Quarterly / Earnings Reports | Fourth Quarter (4Q) Update | Financial Results | Capital Markets | Drilling Program-Rig Count | Capital Expenditure - 2023

Crescent Energy 4Q, Full Year 2022 Results; Maintenance Capital for 2023

Crescent Energy Company announced its financial and operating results for the fourth quarter and full year 2022 as well as its 2023 guidance.

2023 Outlook

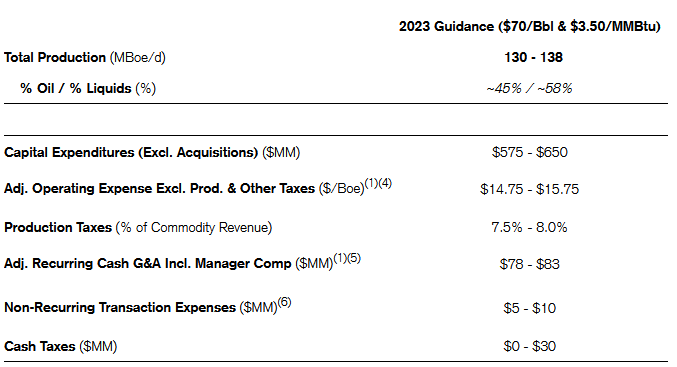

Crescent's 2023 outlook is in-line with the Company's historical focus on generating significant free cash flow, exercising prudent risk management and delivering attractive returns on investment, and assumes pricing of $70/Bbl WTI and $3.50/MMBtu Henry Hub. Crescent's capital program is allocated approximately 85% to its operated assets in the Eagle Ford and Uinta. Non-operated activity and other capital expenditures are expected to comprise approximately 15% of total investment predominately focused on non-operated assets in the Eagle Ford, Permian and DJ basins. Approximately $25 million of capex is carried over from the fourth quarter of 2022.

Full Year 2022 Highlights:

- Completed the year within guidance on production, cash flow and capital expenditures when adjusted for commodity prices and divestitures

- Reported $481 million of net income and $582 million of Adjusted Net Income(1)

- Generated $1.2 billion of Adjusted EBITDAX(1), $1.0 billion of Operating Cash Flow and $484 million of Levered Free Cash Flow(1)

- Produced 138 MBoe/d; oil and liquids comprised 44% and 58% of volumes, respectively

- Operated two rigs and successfully integrated newly acquired assets

- Continued focus on strong return of capital to shareholders through quarterly dividends and opportunistic share buybacks, which represented $143 million or a 7% yield(2) on a full year basis

- Reduced Net LTM Leverage(1) to 1.0x, in-line with the Company's long-term target

- Paid down approximately $300 million of net debt subsequent to closing the Uinta basin acquisition in Q1 2022, extended debt maturities and divested approximately $100 million of assets

- Increased public float by 15% and reduced shares outstanding by 2%

- Disclosed year-end proved reserves of 573 MMBoe, up 8% over prior year, with a SEC PV-10 value of $9.6 billion(1)(3). Approximately 80% were proved developed and 56% were liquids

- Announced 2023 outlook: maintenance program with planned capital investments of $575 - $650 million, excluding acquisitions, slightly lower than 2022 levels at the midpoint

Crescent CEO David Rockecharlie said, "Our team executed extremely well in 2022. Consistent with our priorities, we generated significant cash flow, returned capital to investors and further strengthened the balance sheet. We closed and integrated accretive acquisitions, accessed the capital markets on multiple occasions and unlocked significant value by investing in high-return oil development. We closed out our first year as a public company and entered 2023 with a disciplined investment plan designed to maintain flexibility and create value for our shareholders by executing our proven acquire and exploit strategy in what we see as an attractive market backdrop."

Fourth Quarter 2022 Results

Crescent reported $49 million of net income and $114 million of Adjusted Net Income(1) in the fourth quarter. The Company generated $290 million of Adjusted EBITDAX(1), $215 million of Operating Cash Flow and $113 million of Levered Free Cash Flow(1) for the period.

Fourth quarter production was in-line with expectations and averaged 139 MBoe/d (45% oil and 58% liquids). The decrease quarter-over-quarter was primarily related to the sale of Permian assets, fewer planned completions and winter weather impacts in late 2022. Average realized price for the fourth quarter, including and excluding the effect of commodity derivatives, totaled $42.74 and $52.50 per Boe, respectively. Operating expense and operating expense excluding production and other taxes, stated on a per Boe basis, were $19.92 and $15.63 for the quarter, respectively. G&A expense and Adjusted Recurring Cash G&A(1) (includes manager compensation and excludes non-cash equity-based compensation) totaled $1.99 and $1.73 per Boe, respectively.

Crescent operated one rig in the Uinta and one rig in the Eagle Ford during the fourth quarter and incurred capital investments of $156 million. The Company drilled 5 and 10 gross operated wells and brought online 7 and 5 gross operated wells in the Uinta and Eagle Ford, respectively, during the quarter.

Full Year 2022 Results

Crescent reported $481 million of net income and $582 million of Adjusted Net Income(1) for the year. The Company generated $1.2 billion of Adjusted EBITDAX(1), $1.0 billion of Operating Cash Flow and $484 million of Levered Free Cash Flow(1) in 2022. Full year production averaged 138 MBoe/d (44% oil and 58% liquids). Full year results were in-line with beginning of the year guidance when adjusted for divestitures and commodity prices.

Average realized price for the full year 2022, including and excluding the effect of commodity derivatives, totaled $44.16 and $59.62 per Boe, respectively. Operating expense and operating expense excluding production and other taxes, stated on a per Boe basis, were $20.11 and $15.38 for the year, respectively, reflecting commodity-linked costs, inflationary impacts and opportunistic workover activities. G&A expense and Adjusted Recurring Cash G&A(1) (includes manager compensation and excludes non-cash equity-based compensation) totaled $1.69 and $1.55 per Boe, respectively.

Full year 2022 capital investments, excluding acquisitions, were $625 million, below the mid-point of guidance. Crescent continued to find safe and innovative ways to offset certain industry wide inflationary pressures with operational improvements and capital efficiencies. The Company drilled 22 and 29 gross operated wells and brought online 26 and 24 gross operated wells the Uinta and Eagle Ford, respectively, during the year.

Financial Position

Crescent maintains a strong balance sheet and a low leverage profile. In December, Crescent closed its previously announced sale of Permian assets for $80 million in cash. Proceeds were used to reduce outstanding borrowings on the Company's revolving credit facility (the "Credit Facility"). In February 2023, the Company issued $400 million aggregate principal amount of 9.250% Senior Unsecured Notes due 2028 (the "Notes Offering") and used net proceeds to repay amounts outstanding on its Credit Facility. As of December 31, 2022, on a pro forma basis for the Notes Offering, the Company had total long-term debt of $1.3 billion, a Net LTM Leverage(1) ratio of 1.0x, in-line with its stated long-term target and $1.1 billion of liquidity.

Return of Capital

The Company maintained a consistent cash return strategy during 2022 through a mix of quarterly dividends and opportunistic share buybacks. Crescent returned $143 million to shareholders in 2022, or a 7% yield(2) on a full year basis, through its dividend and share repurchases. The Company intends to continue returning capital to shareholders through cash dividends and opportunistic repurchases of Class B common stock and OpCo Units concurrent with future secondary equity offerings or in other privately negotiated transactions. Any such actions are subject to the Company's Board of Directors (the "Board") approval and other factors.

On March 7, 2023, the Board approved a fourth quarter cash dividend of $0.17 per share, payable on March 31, 2023, to shareholders of record as of the close of business on March 20, 2023.

Stewardship

Crescent strives to be good stewards of others' assets: our investors' capital, the environment and the communities in which we operate. In 2022, Crescent joined the Oil & Gas Methane Partnership 2.0 Initiative to enhance reporting of methane emissions (submission was rated the highest level, "Gold Standard") and released its 2021 ESG report that included benchmarks and targets for measuring future performance, notably to reduce absolute Scope 1 greenhouse gas emissions by 50% by 2027, relative to 2021 asset levels.

Risk Management

Crescent utilizes hedges to manage commodity price risks, protect the balance sheet and ensure returns on invested capital. Crescent is approximately 45% hedged in 2023 at the midpoint of its production guidance. Roughly half of the Company's current hedge book was entered into in connection with prior acquisitions. As certain acquisition hedges roll off, the Company will more fully participate at market pricing.

2022 Year-End Reserves

Crescent's year-end 2022 proved reserves totaled 573 MMBoe, of which 80% were proved developed and 56% were liquids. The first year decline rate of Crescent's proved developed producing reserves, based on production decline curves used in the Company's reserve report, is 22%.

Crescent's proved reserves and associated PV-0 and PV-10 estimates as of December 31, 2022 were prepared by Ryder Scott in accordance with applicable rules and guidelines of the Securities and Exchange Commission ("SEC"). At year-end, the Company's standardized measure of discounted future cash flows of proved reserves was $9.1 billion and PV-10(1)(3), utilizing SEC pricing, was $9.6 billion.

Related Categories :

Fourth Quarter (4Q) Update

More Fourth Quarter (4Q) Update News

-

Endeavor Talks 2023 Development Program; Rigs, Frac Crews -

-

W&T Offshore Fourth Quarter, Full Year 2022 Results; 2023 Guidance

-

Sitio Royalties Fourth Quarter, Full Year 2022 Results; IDs 2023 Guidance

-

Ranger Oil Fourth Quarter, Full Year 2022 Results

-

Earthstone Energy Talks 2022 Results; Plans Five-Rig Program for 2023

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Refracs That Compete: Eagle Ford Wells Return to Life

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

Rockies News >>>

-

Liberty Energy: Navigating the Frac Downturn with Efficiency, Innovation, and Strategic Focus -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -

-

Halliburton Warns of Deepening U.S. Frac Slowdown -

-

Oilfield Service Report : 13 New Leads/Company Formation & Contacts YTD

-

PE Firm Seeds Four New E&P Startups in Strategic Push In 2025 -