Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets

Continental Resources Fourth Quarter, Full Year 2021 Results

Continental Resources Inc. announced its full-year 2021 and fourth quarter 2021 operating and financial results.

2021 Highlights:

- $1.66 B Net Income; $4.56 per Diluted Share ($1.70 B Adj. Net Income; $4.66 per Adj Share (Non-GAAP))

- Company Record $3.97 B Cash Flow from Operations (CFO) & $2.64 B Free Cash Flow (FCF) (Non-GAAP)

- 14.6% Return on Capital Employed1 (ROCE)

- Increasing Quarterly Dividend to $0.23 per Share (~1.7% Dividend Yield2); Targeting 2.0% or Greater Yield Long Term

- Increasing Share Buyback Program from $1.0 B to $1.5 B (Inclusive of $441 MM Repurchased to Date)

The Company reported full-year 2021 net income of $1.66 billion, or $4.56 per diluted share. For full-year 2021, typically excluded items in aggregate represented $39.0 million, or $0.10 per diluted share, of Continental's reported net income. Adjusted net income for full-year 2021 was $1.70 billion, or $4.66 per diluted share (non-GAAP). Net cash provided by operating activities for full-year 2021 was $3.97 billion and EBITDAX was $4.46 billion (non-GAAP).

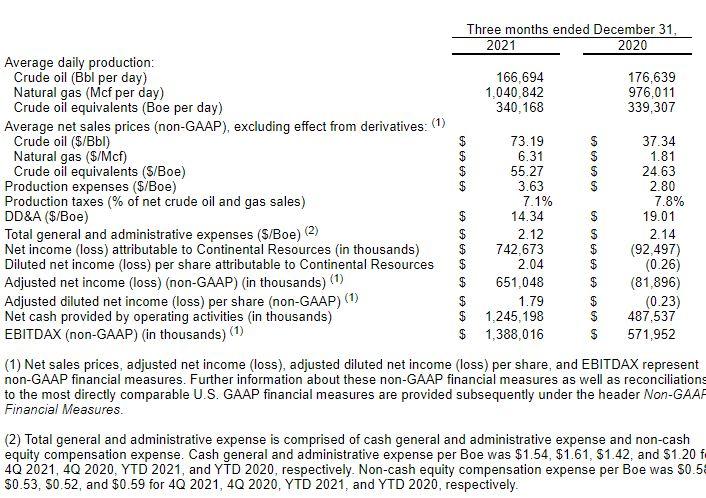

The Company reported net income of $742.7 million, or $2.04 per diluted share, for the quarter ended December 31, 2021. In fourth quarter 2021, typically excluded items in aggregate represented ($91.6) million, or ($0.25) per diluted share, of Continental's reported net income. Adjusted net income for fourth quarter 2021 was $651.0 million, or $1.79 per diluted share (non-GAAP). Net cash provided by operating activities for fourth quarter 2021 was $1.25 billion and EBITDAX was $1.39 billion (non-GAAP).

Adjusted net income (loss), adjusted net income (loss) per share, EBITDAX, free cash flow, free cash flow yield, net debt, net sales prices and cash general and administrative (G&A) expenses per barrel of oil equivalent (Boe) presented herein are non-GAAP financial measures. Definitions and explanations for how these measures relate to the most directly comparable U.S. generally accepted accounting principles (GAAP) financial measures are provided at the conclusion of this press release.

2021 Production & Operations Update

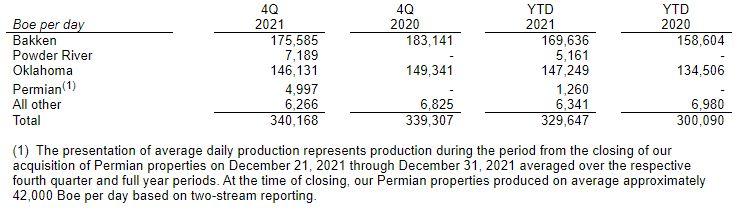

Full-year 2021 total production averaged 329.6 MBoepd. Full-year 2021 oil production averaged 160.6 MBopd. Full-year 2021 natural gas production averaged 1,014 MMcfpd. Fourth quarter 2021 total production averaged 340.2 MBoepd. Fourth quarter 2021 oil production averaged 166.7 MBopd. Fourth quarter 2021 natural gas production averaged 1,041 MMcfpd. The following table provides the Company's average daily production by region for the periods presented:

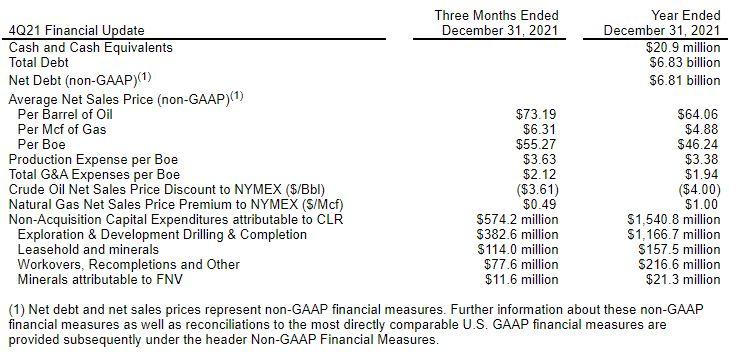

2021 Financial Update

Return of Capital to Shareholders

The Company's Board of Directors recently approved increasing the Company's quarterly dividend to $0.23 per share, payable on March 4, 2022 to stockholders of record on February 22, 2022. This dividend represents a $0.03, or 15%, increase to the Company's $0.20 per share quarterly dividend paid in fourth quarter 2021 and equates to an approximately 1.7% annualized dividend yield, as of February 8, 2022. The Company is targeting a 2% or greater annualized dividend yield long term. The Company is also increasing its existing share repurchase program from $1.0 billion to $1.5 billion, which is inclusive of $441 million repurchased to date. The Company has repurchased 17 million shares to date at an average price of $26.00, which includes 3.2 million shares repurchased in 2021 at an average price of $38.74.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

Mid-Continent News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

From Hedge Funds to Supermajors: Everyone Wants Hub-Linked Gas

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

Mid-Continent - Anadarko Basin News >>>

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

SM Energy Hits Record Output; Driven by Uinta

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative -

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -