Exploration & Production | Quarterly / Earnings Reports

Emerald Oil Almost Doubles Production from 3Q 2012

Emerald Oil, Inc. has announced its results for the quarter ended September 30, 2013.

Increased third quarter production to 172,678 BOE, an average of 1,877 BOEPD and an increase of 35% and 93% compared to the second quarter of 2013 and third quarter of 2012, respectively.

McAndrew Rudisill, Emerald's Chief Executive Officer, stated, "Emerald's operated wells are strong. We are on course to deliver accelerated production growth for the remainder of the year and into 2014. Our land team recently completed a long-term leasing effort that added 34,000 net acres. These newly leased acres further expanded Emerald's core Low Rider area and added three new operated focus areas: Easy Rider in the West Nesson Area in Williams County, North Dakota, Emerald Pronghorn in Stark and Billings Counties, North Dakota and Emerald Lewis & Clark in McKenzie County, North Dakota, south of Low Rider. Our drilling program continues to see efficiency gains from reduced drilling days and lower completion costs. We are focused on fracking multiple newly drilled wells, optimizing existing well performance and improving associated field infrastructure in the fourth quarter for the upcoming winter. Today we are introducing our initial quarterly production and cost guidance for 2014. Emerald is focused on the delivery of meaningful production growth in 2014."

Capital Development Plan

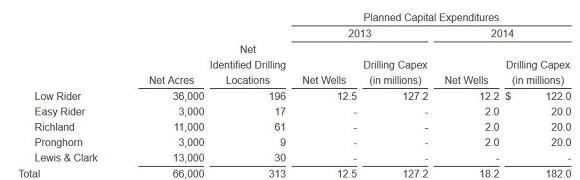

For the 12-month period ending December 31, 2013, Emerald plans to spend approximately $127.2 million to drill 12.0 net operated and 0.5 net non-operated wells in the Williston Basin, of which the Company has spent approximately $76.5 million through September 30, 2013. For the 12-month period ending December 31, 2013, the Company has also budgeted approximately $20.0 million to increase its operated acreage position in its core operated area in McKenzie County, North Dakota, which Emerald refers to as the Low Rider area, and elsewhere in the Williston Basin, with a specific focus on increasing the net working interest position in its operated wells. Emerald added a high specification drilling rig to accelerate development of its Williston Basin operated leasehold, which commenced drilling in June 2013. The rig is a 1,200 horsepower top drive long-reach horizontal-capable rig with the potential to upgrade with a "walking package" for infill efficiency.

Emerald expects to add a third horizontal-capable rig in 2014. For the 12-month period ending December 31, 2014, Emerald plans to spend approximately $182.0 million to drill 18.2 net operated wells in the Williston Basin at an average cost per net well of approximately $10.0 million. The Company has also budgeted approximately $25.0 million to increase its operated acreage position in its core operated areas.

The following table presents summary data for the Company's Williston Basin project area as of September 30, 2013 for the years ended December 31, 2013 and 2014:

Acreage Acquisitionbr />

On August 2, 2013, Emerald closed a transaction with a third party to acquire approximately 3,500 net acres of partially developed leasehold in McKenzie County, North Dakota, for approximately $10.5 million. The acquired acreage is directly southeast and contiguous to Emerald's existing Low Rider area in McKenzie County, North Dakota. The acquisition added eight potentially operated DSUs in the Company's Low Rider area.

On August 30, 2013, Emerald closed a transaction with a third party to acquire approximately 3,600 net acres of undeveloped leasehold in McKenzie County, North Dakota for approximately $3.6 million. The acquired acreage is directly south and contiguous to Emerald's existing operated area in McKenzie County, North Dakota. The acquisition added six potentially operated drilling spacing units in the Company's Low Rider Prospect in McKenzie County, North Dakota.

On September 17, 2013, Emerald leased approximately 30,672 net undeveloped leasehold acres in McKenzie, Billings and Stark Counties, North Dakota, for approximately $20.2 million. The lease acquisitions added 38 potentially operated drilling spacing units in Emerald's Low Rider, Easy Rider, Pronghorn and Lewis & Clark areas. Pursuant to the leases acquired, the Company entered into an agreement with a third party to drill at least five gross wells within the prospect area prior to September 17, 2015. The Company placed $10 million with an escrow agent, of which $2 million per well will be returned to Emerald with each well drilled within the term of the escrow agreement.

On September 19, 2013, Emerald entered into a purchase and sale agreement with a third party to acquire approximately 2,866 net acres of undeveloped leasehold in Williams County, North Dakota for approximately $3.2 million. The acquisition adds seven potentially operated DSUs in Emerald's Low Rider and Easy Rider areas. The purchase closed on October 9, 2013. On September 20, 2013, the Company leased an additional 313 net acres of undeveloped lease hold in the same area in Williams County, North Dakota for approximately $1.3 million.

Emerald's average working interest in its Low Rider area is now approximately 68%, and the Company continues to work toward increasing the average well working interest. On a pro forma basis to reflect closed and pending acquisitions, the Company has approximately 66,000 net acres in the Williston Basin, of which approximately 50,000 net acres are operable in McKenzie, Williams, Billings and Stark County, North Dakota, and 10,000 net acres are operable in Richland County, Montana.

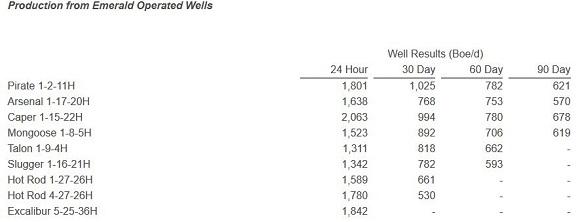

Well Development Activity

During the third quarter 2013, Emerald invested approximately $41.8 million on well development in the Williston Basin.

Third Quarter 2013 Results

Revenues from sales of oil and natural gas increased 144% for the three months ended September 30, 2013 compared to the three months ended September 30, 2012, driven primarily by a 93% increase in production volume as well as higher oil prices.

Production increased due to the development of 6.1 net productive operated wells in the Williston Basin from October 1, 2012 to September 30, 2013. This increase was partially offset by the sale of substantially all non-operated Williston Basin properties on September 6, 2013. During the three months ended September 30, 2013, the Company realized a $95.32 average price per barrel of oil (including realized derivatives) compared to an $82.10 average price per barrel of oil during the three months ended September 30, 2012. The average oil price differential during the three months ended September 30, 2013 was $8.34 per barrel, as compared to $10.08 per barrel in the three months ended September 30, 2012.