Drilling / Well Results | Quarterly / Earnings Reports | First Quarter (1Q) Update | IP Rates-24 Hour | Drilling Activity | Drilling Program-Rig Count

Devon Touts Bone Spring IP24s of 10,000 BOEPD in Q1; Adds Rigs in Eagle Ford, PRB

Devon Energy reported its Q1 2019 results. Highlights are below.

Highlights:

- Five "Prolific" Bone Spring Wells: These wells averaged initial 24-hour production rates in excess of 10,000 BOEPD, of which approximately 80% oil.

- Added third rig to Eagle Ford program

- Increasing Powder River activity - four rigs / dedicated frac crew

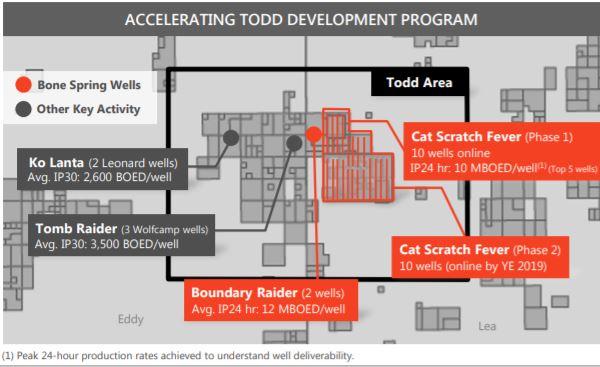

Delaware Basin "Cat Scratch Fever" Wells Impress - 10,000 BOEPD IP24s

First-quarter operating results in the Delaware were highlighted by five prolific Cat Scratch Fever wells targeting a second Bone Spring interval in southwest Lea County, New Mexico.

These wells averaged initial 24-hour production rates in excess of 10,000 Boe per day per well, of which approximately 80% oil.

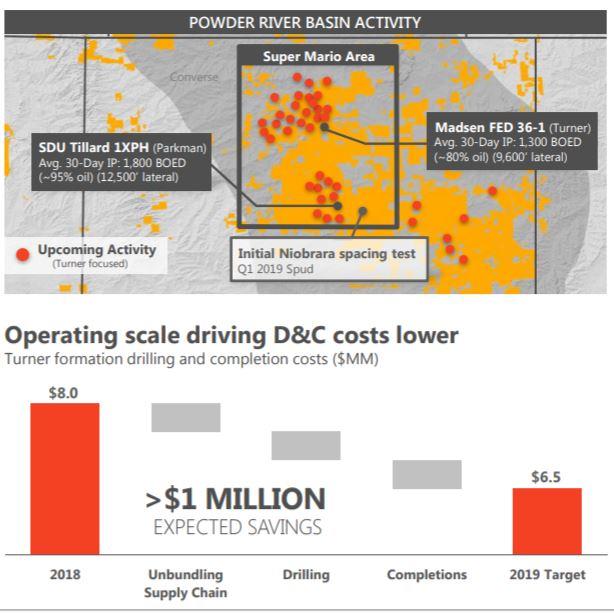

Powder River Highlights

Latest well results:

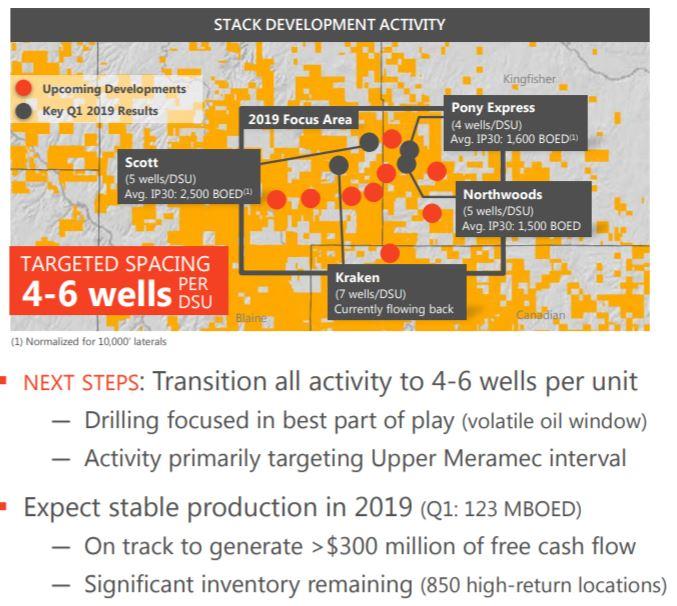

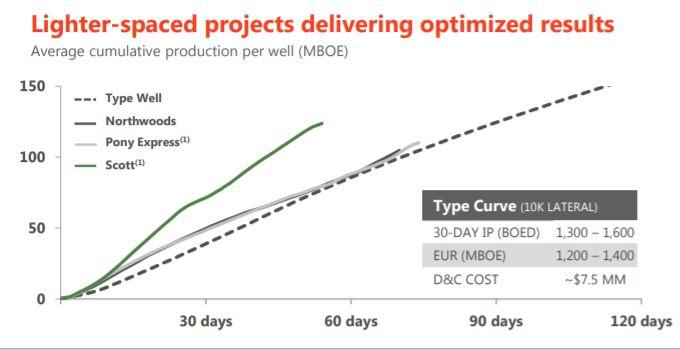

STACK Highlights

Q1 Production Down -25% YOY Due to Asset Sales; Strong Light Oil, Delaware Output Growth

Q1 Production: Net production for retained U.S. assets averaged 308,000 BOEPD, exceeding midpoint guidance by 27,000 BOEPD - this is down -25% YOY from 413,000 BOEPD in Q1 2018 (due to asset sales - Non-core Delaware / Barnett)

- Of this total, oil and liquids production accounted for nearly 70% of total volumes.

First-quarter production was highlighted by results from Devon’s retained U.S. oil business. Light-oil production from these assets averaged 138,000 barrels per day - up +24% YOY. This result exceeded the high-end of guidance by 8,000 barrels per day.

The strongest asset-level performance during the first quarter was from the company’s Delaware Basin properties that delivered prolific growth in high-margin production. Net production increased 76% YOY, with total volumes in the Delaware to 107,000 BOEPD.

Raising 2019 Light-Oil Production Outlook

Based on the strong year-to-date results, Devon is raising the oil production outlook for its retained U.S. business in 2019. The midpoint of the company’s full-year guidance now represents an estimated oil growth rate of 17% compared to 2018, up from the previous guidance of 15%.

Capital Spending Below Q1 Guidance; No Change to 2019 Outlook

In addition to the strong production performance, the company maintained discipline with its capital program. Devon’s upstream capital spending for its retained U.S. oil business was $457 million in the first quarter, which was $43 million, or 9 percent below the company’s midpoint guidance. This level of capital investment represents 24 percent of Devon’s 2019 upstream budget.

For the full-year 2019, Devon has made no modifications to its capital outlook and expects upstream capital spending for retained assets to range between $1.8 billion and $2.0 billion.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Daily Equivalent(boe/d) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Gulf Coast News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -