This was another big week for companies to report their 2Q 2018 updates and changes. Below is a what we captured this week.

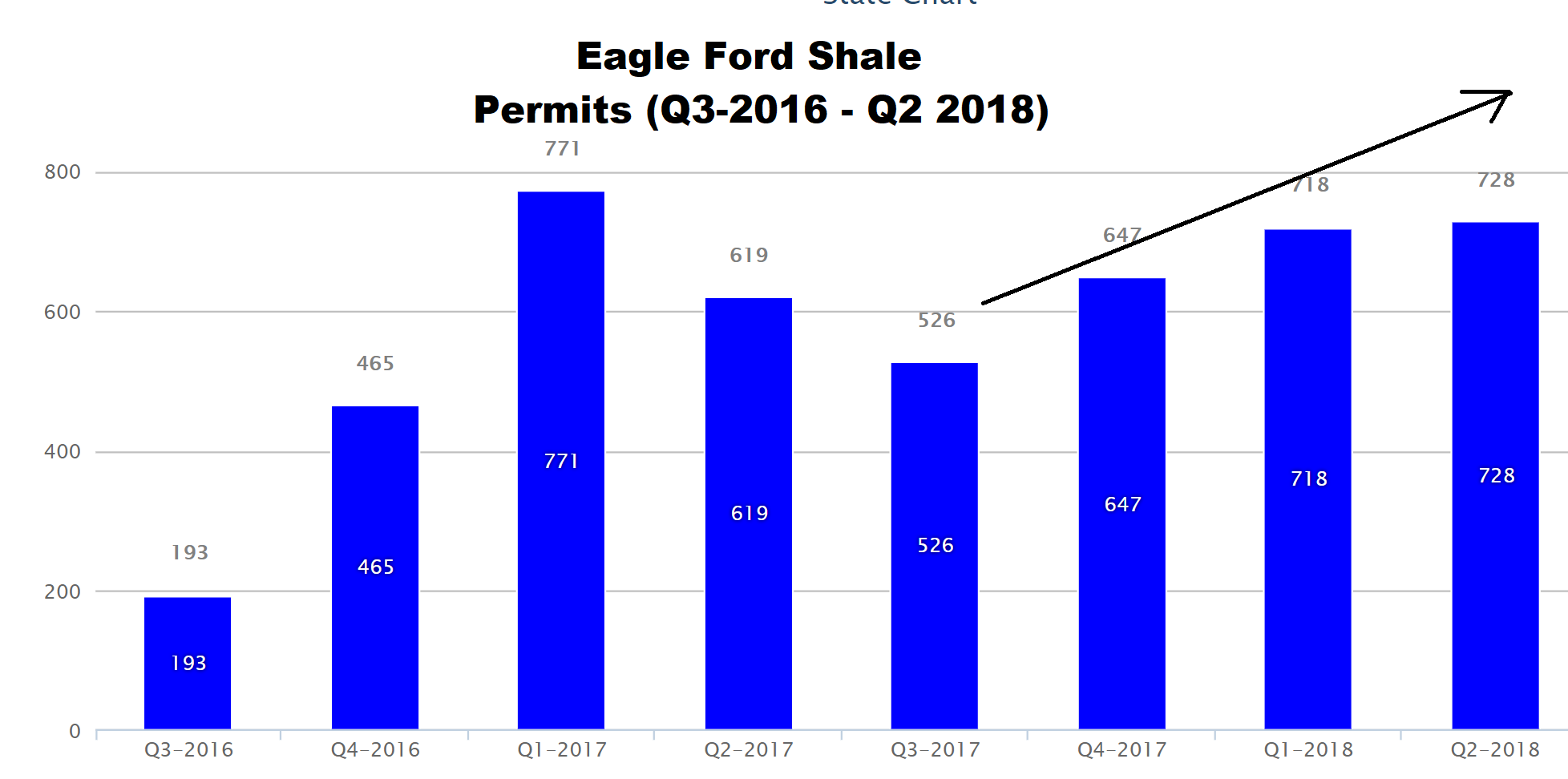

Operators Increasing Wells, Frac and Capital in the Eagle Ford

Eagle Ford Operators are planning on increasing activity in the second half of the year.

Carrizo said it plans to redirect capital away from the Permian and into to the Eagle Ford. The company has revised up the number of wells it plans to drill and complete for the year as well as the capital budget.

Penn Virginia, now a pure play Eagle Ford operator, after reporting some recent impressive Eagle Ford wells, the company is also increasing capital budget and wells plans, aiming to drill and complete more wells in the remainder of the year.

EP Energy recently upped its 2018 capex as the company is focusing on EOR tests in the Eagle Ford.

Eagle ford Permit Activity does support that trend.

Exploration & Appraisals

- Operator to Spend $100 Million on the Louisiana Austin Chalk in 2018

- Operator Touts Significant Oil Discovery Off Western Australia-

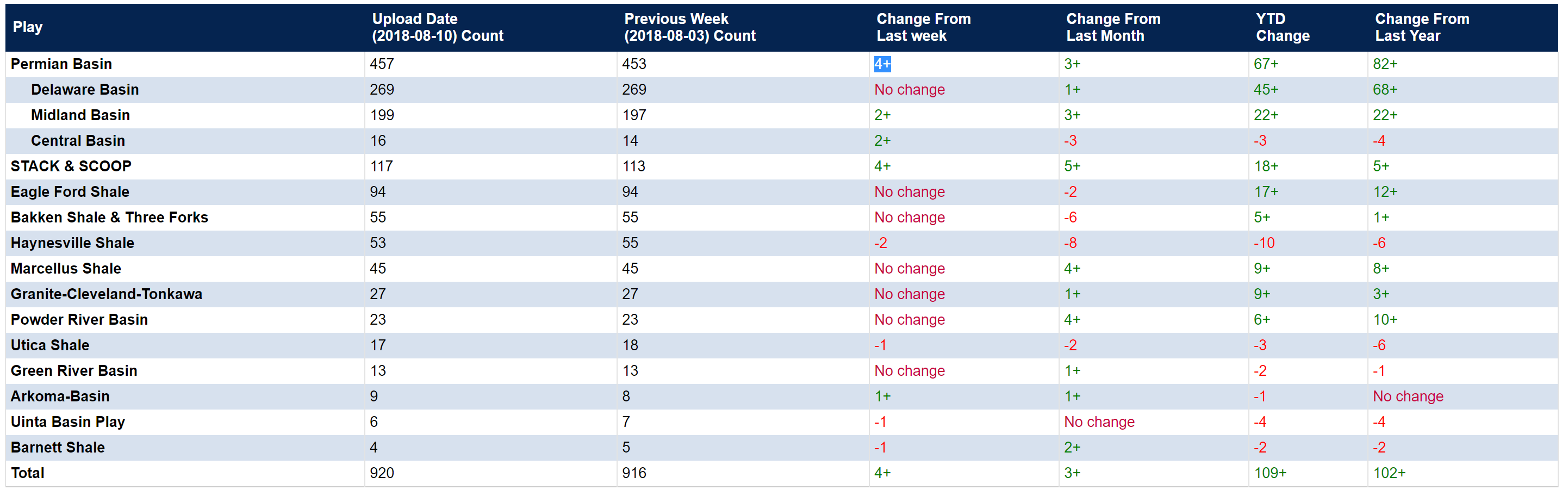

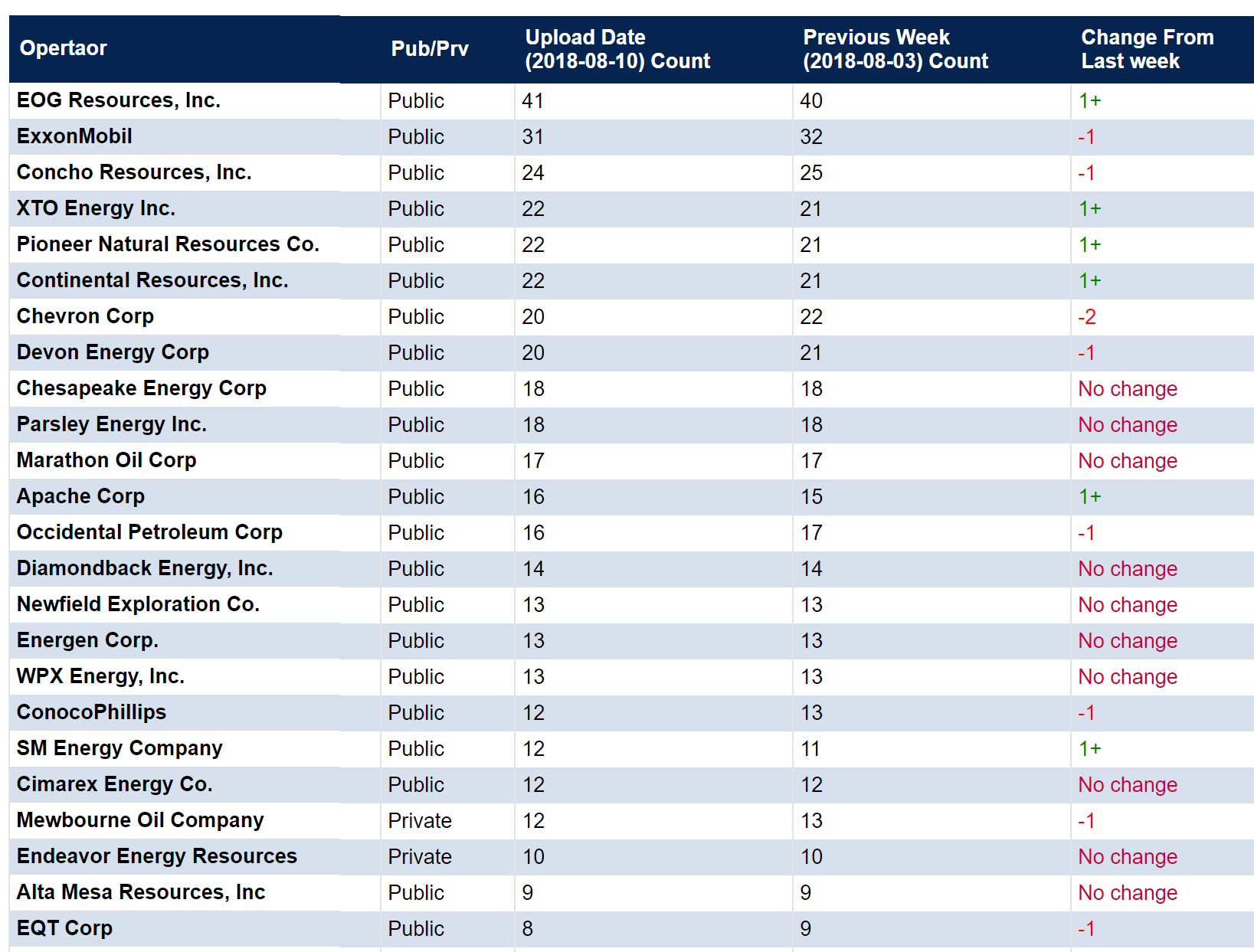

Rig Activity / Drilling Activity for Week ending 8-10-2018

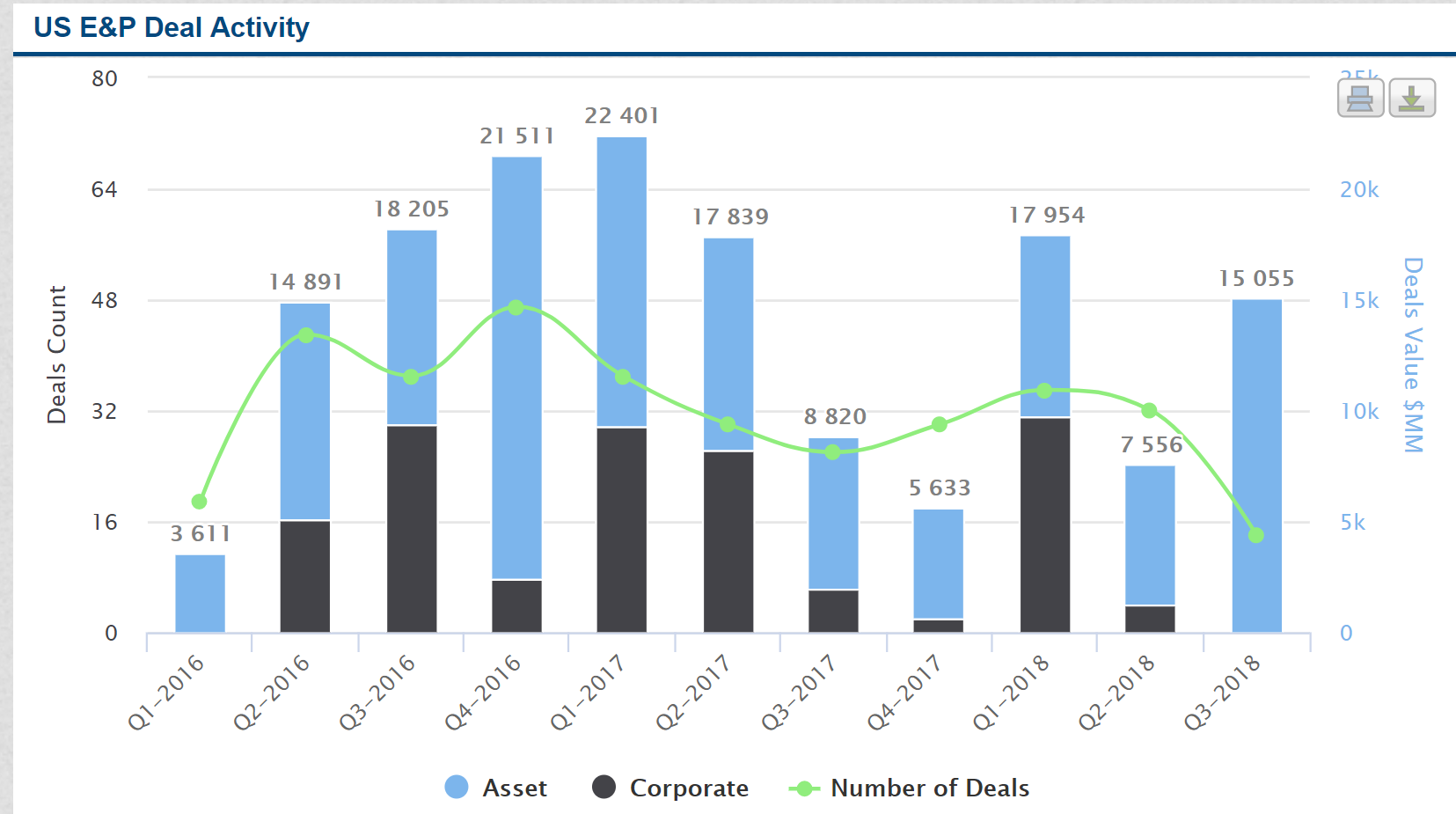

Mergers, Acquisitions, Partnerships

- Diamondback Energy Bolts-On Ajax Resources' Northern Midland Asset for $1.2 Billion in Cash/Stock ($900m in cash and $313 million in stock).

- A Delaware Basin operator armed with 21,000 net acres in the core is looking for a buyer.

- Bonanza Creek became a pure play DJ Basin company after selling its Arkansas/Mid-Con asset for $117MM.

- Much Ado About Nothing : Continental Resources formed a MidCon minerals partnership committing to spending $125 million per year.

Midstream Deals

- Two private equity-backed companies splurged by spending $2.6 billion to acquire midstream assets from Oxy.

- Apache and the folks at Kayne Anderson Acquisition formed a new midstream company to support the Alpine High development.

Deal flow has been boost by the BP acquisition of BHP onshore shale assets, which the company plans to acquire for $10.5 billion.

E&P / Operational Updates

Cost Inflation, Basin Differentials Drives Noble to Move Capital from Permian to DJ Basin

DJ Basin Operator Increased Wells Planned to 158 Wells In 2018

Operator To Spend $100 Million Louisiana Austin Chalk In 2018

Parsley Adds to 2018 Capex Plans; Transitions Back to Larger Well Pads

HighPoint's Wattenberg Midstream Woes Hamper 2018 Production

Extraction's Q2 Output Jumps +68% YOY; Extends Lateral Length

SM Energy Touts Record Setting Wolfcamp A Results; Increases CapEx

Newfield Ups Capex, Guidance for 2018; Boosts STACK Rig Count 18% from 1Q18

Related Categories :

Industry News

More Industry News News

-

Schlumberger Points to Structural Problems in Tight Oil -

-

Wattenberg Drives Colorado Oil Production to 57 Year High

-

The Natural Gas Beast Cannot Be Tamed with 350 Rigs

-

Chesapeake Sues Cameron for Marcellus Shale Well Blowout

-

TAG Commercializes Taranaki Assets; Talks Infrastructure -

Gulf Coast News >>>

-

Why Surface-Only Inventory Predictions Are a Fool’s Errand

-

Occidental Eyes $10 Billion OxyChem Sale Amid Debt and Capital Discipline Push -

-

Permian Gas Gets New Highway: Transwestern’s 1.5 Bcf/d Desert Southwest Expansion -

-

WaterBridge Infrastructure Brings Delaware Basin Water Model to Wall Street -

-

OPEC+ Nudges Supply Higher: Why This Weekend’s Hike Echoes 2020—But Isn’t 2020