Capital Markets | Capital Expenditure - 2020 | 2020 Guidance

Granite Oil Talks 2020 Plans; Capex, Production Outlook

Granite Oil Corp. has unveiled its preliminary 2020 plans.

2020 Production by Quarter

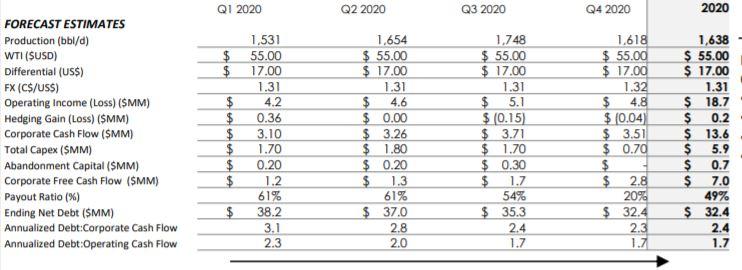

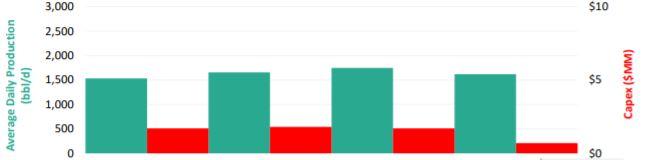

Granite is planning a capital program in 2020 that continues to prioritize significant debt repayment while growing production and adding producing reserves at highly efficient and economic metrics. Following a successful recompletion test in August 2019, in which the Company added new frack stages in a legacy producing well, the Company is confident this tool provides a means with which to accelerate these plans in 2020 while maintaining significant capital flexibility. Granite will enter 2020 with five shut-in wells (approximately 250 bbls/d of oil production capability) that have been actively re-pressurized by the Company’s EOR program since Q2 2019. These wells will form the basis of its recompletion program planned for the year, which will commence mid-January 2020 with its second recompletion. The Company has 11 additional wells identified as potential future recompletion candidates.

The semi-annual borrowing base redetermination of Granite’s credit facilities has been completed. The Company’s lenders have mutually agreed to a renewed borrowing base of $47.5 million with a current authorized amount of $42.5 million, which will serve to reduce associated interest and standby costs. With year-end 2019 net debt expected to be approximately $39.5 million, and with continued quarter-over-quarter debt reduction, the Company’s credit facilities are more than enough to execute, or expand, its planned capital program in 2020.

With a solid, lower-decline production base, a promising recompletion program focused on re-pressurized wells with significant production potential, and a large, proven drilling inventory, Granite will enter 2020 with strong optionality with which to navigate continued volatility in the energy environment. The Company expects to firm-up its 2020 budget shortly after the second recompletion test in January.

Related Categories :

Capital Expenditure - 2020

More Capital Expenditure - 2020 News

-

Diamondback Drill & Complete 456 Wells with $4 Billion Capex IN 2025

-

Operator Ramps Up 2022 Permian Spending by 65%; Nine Rigs, 315 Completions -

-

EQT Details 2022 Guidance: Spending, Rigs, Frac Crews, Wells -

-

Berry Corp. Fourth Quarter, Full Year 2020 Results

-

Pioneer Focusing on Midland Ops for 2021, Capex Flat YOY; Talks 2020 Results

Canada News >>>

-

Vermillion Closes Saskatchewan Asset Sale -

-

MEG Energy Rejects Strathcona Resources' $6 Billion Takeover Offer

-

Petrus Resources Ltd. First Quarter 2023 Results

4.jpg&new_width=60&new_height=60&imgsize=false)

-

Cardinal Energy Ltd. First Quarter 2023 Results

-

Headwater Exploration Inc. First Quarter 2023 Results -

6.jpg&new_width=60&new_height=60&imgsize=false)