Deals - Acquisition, Mergers, Divestitures

Contango Finalizes Acquisition of Mid-Con Energy Partners

Contango Oil & Gas Co. announced the successful completion of its acquisition of Mid-Con Energy Partners.

In accordance with the terms of the merger agreement, Mid-Con unitholders will receive 1.75 shares of Contango common stock for each unit of Mid-Con common units owned.

The deal is valued at $154.8 million.

Wilkie S. Colyer, Jr., Contango's Chief Executive Officer, commented, "After many months of significant effort from both companies, this merger further highlights Contango's ability to execute on its strategy to acquire producing properties and implement cost-cutting efforts that maximize shareholder returns. As a result of the merger, our largest shareholder and Chairman, John C. Goff, has increased his ownership to just under 25% of the combined business. The Board and management team remain committed to growing shareholder value as we look for new opportunities in the current dislocated market environment. We welcome Mid-Con's investors, employees, and other stakeholders to the Contango platform."

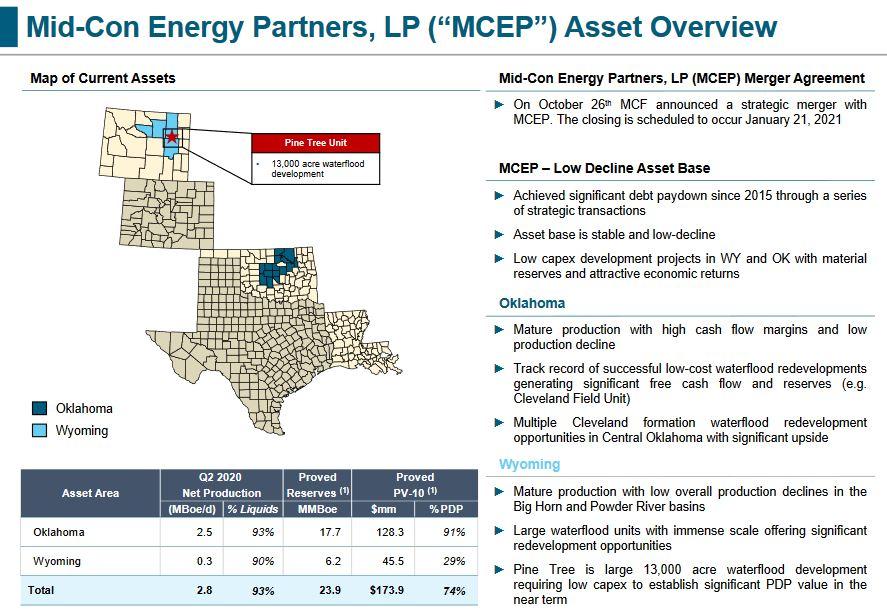

Mid-Con's Assets

Related Categories :

Deals - Deal Close

More Deals - Deal Close News

-

Ring Energy Finalizes Acquisition of Stronghold Energy II

-

Centennial, Colgate Finalize $3.9B Merger; Debut as Permian Resources Corp.

-

Diamondback Seals Rattler Midstream Deal; Takes Company Private

-

Riverbend Finalizes $1.8B Sale of Portfolio Companies

-

Northern Oil Closes $158MM Bolt-On Deal for Williston Assets

Mid-Continent News >>>

-

Oilfield Service Report : 11 New Leads/Company Formation & Contacts

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

IOG forms Partnership with PE-Firm First Reverse To Fund DrillCo's -

-

Liberty Energy Reducing Frac Fleets As Market Activity Slows; Talks 2025 -

-

Top Oilfield Company Retire Rigs & Cut Frac Horsepower Expecting Soft 2025 Market

Mid-Continent - Anadarko Basin News >>>

-

Top Mergers & Acquisitions Deals To Date In Q3 2024

-

Map : $12 Billion Plus in Permian Assets For Sale; Who are Will be the Buyers?

-

Service Companies Talk Bleak Outlook for Remainder of 2024 -

-

Mach Divest Western Anadarko Asset For $38 Million -

-

Contrary to the Noise from Top Service Companies; Activity to Slow For Remainder 2024 -