Drilling & Completions | Quarterly / Earnings Reports | First Quarter (1Q) Update | Deals - Acquisition, Mergers, Divestitures | Financial Results | Capital Markets | Drilling Activity

Diamondback Energy First Quarter 2021 Results

Diamondback Energy, Inc. reported its Q1 2021 results.

Q1 Highlights:

- Previously announced Q1 2021 average production of 184.2 MBO/d (307.4 MBOE/d)

- Generated Q1 2021 cash flow from operating activities of $624 million. Operating Cash Flow Before Working Capital Changes (as defined and reconciled below) of $627 million

- Q1 2021 cash capital expenditures of $296 million; Q1 2021 activity-based capital expenditures incurred of approximately $267 million

- Generated Q1 2021 Free Cash Flow (as defined and reconciled below) of $331 million

- Q1 2021 cash operating costs of $8.06 per BOE; including cash general and administrative ("G&A") expenses of $0.54 per BOE and lease operating expenses ("LOE") of $3.69 per BOE

- Closed the previously announced acquisition of assets from Guidon Operating LLC ("Guidon") and the acquisition of QEP Resources, Inc. ("QEP") in an all stock merger, adding an aggregate of over 80,000 net acres to our asset base in the Permian Basin and generating significant synergies

- Signed definitive agreements in the second quarter of 2021 to divest Williston Basin assets acquired in the merger with QEP and non-core Permian Basin assets for total consideration of $832 million, subject to certain closing adjustments; assets being sold have estimated full year 2021 net production of approximately 16 MBO/d (28 MBOE/d)

- Flared 0.75% (1.0% including QEP) of gross natural gas production in the first quarter of 2021

- Received $103 million federal net operating loss carryback and alternative minimum tax credit refund in January 2021, which included $3 million of interest income

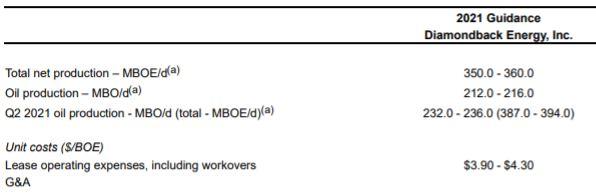

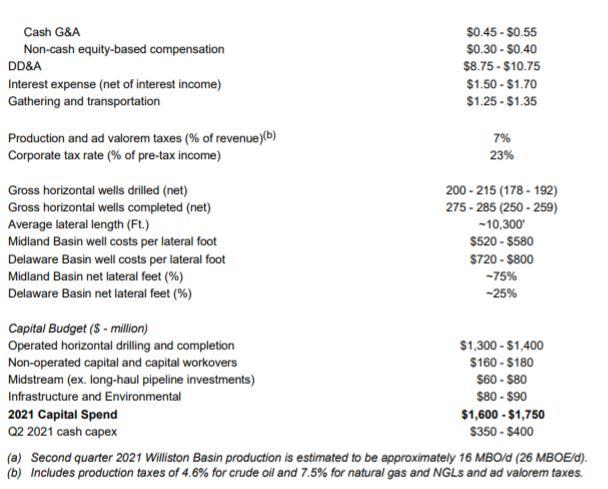

- Initiating Q2 2021 production guidance of 232.0 - 236.0 MBO/d (387.0 - 394.0 MBOE/d) and cash capex guidance of $350 - $400 million

CEO Travis Stice said: "Diamondback started 2021 with a successful first quarter, effectively overcoming the production obstacles presented by Winter Storm Uri while keeping our capital and operating costs near all-time lows. As a result, we generated over $330 million of Free Cash Flow in the first quarter. At current strip pricing, and pro forma for our asset sales announced today, we expect to continue generating significant Free Cash Flow in 2021. This Free Cash Flow, coupled with the cash proceeds from the successful execution of our three non-core asset sales announced today, will allow us to accelerate our debt reduction program, further strengthening our balance sheet.

Mr. Stice continued, "We continue to be pleased with the seamless integration of both the Guidon and QEP assets, and we are achieving our synergy targets ahead of schedule and in excess of those highlighted during the acquisition announcement. This progress only adds to our 'exploit and return' strategy of spending maintenance capital to hold oil production flat, while using Free Cash Flow to reduce debt and return cash to stockholders."

Pending Bakken Sale

Click here to access the deal in Shale Expert's M&A Database

- Divesting approximately 95,000 net acres in the Williston Basin; a complete Williston exit for Diamondback

- Gross purchase price of $745 million, subject to certain closing adjustments; net proceeds expected to be applied towards debt reduction

- Assets being sold have estimated net production of approximately 15 MBO/d (25 MBOE/d) for the full year 2021, including approximately 12 MBO/d (19 MBOE/d) of estimated net production attributable to the Williston Basin assets acquired in the merger with QEP from the March 17, 2021 closing date through year end 2021

- Transaction expected to close in the third quarter of 2021, subject to continued diligence and closing conditions

Goldman Sachs & Co. LLC is acting as exclusive financial advisor to Diamondback for the Williston Basin sale, with Latham & Watkins LLP serving as legal advisor to Diamondback.

Pending Permian Deal

Click here to access the deal in Shale Expert's M&A Database

- Divesting approximately 7,000 net acres of non-core Southern Midland Basin acreage in Upton county and approximately 1,300 net acres of non-core, non-operated Delaware Basin assets in Lea county, New Mexico

- Combined gross purchase price of $87 million, subject to certain closing adjustments; net proceeds expected to be applied towards debt reduction

- Assets being sold have estimated net production of approximately 900 BO/d (2,650 BOE/d) for the full year 2021 from 140 producing wells

- Both transactions expected to close in the second quarter of 2021, subject to continued diligence and closing conditions

Tudor, Pickering, & Holt Co. is acting as exclusive financial advisor to Diamondback for the Permian Basin asset sales.

Ops Update

The tables below provide a summary of operating activity for the first quarter of 2021. All activity detail assumes wells are counted only if they completed drilling or completion activities after the closing date of the Guidon or QEP transaction, as applicable.

| Total Activity (Gross Operated): | |||||

| Number of Wells Drilled | Number of Wells Completed | ||||

| Midland Basin | 41 | 42 | |||

| Delaware Basin | 8 | 25 | |||

| Total | 49 | 67 | |||

| Total Activity (Net Operated): | |||||

| Number of Wells Drilled | Number of Wells Completed | ||||

| Midland Basin | 40 | 37 | |||

| Delaware Basin | 7 | 23 | |||

| Total | 47 | 60 | |||

During the first quarter of 2021, Diamondback drilled 41 gross horizontal wells in the Midland Basin and eight gross horizontal wells in the Delaware Basin. The Company turned 42 operated horizontal wells to production in the Midland Basin and 25 operated horizontal wells to production in the Delaware Basin. The average lateral length for the wells completed during the first quarter was 10,331 feet. Operated completions during the first quarter consisted of 27 Wolfcamp A wells, 10 Lower Spraberry wells, eight Wolfcamp B wells, seven Middle Spraberry wells, six Second Bone Spring wells, four Jo Mill wells, three Third Bone Spring wells, one Barnett well and one Dean well.

Financial Update

Diamondback's first quarter 2021 net income was $220 million, or $1.33 per diluted share. Adjusted net income (a non-GAAP financial measure as defined and reconciled below) was $379 million, or $2.30 per diluted share.

First quarter 2021 Consolidated Adjusted EBITDA (as defined and reconciled below) was $845 million. Adjusted EBITDA net of non-controlling interest was $836 million.

As previously announced, first quarter 2021 average unhedged realized prices were $56.94 per barrel of oil, $3.05 per Mcf of natural gas and $22.94 per barrel of natural gas liquids, resulting in a total equivalent unhedged price of $42.36 per BOE.

Diamondback's cash operating costs for the first quarter of 2021 were $8.06 per BOE, including LOE of $3.69 per BOE, cash G&A expenses of $0.54 per BOE, production and ad valorem taxes of $2.71 per BOE and gathering and transportation expenses of $1.12 per BOE.

As of March 31, 2021, Diamondback had $100 million in standalone cash and $52 million of borrowings outstanding under its revolving credit facility, with approximately $1.9 billion available for future borrowing under the facility and $2 billion of total liquidity.

During the first quarter of 2021, Diamondback spent $273 million on drilling and completion, $7 million on midstream, $8 million on infrastructure and $8 million on non-operated properties, for total capital cash expenditures of $296 million.

Dividend

Diamondback announced today that the Company's Board of Directors declared a cash dividend of $0.40 per common share for the first quarter of 2021 payable on May 20, 2021, to stockholders of record at the close of business on May 13, 2021. Future dividends remain subject to review and approval at the discretion of the Company's Board of Directors.

2021 Guidance

Below is Diamondback's guidance for the full year 2021, which includes the initiation of second quarter production and capital guidance, and is pro forma for the pending asset divestitures announced today.

| Category | 2023 | 2024Est. Initial | Updated 2024 Guidance | %Difference (2023 vs 2024) |

| Total Capital Expenditure($mm) |

|

|

|

|

| Production Daily Equivalent(boe/d) |

|

|

|

|

| Production Oil(bbls/d) |

|

|

|

|

Related Categories :

First Quarter (1Q) Update

More First Quarter (1Q) Update News

-

Petrus Resources Ltd. First Quarter 2023 Results

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results

-

Rubellite Energy Inc. First Quarter 2023 Results

-

Bonterra Eneergy Corporation First Quarter 2023 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -