Drilling & Completions | Quarterly / Earnings Reports | First Quarter (1Q) Update | Financial Results | Capital Markets | Drilling Activity | Capex Increase

Continental Resources First Quarter 2022 Results; Ups 2022 Capex by $350MM

Continental Resources, Inc. announced its first quarter 2022 operating and financial results, increased shareholder return of capital, and enhanced 2022 projections.

Highlights:

- $1.50 B Cash Flow from Operations (CFO) & $1.15 B Free Cash Flow (FCF) (Non-GAAP)

- $597.8 MM Net Income; $1.65 per Diluted Share ($960.0 MM Adj. Net Income; $2.65 per Adj. Share (Non-GAAP))

Increasing Shareholder Return of Capital

- Quarterly Dividend Increased to $0.28 per Share (~2.0% Dividend Yield1)

- $100 MM Shares Repurchased in 1Q22 (~$960 MM Remaining in Share Buyback Program)

- $264 MM Total Debt Reduction in 1Q22 (Inclusive of $450 MM Powder River Basin Acquisition & Initial $63 MM Summit Carbon Capture Investment)

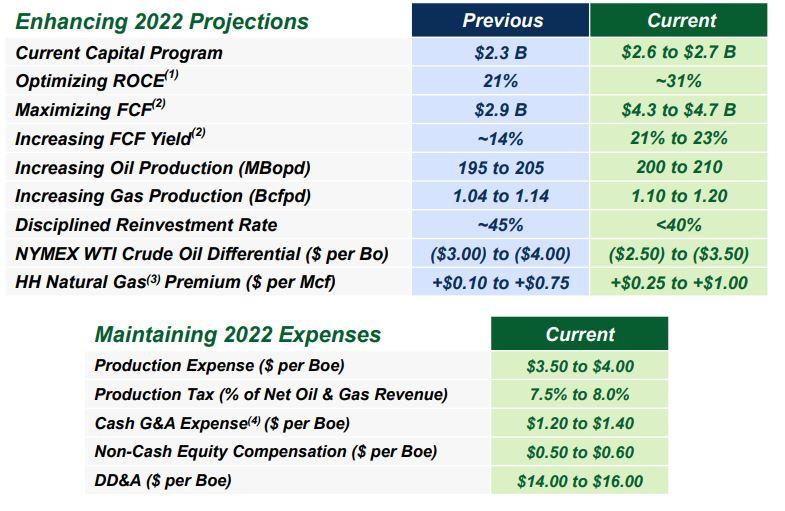

Enhancing 2022 Projections

- Increased Projected Return on Capital Employed (ROCE) to ~31% from Previous 21%

- Increased Avg. Daily Oil Production to 200 to 210 MBopd & Avg. Daily Natural Gas Production to 1.1 to 1.2 Bcfpd

- 220 to 230 MBopd December 2022 Avg. Daily Oil Production Exit Rate

- Projecting Full Year CFO of $6.5 to $7.0 B (Inclusive of ~$450 MM Working Capital Adjustment) and Projecting Full Year FCF2 of $4.3 to $4.7 B; 21% to 23% FCF Yield3 (Non-GAAP)

CEO Bill Berry commented: "Continental's outstanding first quarter 2022 results underscore our commitment to both return of capital to shareholders and corporate disciplined return on capital employed. Additionally, we continue to enhance our 2022 capital program and are realizing opportunities to optimize our operational and financial performance, as evident in our increased 2022 projected free cash flow of $4.3 to $4.7 billion, which equates to a 21% to 23% free cash flow yield. Our fifth consecutive increase to our quarterly dividend and approximately 31% projected return on capital employed continues to competitively differentiate us versus both our peers and the S&P 500 by delivering on our unique shareholder value proposition."

Enhancing 2022 Projections

The Company recently announced its modified 2022 capital program of $2.6 to $2.7 billion from $2.3 billion, which is expected to enhance the Company's projected return on capital employed by 2.0% over its originally projected 21% return on capital employed at $80 WTI and $3.50 HH.

Adjusting for current commodity prices, the Company's projected return on capital employed is increasing to approximately 31% in 2022. The Company is also projecting a 40% or lower reinvestment rate, versus approximately 45% in the original capital program.

The Company has updated its 2022 annual oil production guidance to 200 to 210 MBopd from 195 to 205 MBopd. This is inclusive of production from the closing of the Company's Powder River Basin acquisition on March 25, 2022, through December 31, 2022. The Company is also projecting a December 2022 oil production exit rate of approximately 220 to 230 MBopd. Additionally, the Company has updated its 2022 annual natural gas production guidance to 1,100 MMcfpd to 1,200 MMcfpd from 1,040 to 1,140 MMcfpd.

The updated 2022 capital program is projected to generate approximately $6.5 to $7.0 billion of cash flow from operations (inclusive of approximately $450 million working capital adjustment) and $4.3 to $4.7 billion of free cash flow (non-GAAP) for full-year 2022, inclusive of first quarter 2022 actuals and strip WTI and Henry Hub prices as of May 2, 2022, for the remainder of the year. The Company's full-year 2022 free cash flow projection equates to a 21% to 23% free cash flow yield (non-GAAP).

The Company is improving its oil and natural gas differentials given strong pricing realizations. 2022 crude oil differentials guidance per barrel of oil is now projected to average ($2.50) to ($3.50) and 2022 natural gas differentials guidance per Mcf is now projected to average a premium of $0.25 to $1.00.

1Q 2022 Results Overview

The Company reported net income of $597.8 million, or $1.65 per diluted share, for the quarter ended March 31, 2022. In first quarter 2022, typically excluded items in aggregate represented $362.2 million, or $1.00 per diluted share, of Continental's reported net income. Adjusted net income for first quarter 2022 was $960.0 million, or $2.65 per diluted share (non-GAAP). Net cash provided by operating activities for first quarter 2022 was $1.50 billion, and EBITDAX was $1.84 billion (non-GAAP).

Adjusted net income, adjusted net income per share, EBITDAX, free cash flow, free cash flow yield, net debt, net sales prices, and cash general and administrative (G&A) expenses per barrel of oil equivalent (Boe) presented herein are non-GAAP financial measures. Definitions and explanations for how these measures relate to the most directly comparable U.S. generally accepted accounting principles (GAAP) financial measures are provided at the conclusion of this press release.

1Q22 Production & Operations Update

First quarter 2022 total production averaged 373.8 MBoepd. First quarter 2022 oil production averaged 194.8 MBopd. First quarter 2022 natural gas production averaged 1,074 MMcfpd.

The following table provides the Company's average daily production by region for the periods presented:

|

1Q |

1Q |

|||

|

Boe per day |

2022 |

2021 |

||

|

Bakken |

171,401 |

160,577 |

||

|

Anadarko Basin |

143,963 |

138,386 |

||

|

Powder River Basin |

11,653 |

2,464 |

||

|

Permian Basin |

40,248 |

- |

||

|

All other |

6,545 |

6,515 |

||

|

Total |

373,810 |

307,942 |

1Q22 Financial Update

John Hart, Chief Financial Officer & Executive Vice President of Strategic Planning, said: "The Company delivered a record quarter of adjusted earnings per share and exceptional free cash flow generation while executing the $450 million Powder River Basin acquisition and $63 million Summit carbon capture investment during the first quarter 2022. We continued to demonstrate our ongoing commitment to capital discipline and shareholder return of capital by reducing our total debt by $264 million and executing $100 million of share repurchases since year end 2021, while increasing our quarterly fixed dividend by 22% versus last quarter."

Increasing Shareholder Return of Capital

The Company's Board of Directors recently approved increasing the Company's quarterly dividend to $0.28 per share, payable on May 23, 2022, to stockholders of record on May 9, 2022. This dividend represents a $0.05, or approximately 22%, increase to the Company's $0.23 per share quarterly dividend paid in first quarter 2022 and equates to an approximate 2.0% annualized dividend yield, as of May 2, 2022, which exceeds the S&P 500 average yield. The Company continues to target maintaining a 2.0% or greater annualized dividend yield long term.

During first quarter 2022, the Company repurchased 1.84 million shares at an aggregate cost of $100 million. Cumulatively the Company has repurchased 18.81 million shares at an aggregate cost of $541 million (average of $28.76 per share), leaving approximately $960 million of authorized repurchasing capacity remaining under the $1.5 billion program.

During first quarter 2022, the Company reduced its total debt to $6.57 billion, with $264 million of total debt reduction since December 31, 2021. This is inclusive of the $450 million Powder River Basin acquisition and $63 million Summit carbon capture investment. The Company is accelerating its net debt reduction and is targeting $4.8 billion of total debt, which assumes a paydown of the Company's 2023 and 2024 senior notes, and $4.0 billion of net debt (non-GAAP) by year end 2022. At the end of first quarter 2022, the Company's net debt (non-GAAP) to annualized first quarter 2022 EBITDAX (non-GAAP) ratio was below 1.0x and is projected to be below 1.0x on a trailing twelve-month EBITDAX basis by the end of second quarter 2022.

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Gulfport Touts Super Long Lateral and Strategic Pivot To Gas Asset

-

Civitas Provides Update on Current Rigs & Frac Crews -

-

Large Permian E&P Talks 1Q'24; 282 Wells Planned for 2024 -

-

CNX Resources Cut Frac Activity 50%, Talks 1st Quarter Activity -

-

Large E&P To Defer Completion Activity, Build DUCs -

Mid-Continent News >>>

-

Crescent Energy Said to be in Advance Talks to Acquire Pure Play Permian, Vital Energy -

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

Mid-Continent - Anadarko Basin News >>>

-

$2.4B Deal Gives MPLX Sour Gas Edge in Permian -

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD