Reserves | Hedging | Capital Markets | Capital Expenditure | Capital Expenditure - 2022

Crescent Energy Unveils Eagle Ford-Focused 2022 Capex, D&C Program

Crescent Energy Co. provided initial 2022 guidance as well as its proved reserves and hedge portfolio.

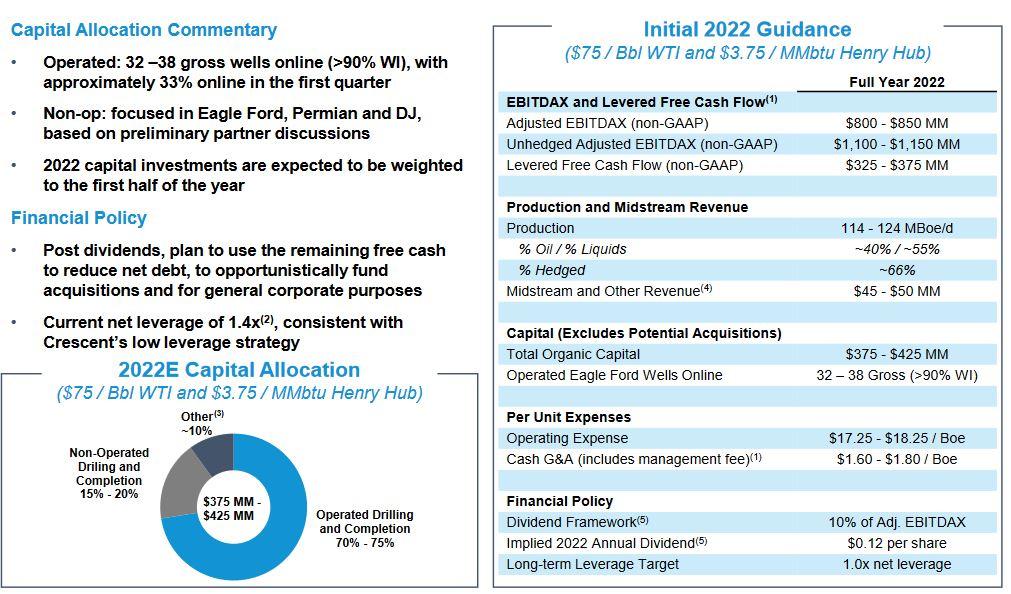

2022 Guidance

- Capex: $375-425 million

- Production: 114-124 MBOEPD

- D&C Plans: 32-38 gross wells TIL

Crescent's 2022 capital program is allocated 70 to 75% to its operated assets, primarily in the Eagle Ford, where the Company expects to bring online 32 - 38 gross operated wells with greater than 90% working interest on average. Capital investments are expected to be weighted to the first half of the year with approximately one-third of the operated Eagle Ford wells expected to come online in the first quarter. Non-operated activity is expected to comprise 15 to 20% of total investment across the Eagle Ford, Permian and DJ basins, based primarily on preliminary partner discussions.

Chief Executive Officer David Rockecharlie said: "For the last decade, management has executed a clearly defined strategy to deliver responsibly what the market requires today. Our stable asset base, financial strength and disciplined investment continue to generate significant free cash for shareholders. We see high growth potential in the acquisition market, and we will continue to create value by investing in our best organic and acquisition opportunities to generate attractive returns on capital."

John Goff, Crescent Chairman, said, "The objective of this merger was not only to combine the talents of two companies, but also to create the financial power to continue the strategy of growth through acquisitions. We believe the scale and financial flexibility that the merger provided will allow us to benefit from expected divestitures by the majors as well as continued consolidation in the industry. We are now well positioned for significant growth."

2022 Objectives

- Significant Free Cash Flow: Anticipate delivering $800 - $850 million of Adjusted EBITDAX and $325 - $375 million of levered free cash flow at $75 per barrel ("Bbl") WTI oil and $3.75 per million british thermal units ("MMBtu") NYMEX Henry Hub gas(1)

- Approximately two-thirds of estimated 2022 production hedged

- Disciplined Capital Investment Strategy: Organic capital investments expected to be $375 - $425 million, with operated Eagle Ford representing the largest area of investment

- Meaningful Return of Cash to Shareholders: Projected $80 - $85 million of annual dividends, based on its 10% of Adjusted EBITDAX dividend framework and initial Adj. EBITDAX guidance(2)

- Implies a quarterly dividend of $0.12/share at current shares outstanding(2)

- Intends to pay a dividend in the first quarter of 2022(2)

- Maintain Strong Balance Sheet: Current net leverage of 1.4x(3), consistent with Crescent's low leverage strategy

- Consistent Low-Decline Production: Estimated production of 114 - 124 thousand barrels of oil equivalent per day ("MBoe/d"), ~3% higher than pro forma production for the nine-month period ended September 30, 2021(3)

- Leading proved developed producing decline rate estimated at 17% in year one

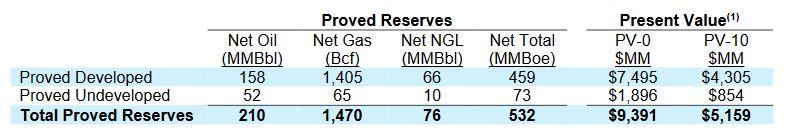

- Substantial Proved Reserves:Proved reserves at year-end 2021 totaled 532 million barrels of oil equivalent ("MMBoe"), of which 54% were liquids and 86% were proved developed.

- Proved reserves SEC PV-10 at year-end was approximately $5.2 billion(1)(4)

- Commitment to ESG: Published inaugural 2020 Environmental, Social and Governance ("ESG") report in December 2021 and identified ESG priorities and actions for 2022

- Attractive Acquisition Market: Strong growth potential through existing M&A strategy and current acquisition pipeline

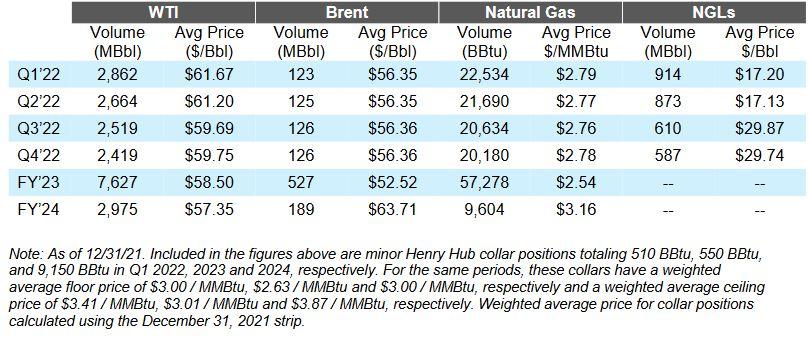

2022 Hedge Book

Proved Reserves

Related Categories :

Capital Expenditure - 2022

More Capital Expenditure - 2022 News

-

Capex Plans Jump After 2Q: Nearly 30 E&P Companies Raise 2022 Budgets -

-

Civeo Corp. Second Quarter 2022 Results; Raises Guidances

-

2022 Guidance Growth: Several Operators Bolster Capex, Production Outlook -

-

PDC Updates Budget Following Great Western Deal; Adds $50MM

-

Enerplus Bets on Bakken for 2022; Drill 50 Wells, 1.5 Rigs -

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -