Financial Results | Capital Markets | Capital Expenditure | Capital Expenditure - 2022

Enerplus Talks 4Q21 Results, 2022 Plans; Will Divest Canadian Assets

Enerplus Corp. announced preliminary fourth quarter and full year 2021 production and capital spending, along with plans to initiate a divestment process for its Canadian assets.

In addition, the Company announced its intention to change its reporting currency to U.S. dollars and the future presentation of its production volumes to a "net", after deduction of royalty basis.

2022 Plans

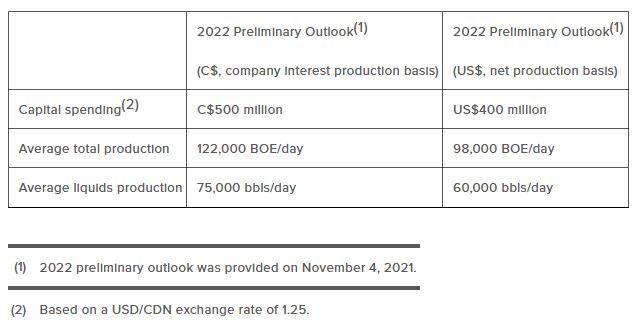

In November 2021, Enerplus announced a preliminary 2022 capital budget of C$500 million expected to result in average company interest production of approximately 122,000 BOE per day, including 75,000 barrels per day of liquids. Following the Company's change to U.S. dollar and net volume reporting, this preliminary budget corresponds to approximately US$400 million with net production of 98,000 BOE per day, including 60,000 barrels per day of liquids.

Enerplus plans to provide comprehensive 2022 guidance with its fourth quarter and full year 2021 operating and financial results on February 24, 2022.

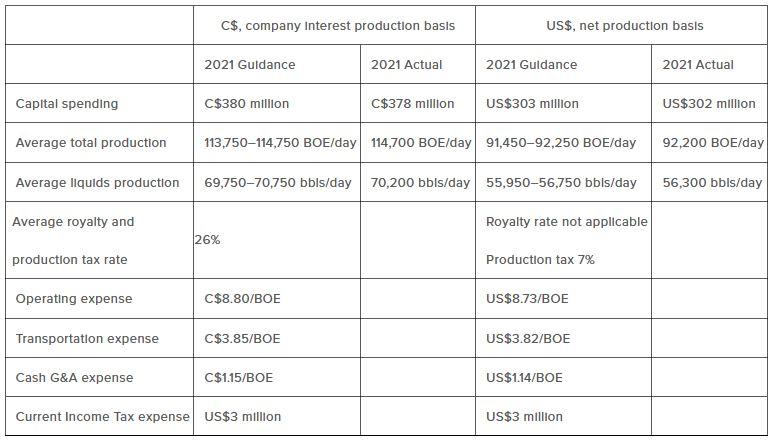

Summary tables at the end of this news release show the Company's 2021 guidance and preliminary results and 2022 preliminary outlook on both a Canadian dollar, company interest production basis and a U.S. dollar, net production basis.

4Q 2021 Ops Update

Fourth quarter 2021 total production was 128,000 BOE per day, which was at the high-end of the Company's guidance of 124,500 to 128,500 BOE per day. Fourth quarter liquids production was 81,000 barrels per day, in line with the Company's guidance of 80,000 to 83,000 barrels per day. Capital spending in the fourth quarter was C$102 million.

For the full year 2021, total production was 114,700 BOE per day, which was at the high-end of the Company's full year guidance of 113,750 to 114,750 BOE per day. Full year liquids production was 70,200 barrels per day, in line with the Company's full year guidance of 69,750 to 70,750 barrels per day. Capital spending in 2021 was C$378 million compared to guidance of C$380 million.

Divestment Process for Canadian Assets

As Enerplus continues to focus on its strategic position in the Williston Basin, the Company plans to initiate a divestment process for its Canadian assets. Production from Enerplus' Canadian assets averaged approximately 9,100 BOE per day ("company interest" basis) in the fourth quarter of 2021, representing 7% of the Company's total production.

If the marketing effort is successful, Enerplus would work to conclude the divestment process by mid-2022, and will continue to have a Canadian head office.

Change in Reporting Currency

Enerplus is electing to change its reporting currency from Canadian dollars to U.S. dollars since the majority of its crude oil and natural gas properties are in the U.S. The change in reporting currency is a voluntary change which is accounted for retrospectively. All prior periods will be restated to U.S. dollars.

In conjunction with the reporting currency change, Enerplus also intends to change the presentation of its production volumes to be on a "net" basis, where permitted. As defined in Canadian National Instrument 51-101 and consistent with U.S. SEC reporting practices, "net" production means the Company's working interest share of production after the deduction of any royalty obligations plus the Company's royalty interests. Enerplus' royalty obligations are approximately 20% of the Company's working interest share. Previously, Enerplus presented production volumes on a "company interest" basis which does not deduct royalties paid to others. With these changes, production volumes presented by Enerplus on a "net" basis are expected to be lower than those presented historically. The Company believes, however, this change in presentation to "net" production in conjunction with the change in reporting currency to U.S. dollars, should facilitate a more direct comparison to other U.S. exploration and production companies.

The above noted changes will be in effect beginning with the Company's reporting of its fourth quarter and full year 2021 operating and financial results and reserves, which are scheduled for release on February 24, 2022.

Share Repurchase Program

Between November 2021 through the end of January 2022, Enerplus repurchased 12.1 million shares at an average price of C$12.89 per share for a total cost of C$155.5 million under the Company's current C$200 million share repurchase program. Enerplus expects to complete the balance of this share repurchase program by the end of the first quarter of 2022 whereupon its remaining normal course issuer bid ("NCIB") authorization will be approximately 3% of shares outstanding. The Company can renew its NCIB in August 2022 and will continue to evaluate opportunities to enhance cash returns to shareholders.

Related Categories :

Quarterly - Preliminary

More Quarterly - Preliminary News

-

Talos Details Preliminary Q2 Estimates; 65 MBOEPD in Production

-

Ring Energy Details Preliminary 1Q22 Results; Production Beats Expectations

-

HighPeak Energy Preliminary Fourth Quarter Results, Reserve Update

-

Ring Energy Details Preliminary 4Q21 Results, Hedging Update

-

Earthstone Energy Preliminary Fourth Quarter Results, Reserves

Canada News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020

-

SM Energy Hits Record Output; Driven by Uinta

-

Large Cap E&P To Reduce Drilling & Completion Activity in 2026 -

-

Baker Hughes Solid Y/Y Performance Amidst US Frac Market Slowdown -