 net wells - up +167% and +3% YOY, respectively

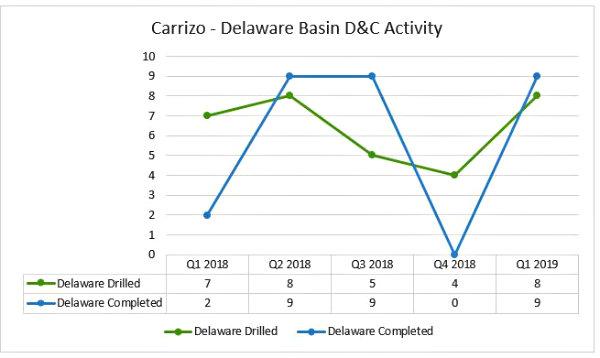

- Delaware Basin: Drilled 8 net wells / Completed 9 net wells - up +14% and +350% YOY, respectively

- Rigs: 7 total rigs running - flat YOY

- Delaware Basin: 3 rigs running - up +40% YOY

- Eagle Ford: 4 rigs running - up +100% YOY

- Q1 D&C Spending: $215 million - up +X% YOY

- Q1 Production: Total equivalent production averaged 61.96 MBOEPD - up +21% from Q1 2018

- Crude oil production of 40,727 Bbls/d, 19% above the first quarter of 2018

- Reiterates Guidance:

- 2019 DC&I capital expenditure guidance maintained at $525-$575 million

- 2019 production guidance reiterated at 66,800-67,800 Boe/d

Eagle Ford

In the Eagle Ford Shale, where the Company holds approximately 76,500 net acres, Carrizo drilled 27 gross (24 net) operated wells during the first quarter and completed 32 gross (32 net) operated wells. Production from the play was more than 39,500 Boe/d for the quarter, up 2% versus the prior quarter as production from the multipads began coming online; crude oil accounted for 79% of the Company's production from the play. At the end of the quarter, Carrizo had 41 gross (38 net) operated Eagle Ford Shale wells in progress or waiting on completion. Carrizo currently expects to drill 55-60 gross (45-50 net) operated wells and complete 75-80 gross (70-75 net) operated wells in the play during 2019.

Production from Carrizo's two recent large-scale multipad projects in the Eagle Ford Shale, located in its Pena and RPG project areas, began during the first quarter of the year. Total production from the projects has increased materially over the last several months as additional wells have been turned to sales. The projects consist of a total of 33 wells on eight pads, with 12 wells located in the Pena project area and 21 wells located in the RPG project area. Production from the projects has been consistent with the Company's expectations, and has recently been averaging more than 13,700 Boe/d net (90% oil) from restricted chokes.

Carrizo continues to reduce cycle times and capture efficiency gains in its Eagle Ford Shale program. Year-to-date, Carrizo has averaged approximately 8 drilling days per well, down from 9-10 in 2018. The Company has also been able to increase its completion cadence to approximately 9 stages per day, versus 6-7 on average in 2018. The improved cycle times, plus the other process improvements and service cost reductions that the Company has previously discussed, resulted in a 10%-15% reduction in average drilling cost and completion cost per effective lateral foot in the first quarter relative to the fourth quarter of 2018. The efficiency gains achieved to date have exceeded the Company's prior expectations, and Carrizo now expects average well costs in the Eagle Ford Shale to be $3.9-$4.1 million for a 6,600-ft. lateral well, down from $4.3 million previously.

Delaware Basin

In the Delaware Basin, where it holds more than 46,000 net acres, Carrizo drilled 8 gross (8 net) operated wells during the first quarter and completed 11 gross (9 net) wells. Production from the play was more than 22,400 Boe/d for the quarter, down versus the prior quarter due to a limited number of wells coming online in late 2018 and early 2019 as well as a higher level of downtime associated with offsetting completion activity. Crude oil production during the first quarter was approximately 9,400 Bbls/d, accounting for 42% of the Company's production from the play. At the end of the quarter, Carrizo had 9 gross (8 net) operated Delaware Basin wells in progress or waiting on completion. Carrizo currently expects to drill 20-25 gross (20-25 net) operated wells and complete 20-25 gross (15-20 net) operated wells in the play during 2019.

Carrizo's primary operational focus in the Delaware Basin thus far in 2019 has been testing multi-layer, co-development concepts on its acreage. The Company recently completed The Six, its first large-scale, co-development test of the Wolfcamp A, B, and C, consisting of six wells across four landing zones. The test spans more than 550 feet of vertical reservoir thickness with the six wells spaced in a 330-ft. wine-rack configuration. The wells began production in mid-April, and are continuing to clean up. While early, Carrizo is pleased with the initial performance from the project as it has already achieved a rate of approximately 10,600 Boe/d (60% oil, 78% liquids).

Included in this co-development, or cube, test was an additional Wolfcamp C well in the Phantom project area. The St. Clair 2827 Allocation A 12H, which was drilled approximately 250 feet below the two Wolfcamp B Lower wells, recently recorded a 7-day rate of more than 1,450 Boe/d (51% oil, 73% liquids) from an approximate 10,000-ft. lateral. The early results from this well continue to support the Wolfcamp C as an additional potential target on the Company's Phantom-area acreage. Currently, Carrizo's estimate of net de-risked drilling locations in the Delaware Basin includes only those in the Wolfcamp A and B.

Early processing results from the microseismic data collected during the completion of The Six have yielded some notable insights. In particular, the spatial distribution of the microseismic events showed the potential for increased hydraulic fracture complexity and increased stimulated rock in the Wolfcamp layers. This implies that multi-layer co-development could result in improved frac geometries and positive communication, a dynamic the Company previously saw when developing the Barnett Shale. In addition to these preliminary conclusions, the microseismic data indicates that carbonates of a certain thickness may act as a barrier to control frac-height growth. Carrizo is planning additional co-development tests in both the Ford West and Phantom areas, and expects to provide updates on them once it has sufficient production history.

Carrizo also remains focused on improving efficiencies and driving down costs in its Delaware Basin operations. In 2019, the Company has transitioned to a full-scale, multi-well pad development program in the basin. During the first quarter of the year, Carrizo's drilling activity was primarily on its Ford West acreage, as it was completing The Six in the Phantom area. The Company was able to materially reduce its drilling cycle times in the play during the quarter, with wells on multi-well pads being drilled 19% faster than their single-well counterparts during 2018. One recent three-well pad of 10,000-ft. lateral wells in the Ford West area was drilled in approximately 20 days on average, a Company record; this was more than 30% faster than the Company's budgeted drilling curve for the area. The reduced cycle times coupled with other process improvements resulted in more than a 35% reduction in drilling cost per effective lateral foot in the Ford West area during the first quarter relative to the fourth quarter of 2018. Efficiency gains and cost reductions have also helped Carrizo materially reduce its completion costs in the Delaware Basin, with average completion cost per effective lateral foot declining by approximately 25% in the first quarter relative to the third quarter of 2018. As with the Eagle Ford Shale, these efficiency gains have exceeded the Company's prior expectations, and Carrizo now expects average well costs in the Delaware Basin to be $7.8-$8.2 million for a 7,000-ft. lateral well, down from $8.5 million previously.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020