Drilling & Completions | Quarterly / Earnings Reports | Second Quarter (2Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Capital Markets | Capital Expenditure | Drilling Activity | Capex Increase

Chord Energy Second Quarter 2022 Results

Chord Energy Corp. announced its updated return of capital plan, provided an updated outlook for the business and reported financial and operating results for the quarter ending June 30, 2022.

The Company completed the merger of equals transaction between Oasis Petroleum Inc. and Whiting Petroleum Corp. on July 1, 2022 and began trading under the ticker "CHRD" on July 5, 2022.

Danny Brown, Chord Energy's President and Chief Executive Officer, commented: "The second quarter was marked by strong operating performance and culminated in the establishment of Chord Energy. Additionally, we are announcing a new return of capital program which includes an approximate 114% increase to the base dividend and a $300MM share repurchase program. Given our high-quality assets with low breakeven pricing and very strong financial position, Chord Energy is able to return significant amounts of capital to shareholders. The new return of capital program is highly competitive and represents our commitment to operating efficiently, maximizing returns and valuing the return of capital to shareholders."

"Chord Energy is making significant progress on integration and remains excited about its future. I'd like to thank our employees for their hard work and dedication through the closing of the merger and also for driving strong operating and safety performance. With enhanced scale and a low cost of supply, Chord Energy is well positioned to deliver strong value to our shareholders while operating in a sustainable manner and remains a compelling investment opportunity."

Return of Capital Plan

Chord Energy introduced a return of capital plan designed to provide peer-leading, sustainable shareholder returns. The plan calls for returning capital to investors based on free cash flow ("FCF") generated during the quarter and leverage under the following framework (see "Additional Return of Capital Plan Details" below for additional information):

- Below 0.5x leverage: 75%+ of FCF

- Below 1.0x leverage: 50%+ of FCF

- >1.0x leverage: Base dividend

Capital will be returned through base dividends, variable dividends and share repurchases. Chord is increasing its base dividend to $1.25 per share per quarter ($5.00 per share annualized), representing an approximate 114% increase from the prior base dividend of $0.585 per share per quarter. The new base dividend represents an annualized yield of approximately 3.9%. The 2Q22 base dividend will be payable on August 30, 2022 to shareholders of record as of August 16, 2022.

In July 2022, Chord repurchased $125MM of common stock at a weighted average price of $106.25 per share. As of July 31, 2022, the Company had 41,454,152 shares of common stock outstanding. In August, the Board of Directors authorized a new $300MM share repurchase program. Separately, the Company returned $540MM in cash to shareholders in July under the terms of the merger agreement. In November, Chord expects to announce its 3Q22 base dividend and variable dividend. The variable dividend will be calculated using the framework noted above to establish the minimum percentage of FCF to be returned less share repurchases completed during the quarter and the base dividend.

In addition to the share repurchases and dividends, the Company paid a significant portion of the transaction costs related to the merger in July 2022. As of July 31, 2022, Chord had approximately $95.7MM of cash, no outstanding credit facility borrowings, $3.1MM of outstanding letters of credit and $400MM of senior unsecured notes outstanding. The Company has a strong balance sheet and substantial liquidity afforded under its $2.0B credit facility, which has $800MM of elected commitments.

Updated Outlook

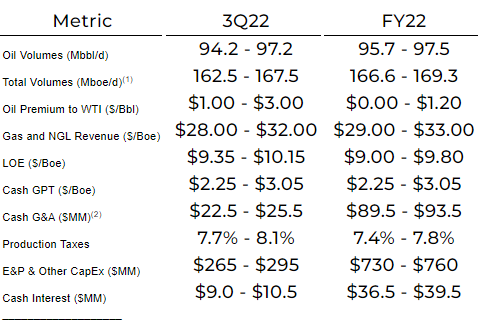

The following table presents select operational and financial guidance for 3Q22 and FY22 (pro forma for combined Company results including 1H22):

Cash taxes as a percentage of 2H22 Adjusted EBITDA are expected to range between 1% at $80 WTI and 3.6% at $100 WTI, generally trending upward in a linear fashion as oil price increases, and are expected to be paid in 4Q22.

2Q22 Operational and Financial Update

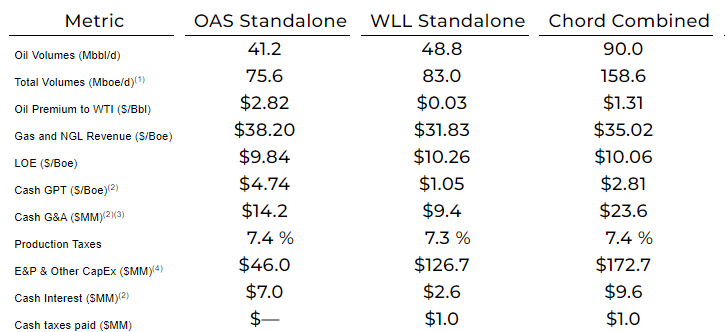

The following table presents select 2Q22 operational and financial data compared to preliminary ranges announced on July 1, 2022.

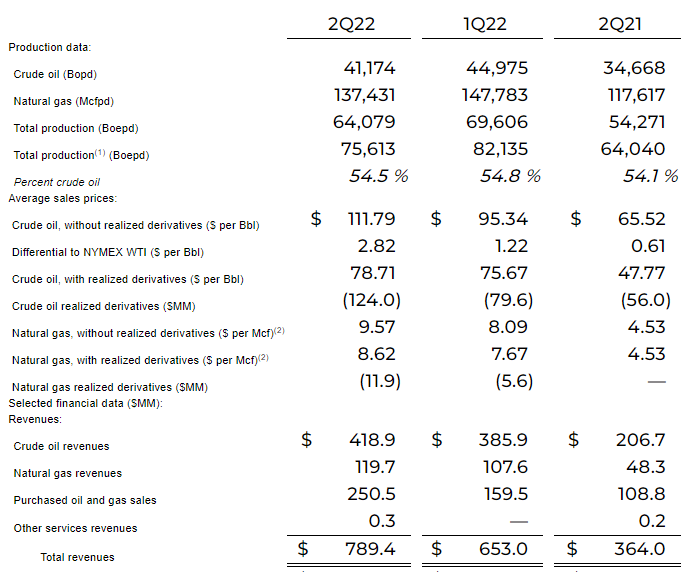

The following results for the three months ended June 30, 2022 discussed below represent legacy Oasis and exclude amounts related to legacy Whiting, unless otherwise specified.

Net cash provided by operating activities was $396.4MM and net income from continuing operations was $130.8MM ($6.23/ diluted share). Adjusted EBITDA from continuing operations was $255.9MM, Adjusted Free Cash Flow was $202.9MM and Adjusted Net Income was $153.5MM ($7.30/diluted share). Adjusted EBITDA, Adjusted Free Cash Flow and Adjusted Net Income are non-GAAP financial measures. See "Non-GAAP Financial Measures" below for a reconciliation to the most directly comparable financial measures under GAAP.

Legacy Oasis completed and placed on production 7 gross (5.3 net) operated wells in 2Q22. On a combined basis, Chord completed and placed on production 16 gross (12.0 net) operated wells in 2Q22.

Select Operational and Financial Data - Legacy Oasis

The following table presents select operational and financial data of legacy Oasis for the periods presented:

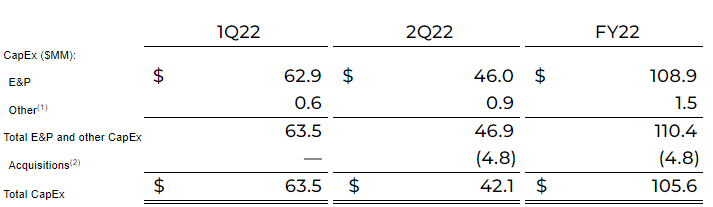

Capital Expenditures - Legacy Oasis

The following table presents the Company's total capital expenditures ("CapEx") from continuing operations by category for the periods presented:

Additional Return of Capital Plan Details

FCF Definition

FCF is defined as Adjusted EBITDA (excluding transaction costs) less CapEx, cash interest and cash taxes. FCF is expected to be calculated for the prior quarter to determine the amount of capital to be returned.

Leverage

Leverage is defined as Net Debt (debt less cash) to forecasted next twelve months Adjusted EBITDA run at $65/bbl WTI and $3.00/mmBtu Henry Hub, excluding the impact of hedges.

Share Repurchases

The Company intends to purchase stock under the repurchase program opportunistically with cash on hand, free cash flow from operations and proceeds from potential liquidity events such as the sale of assets. This repurchase program has no time limit and may be suspended from time to time, modified, extended or discontinued by the Board of Directors at any time. Purchases under the repurchase program may be made from time to time in the open market or privately negotiated transactions in compliance with Rule 10b-18 under the Securities Exchange Act of 1934, as amended, and would be subject to market conditions, applicable legal requirements and other factors. Any stock purchased as part of this program would be put into treasury shares.

Related Categories :

Second Quarter (2Q) Update

More Second Quarter (2Q) Update News

-

SM Energy Hits Record Output; Driven by Uinta

-

Expand Energy Talks, Wells, Frac Crews, Production For 2H-2025 -

-

Comstock Rides Higher Gas Prices, Operational Momentum in Q2 2025

-

A Quarter of Quiet Strength: CNX’s Patient Ascent in Appalachia -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Permian News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

Rockies News >>>

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -