Top Story | Deals - On The Market | Deals - Property For Sale | Bankruptcy / Restructure Update | Deals - Acquisition, Mergers, Divestitures | Capital Markets

Chesapeake Gets Court Approval for MidContinent Asset Sale

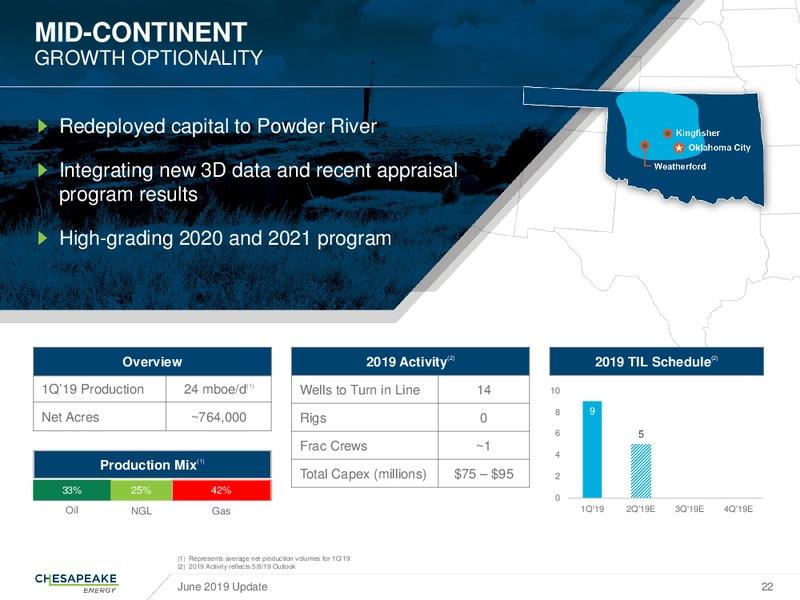

Bankrupt Chesapeake Energy Corp. has gotten approval from the bankruptcy courts to pursue the sale of its Midcontinent assets, according to multiple reports.

In recent years, the company has curtailed spending in the region in favor of its Powder River Basin assets - making these assets an unsurprising target for a sale.

The courts have set a deadline of October 22, 2020 to obtain a stalking horse bid that would set the bar for the sale value. Any other bids would be accepted until October 29, 2020, with the final auction taking place around November 10.

Asset Overview

Chesapeake has over 700,000 net acres in the MidContinent region. As of Q2 2020, the asset was producing at 12 MBOEPD (down from 25 MBOEPD a year ago).

The company exited its other position in the region (the Mississippi Lime) back in February 2018, selling the associated assets to Mach Resources for $500 million.

Related Categories :

Deals - Property For Sale

More Deals - Property For Sale News

-

PE-Backed Permian E&P to Sell for $4.0 Billion -

-

E&P Sells Eagle Ford Property for $100 Million; 22,000 Net Acres -

-

PE-Backed Haynesville E&P Mulling Asset Sale Worth $2.0 Billion -

-

Chevron Looking to Sell Eagle Ford For Billions: Map Inside -

-

Eagle Ford Operator with 71,000 Net Acres Looking for Buyer; Map Inside -

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

Mid-Continent - Anadarko Basin News >>>

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -

-

Schlumberger Shows Steady Resilience Amid Market Volatility -

-

Diversified Energy and Carlyle Forge $2 Billion PDP Partnership

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset