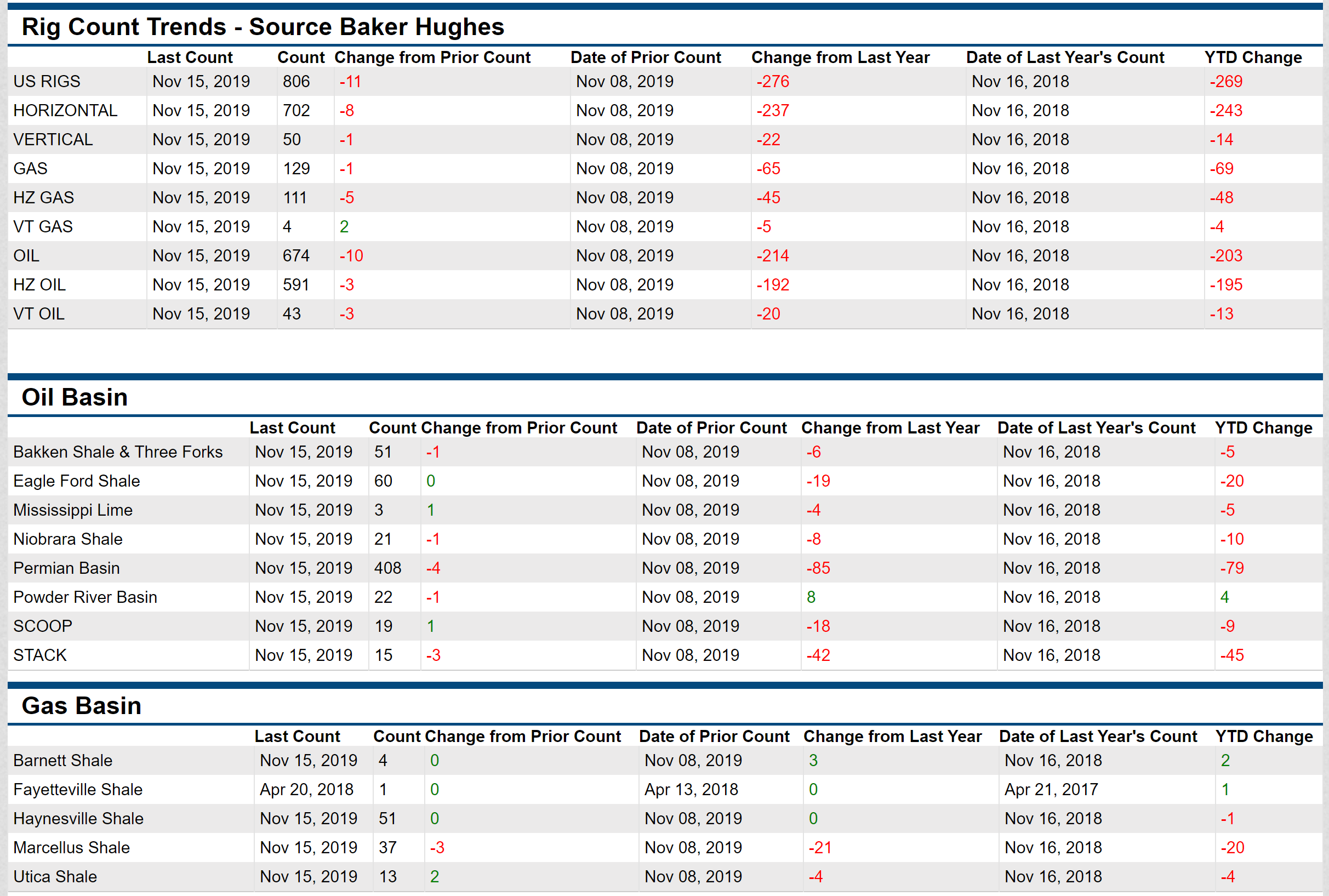

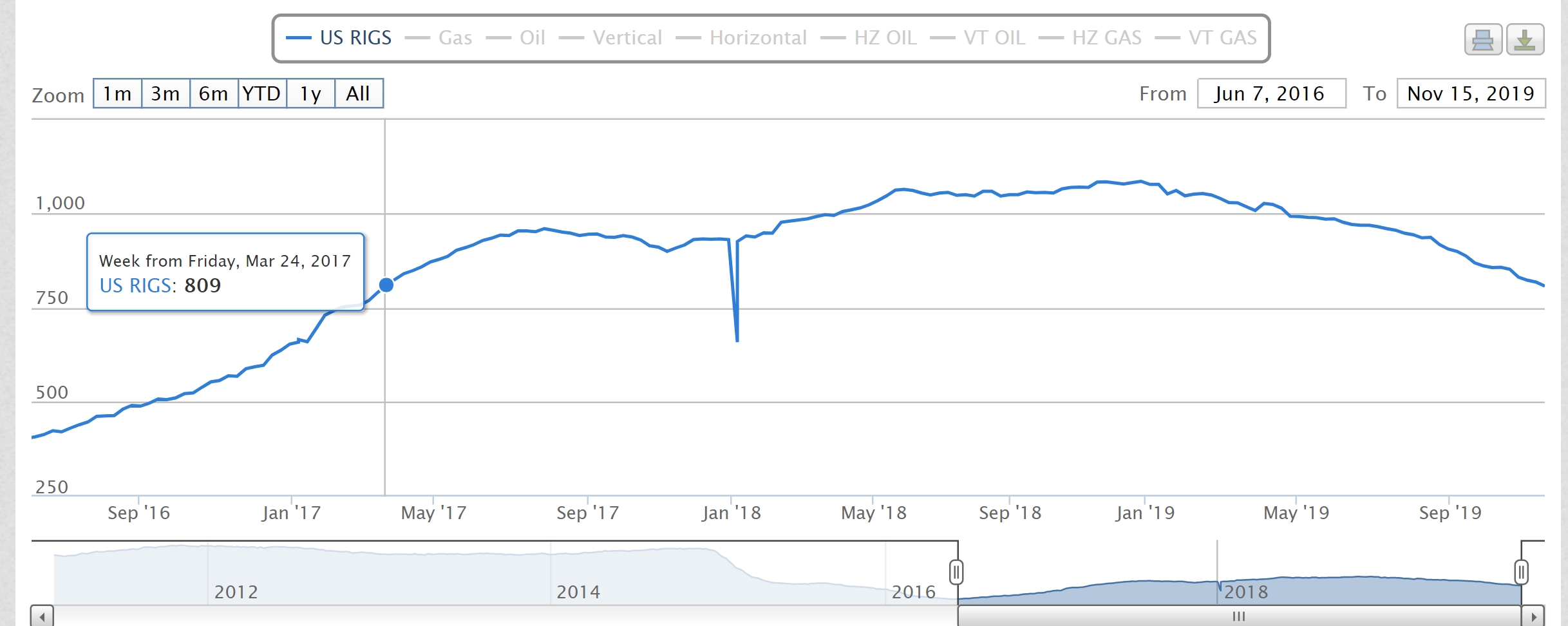

This week we saw rig count drop another 11 rigs to end the week at 806 Rigs, (702 Horizontal, 50 vertical) with 674 oil rigs and 129 gas rigs.

YTD we have dropped some 269 rigs. To access the full list of operators rig count by county, basin and entire US click here. The chart below shows a small snippet of those companies.

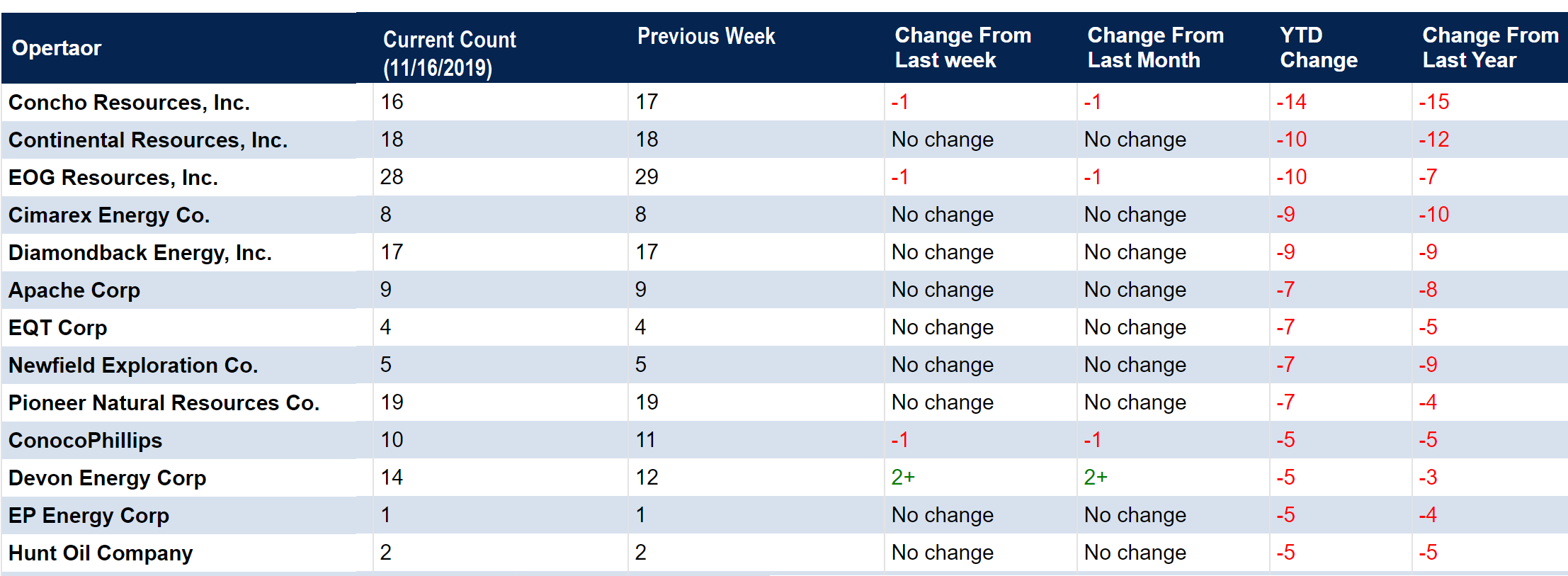

Who is cutting rigs? Almost everyone. Below is a list of operators who have cut the most. Click here for the full list.

Rig Count by Company

What are drilling contractors saying?

Nabors Drilling : "Customers continued to adjust their operations' tempo to lower cash flows, capital constraints and oil price worries."

Patterson UTI : "Both drilling and pressure pumping activity are expected to decline further in the fourth quarter, but recent customer conversations suggested our drilling rig activity will bottom in the fourth quarter and then a modest increase in late December and early January."

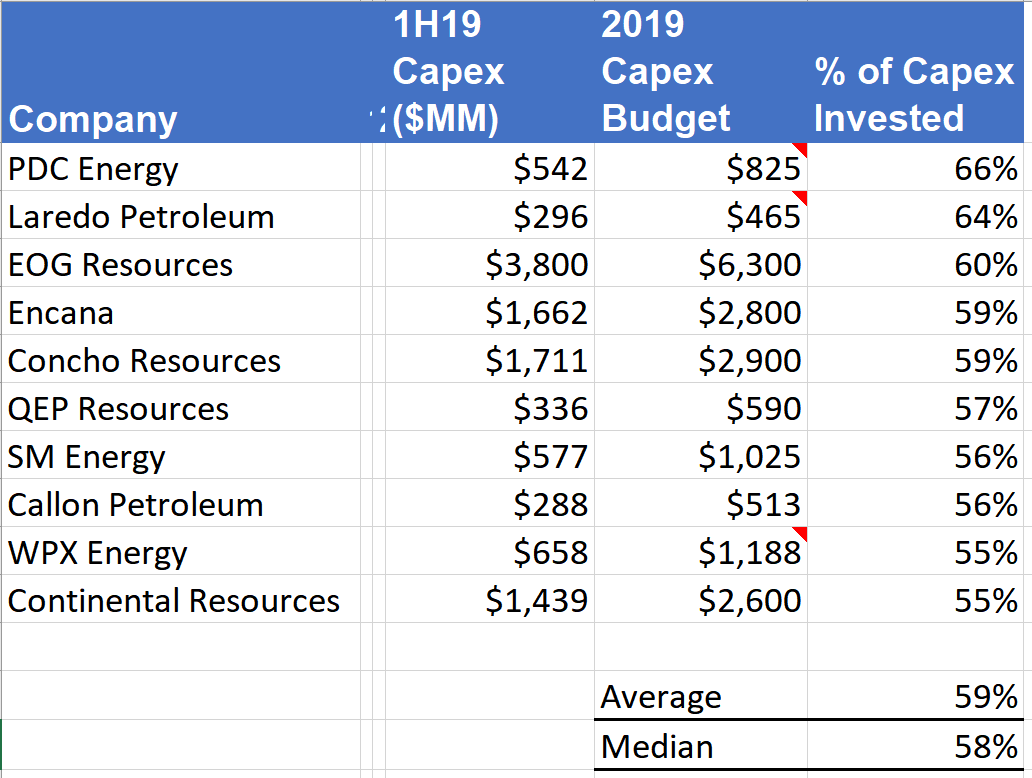

Helmerich & Payne : "Collectively, our customers appear to have outspent their budgets during the first six months of 2019 and have been making up for it in the second half. Reflective of these trends as well as customer conversations, we expect to see more stability in rig demand over the next couple of months and heading into calendar of 2020."

So what is the cause of such rapid reduction in rig count?

1. A lost of companies spent more than 60% of their FY- 2019 capex in the first half of the year

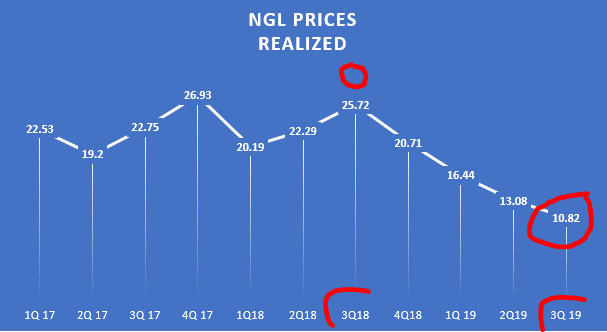

2. Coupled with first half spending, we saw a dramatic drop in NGL and gas prices.

Some of the operators who have cut the most in terms of rigs.

NGL Prices cut in half.

Capital Spending (front half weighted)

Related Categories :

Rig Count

More Rig Count News

-

SM Energy Hits Record Output; Driven by Uinta

-

EQT Provides an Update on Rigs & Frac Crews, Post Recent Transaction -

-

These Permian Companies Will Frac 3600 Wells In 2025, Using 160 Rigs & 55 Frac Crews -

-

Appalachia E&P Details 2025, Rig, Wells & Completion Crew Programs -

-

Patterson-UTI Expects +50 Rigs To be Added in 2023; PE-backed E&P To Lead.

Gulf Coast News >>>

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

ConocoPhillips to divest Anadarko Basin asset for $1.3B -

-

Silent Surge: Operator Tops Antero in Utica Well Performance

-

Gas Players : A Comparative Analsysis