Reserves | Capital Markets | Capital Expenditure | Drilling Program - Wells | Drilling Activity | Capital Expenditure - 2021

Earthstone Talks 2020 Capital Plan; Spending Up 73% from 2020

Earthstone Energy Inc. provided an operations update, released 2021 guidance and announced its year-end 2020 estimated proved reserves.

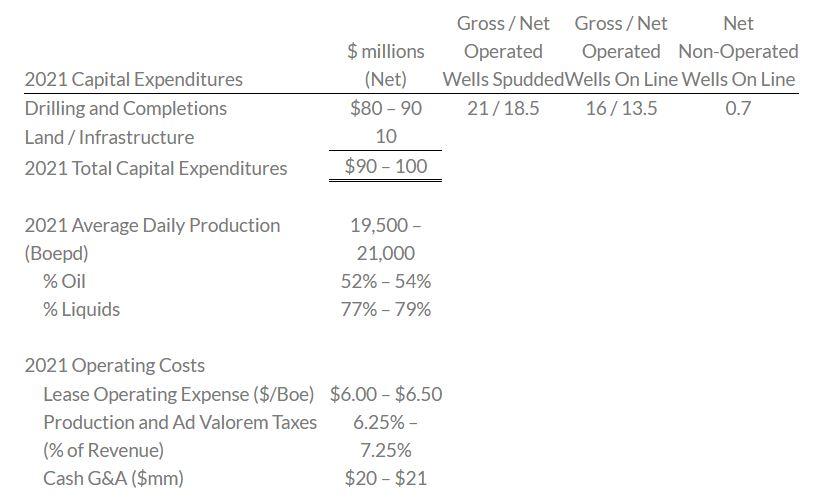

2021 Guidance

- 2021 Capex: $90-100 million - up 73% from 2020

- Production: 19,500-21,000 boepd (53% oil) - up 32% from year-end 2020

- Rigs: one-rig operated program on its acreage in the Midland Basin commencing in March

- Well Plans: Spud 21 gross / 18.5 net operated wells; Bring online 16 gross / 13.5 net operated wells and 0.7 net non-operated wells - double vs. 2020

2020 Review

The Company has estimated its oil and gas sales volumes for the fourth quarter of 2020 to be approximately 1.40 MMBoe or an average of approximately 15,232 Boepd (47% oil). For the year ended December 31, 2020, the Company estimates its annual sales volumes grew 15% to approximately 5.63 MMBoe, or an average of approximately 15,382 Boepd (56% oil) compared to 13,429 Boepd (63% oil) reported for the year ended December 31, 2019. The Company also announced its year-end 2020 SEC total estimated proved reserves of approximately 78.9 MMBoe.

Key highlights include:- Achieved record estimated average daily sales volumes in 2020 of 15,382 Boepd (56% oil), exceeding the top end of guidance of 14,500 Boepd by 6%

- 2021 production guidance of 19,500-21,000 Boepd (52%-54% oil) and $90-100 million of capital expenditures

- Estimated accrued capital expenditures of $20.3 million and $66.8 million for the fourth quarter of 2020 and full year 2020, respectively, slightly below the $67.5 million midpoint of full year guidance

- Reduced outstanding long-term debt in 2020 by 32%, from $170 million to $115 million

- Signed Purchase and Sale Agreement on the acquisition of Independence Resource Management, LLC ("IRM") on December 17, 2020

- Strong balance sheet and liquidity position with $100 million of undrawn capacity on a $360 million senior secured revolving credit facility and a cash balance of $15.3 million as of December 31, 2020 on a combined basis including the subsequent closing of Earthstone's acquisition of IRM on January 7, 2021

- Year-End 2020 SEC total estimated proved reserves were 78.9 MMBoe (49% Proved Developed; 51% oil)

Robert J. Anderson, President and Chief Executive Officer of Earthstone, stated, "Despite the challenges that 2020 brought to the industry, we continued to strengthen our Company in 2020. We managed to achieve Company record production levels in 2020 despite oil prices averaging over 30% less in 2020 vs. 2019 and reducing our capital expenditures by approximately 68%. Further, due to our strong hedge profile and active cost management, we expect to have among the very smallest year over year Adjusted EBITDAX impacts in the industry. During 2020 we paid down nearly one third of our outstanding debt and expect to end 2020 with a meaningful reduction in leverage vs. the 1.2x leverage in 2019. We ended 2020 in a stronger financial and strategic position than 2019."

"Additionally, we entered into an agreement to acquire IRM in December 2020, and closed the acquisition on January 7, 2021 and are rapidly integrating our businesses. We are excited to get back to work in 2021 with the commencement of a drilling program anticipated to begin late in the first quarter. We have designed an operating plan that we expect will generate significant free cash flow in 2021, while focusing on areas with the highest drilling returns. This free cash flow will be used to reduce debt further while we seek additional acquisition opportunities. We continue to be focused on consolidation and creating additional scale that we believe will result in continued improved cost structure and creation of shareholder value."

Liquidity Update

As of December 31, 2020, we had $1.5 million in cash and $115 million of long-term debt outstanding under our credit facility with a borrowing base of $240 million. With the $125 million of undrawn borrowing base capacity and $1.5 million in cash, we had total liquidity of approximately $126.5 million. Subsequent to year-end, Earthstone closed on its previously announced acquisition of IRM. When adjusted to include the acquisition of IRM, we had an estimated $15.3 million in cash and $260 million of long-term debt outstanding under our credit facility with a borrowing base of $360 million. With the $100 million of undrawn borrowing base capacity and $15.3 million in cash, we had total liquidity of approximately $115.3 million on a combined basis.

Operational Update

During 2020, the Company completed and turned to sales 9 gross / 9 net operated wells and had 3.1 net non-operated wells completed and turned to sales. The Company exited 2020 with 5 gross / 3.7 net wells that were drilled and awaiting completion. Completion activity has been initiated on these wells, located in Upton County, and the Company expects to turn these wells to sales late in the first quarter of 2021.

The Company completed 6 gross / 6 net wells on its Ratliff project in Upton County in December 2020. These wells targeted Wolfcamp A, Wolfcamp B Upper, Wolfcamp B Lower and Wolfcamp C zones and had an average completed lateral length of approximately 8,300 feet. Through the first 45 days of production, total aggregate production from the six wells has averaged 3,864 Boepd (87% oil) with current production of ~3,600 Boepd (86% oil). Two of the six wells are still cleaning up and have not yet reached peak 30-day production rates.

The Company is preparing to resume drilling operations with the deployment of a rig late in the first quarter of 2021. Initial plans are to commence drilling in Midland County on a three-well pad in our Hamman project and then on a four-well pad on the recently acquired IRM Spanish Pearl project. From there, the Company anticipates moving the rig to Upton County and drilling 10-11 wells. For the full year 2021 the Company anticipates drilling 16 gross / 14.8 net operated wells to total depth and spudding an additional 5 gross / 3.7 net operated wells. Including the 5 gross / 3.7 net wells in Upton County that are currently being completed, the Company anticipates completing and turning to sales a total of 16 gross / 13.5 net operated wells in 2021, with an average completed lateral length of approximately 6,500 feet.

The Company is focused on efficiently integrating the recently acquired IRM assets into our operations. IRM produced approximately 7,3182 Boepd (61% oil) in the fourth quarter of 2020.

Year-End 2020 SEC Estimated Proved Reserves

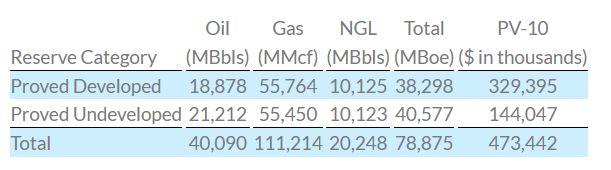

Earthstone Stand-Alone Year-End 2020 Estimated Proved Reserves Highlights:

- Proved Reserves of 78.9 MMBoe with corresponding PV-10 of $473 MM

- Proved Reserves are 51% oil, 26% natural gas liquids, and 23% natural gas

- Proved Reserves are 49% Proved Developed and 51% Proved Undeveloped

As shown in the table below, the Company's estimated proved reserves at year-end 2020, which were prepared in accordance with Securities and Exchange Commission ("SEC") guidelines by Cawley, Gillespie & Associates, Inc. ("CGA"), an independent petroleum engineering firm, were approximately 78.9 MMBOE.

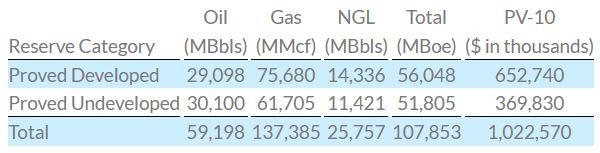

To illustrate the effects of commodity price fluctuations on estimated reserve quantities and present values and to illustrate the impact of the recent acquisition of IRM, which closed on January 7, 2021, Earthstone is also providing an alternative summary of estimated proved reserves. This alternative summary as shown in the table below has been prepared in accordance with Society of Petroleum Engineers' 2018 Petroleum Resources Management System utilizing constant benchmark prices of $50.00 per barrel for oil and $2.50 per MMBtu for natural gas.

Related Categories :

Capital Expenditure - 2021

More Capital Expenditure - 2021 News

-

Pine Cliff Energy Ups Spending, Production Plans by 10% for 2022

-

Whitecap Resources Unveils 2022 Budget; Up 12% vs. 2021

-

Southwestern Closes Acquisition of Indigo Natural Resources; Ups Capex

-

Altura Energy First Quarter 2021 Results

-

Razor Energy Corp. First Quarter 2021 Results

Permian News >>>

-

Seventeen (17) E&Ps; To Use 47 Frac Crews To Complete 2,800 Wells In 2024

-

These Permian Operators Plan to Complete/Frac 2,100 Wells IN 2024

-

Large E&P Chops Permian/Anadarko Basin Frac Activity by 30% In 2024

-

Permian E&P Ups 2024 Well Completed by +27% vs. 2023

-

Contrary to The Noise, U.S. Oil Production will Likely Growth 4-5% In 2024; A look Inside -

Permian - Midland Basin News >>>

-

New Permian E&P Company Score Capital; On The Hunt For Assets -

-

Chevron To Cut D&C Activity in U.S. Shale In 2024; Here is Where. -

-

An Early Look at Company 2024 Capital & Development Plans

-

EOG Resources Reports Third Quarter 2023 Results

-

A Look at Capital Spending By Company In First Half 2023; Budget Exhausion?