Top Story | Deals - On The Market | Corporate Strategy

Chesapeake Engages Evercore to Market Eagle Ford Portfolio

Chesapeake Energy Corp. has tapped investment banking firm Evercore to assist in selling its Eagle Ford asset portfolio, according to a report by Bloomberg.

In early August, Chesapeake signaled that it will be exiting all oil-focused ventures, and will divert the bulk of its investments on shale gas assets in the Marcellus and Haynesville.

Per the report, the sale is expected to open the week of September 5th.

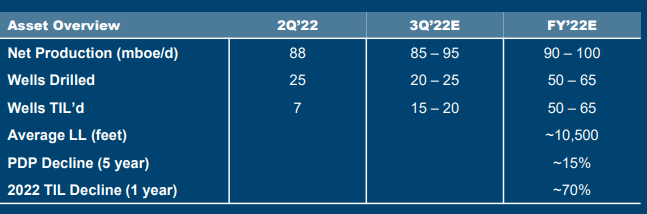

Chesapeake's Eagle Ford Portfolio

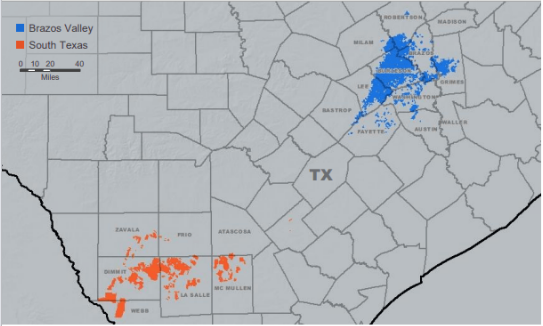

Currently, Chesapeake has approximately 610,000 net acres in the play (map below) and produced 88,000 BOEPD in 2Q22.

Chesapeake's Eagle Ford Acreage

Related Categories :

Deals - On The Market

More Deals - On The Market News

-

Exxon Puts Gas-Heavy Appalachian Assets Up for Sale

-

Large PE-Backed Permian E&P Looking for Buyer; Deal Value Could Top $2.0B -

-

Supermajor Mulling Sale of Permian Basin Portfolio; Could Fetch Up to $10B

-

Bakken Operators Looking to Divest 36,000 Barrels Per Day -

-

Report: Ovintiv Looking to Sell Eagle Ford Assets

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -