Hedging | Capital Markets | Capital Expenditure | Drilling Program - Wells | Corporate Strategy | Capital Expenditure - 2021

Crew to Ramp Up Spending by Over 300% in 2021; Wells, Production Plans

Crew Energy Inc. has reported its 2021 capital plans as well as its outlook for 2022.

It will focus its program on its Montney assets.

2021 Plans

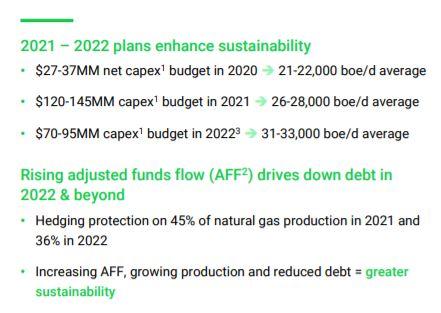

- Capital Budget: $120-145 million - up 314% vs. 2020's $32 million budget

- Well Plans: Drill 19 wells / Complete 14-21 wells (all in Greater Septimus Area of BC)

- Average Production: 26,000-28,000 BOEPD - up 26% from 2020 (exit rate estimate of 30,000+ BOEPD)

2022 Outlook

- Capital Budget: $70 to $95 million - down 38% from 2021 plans

- Well Plans: Drill 9 wells / Complete 9-16 wells (all in Greater Septimus Area of BC)

- Average Production: 31,000 to 33,000 BOEPD (estimates an exit rate of over 33,000 BOEPD)

Hedging

Average forward natural gas prices for 2021 and 2022 have been higher than they have been since 2014. Crew acted quickly and took the opportunity to lock in approximately 45% of our forecast natural gas production for 2021 at an average price of $2.48 per Gigajoule ("GJ") (or $3.08 per thousand cubic feet ("mcf") calculated using Crew's heat content factor) and approximately 36% of targeted natural gas production for 2022 at an average price of $2.46 per GJ (or $3.05 per mcf using Crew's heat content factor). This program has enabled the Company to underpin a material portion of AFF for both years, in addition to securing attractive payouts2 on capital investments targeting an estimated 11 to 14 months.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Canada News >>>

-

Topaz Energy Expands Montney Royalty Footprint -

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Large Permian E&P Cuts Capex;Outlines New D&C Plans, 2024

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

6.jpg&new_width=60&new_height=60&imgsize=false)