Top Story | Field Development | Exclusives / Features

Coterra’s Strategic Pivot: Realigning Rig Activity and Capital Deployment in 2025

Operational Adjustments: From Peak Activity to Precision Targeting

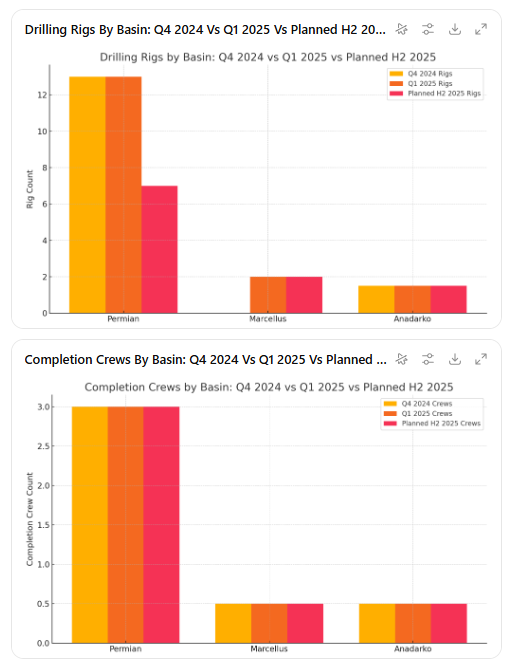

The Permian Basin, long Coterra’s oil production growth engine, saw a spike in rig count to 13 rigs by the end of Q4 2024, following the closing of the Franklin Mountain Energy and Avant Natural Resources acquisitions. However, as macroeconomic uncertainty and oil price headwinds emerged in early 2025, management revised its forward plan.

Beginning in the second half of 2025, Permian rig count will be reduced to 7, marking a 30% cut from original guidance. This reduction is expected to trim $150 million from Permian capital expenditures while still preserving full-year oil production guidance.

Meanwhile, the Marcellus — benefiting from strengthening gas prices — is getting more attention. After operating zero rigs in Q4, Coterra deployed two gas-directed rigs in April 2025, and expects to keep them running into H2, potentially through year-end. Anadarko activity remains steady with 1.5 rigs and 0.5 completion crews.

Frac Crew Deployment: Holding Steady, Supporting Flexibility

Despite rig count reductions, Coterra is maintaining its completion crew levels across all basins, including three frac crews in the Permian. This suggests a focus on drawing down the drilled-but-uncompleted (DUC) inventory and maintaining production efficiency without overcommitting to new drilling.

This steady crew deployment also highlights Coterra’s operational agility: its short-term service contracts and minimal marketing commitments allow it to flex activity quickly in response to shifting price signals and basin economics.

Strategic Impacts and Financial Implications

These activity shifts align tightly with Coterra’s 2025 goals:

-

Revised capital guidance lowered to $2.0–$2.3 billion, with a reinvestment rate of ~50%.

-

Free cash flow is projected at $2.1 billion, allowing Coterra to fund its dividend, reduce term loan debt, and execute opportunistic share buybacks.

-

The company reiterated its commitment to return 50%+ of FCF to shareholders, while prioritizing debt reduction in the near term.

Related Categories :

Exclusives / Features

More Exclusives / Features News

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

Silent Surge: Operator Tops Antero in Utica Well Performance -

-

Gas Players : A Comparative Analsysis -

-

The Permian Play: How ExxonMobil Is Rewriting the Shale Narrative

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

Northeast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020